It’s easy to underestimate just how luxury-focused the New York City real estate cycle has been since the sunset of the financial crisis.

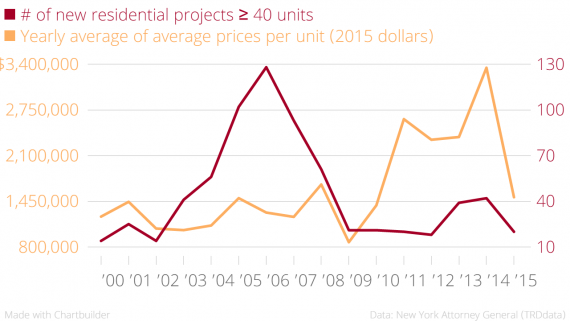

Average per-unit prices at large new residential developments have soared since 2010, far exceeding the previous cycle, even as the number of new projects stayed doggedly low, according to an analysis by The Real Deal of new residential development offering plans filed with the Attorney General’s Office since 2000.

From 2010 to the present — roughly the period of the post-crash recovery — developers filed for just 160 residential projects aiming to build 40 units or more, compared to 434 in 2002-2007.

Average per-unit prices at those buildings — based on initial estimates of total sellout, adjusted for inflation — hit unprecedented highs in recent years.

The yearly average of per-unit prices topped $3.3 million in 2014, up from a pre-crisis peak of $1.7 million in 2008.

Data for residential projects planning 40 or more new units

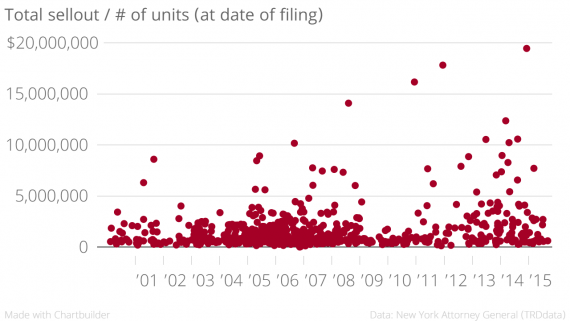

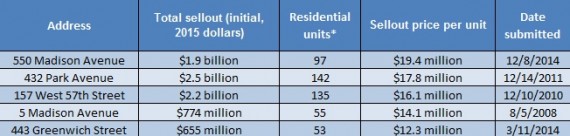

At that record-breaking high end, many of the players and projects are familiar (see the 50 most expensive on the map below): The Chetrit Group’s luxury conversion at the Sony Tower at 550 Madison Avenue, with an average per-unit sellout of $19.4 million; Macklowe Properties’ and CIM Group’s 432 Park Avenue, at $17.8 million; and Extell Development’s One57, at $16.1 million.

The priciest projects on average are all in Manhattan, mostly in Midtown, with a smattering in Chelsea, the Flatiron District and Downtown.

While those projects dwarf all but just a handful of the most aspirational residential developments in the last cycle, the real story since 2012 is the large number of new developments with per-unit prices between $5 million and $15 million — 16, compared to 12 in the last cycle — and the far smaller number of projects below that.

The data offer a deeper insight into the increasingly-common criticism of an industry too focused on ultra-luxury properties at the expense of still-somewhat-luxurious $1 million-to-$5 million”middle” market.

Last year, The Real Deal ran a back-of-the-envelope analysis of potential global demand for the most expensive luxury units, finding there might be fewer buys able to afford these properties than developers are hoping.

Experts have proposed various explanations for this phenomenon, from high land prices requiring developers to make huge returns, to cheap credit, to persistent demand from overseas buyers fueling unit prices.

[Note: Residential unit figures were compiled by adding “No. of Residential Units,” No. of Regulated Units,” “No. of Non-regulated units,” and “No. of Other Units,” from the Attorney General’s filings. Filings with no initial total sellout figures were omitted.]