From the March issue: The lending market has already shifted gears since the start of the year. Lenders are tightening their standards, and the issuance of commercial mortgage-backed securities is slowing down.

“We are telling borrowers to shy away from the CMBS market, because there is no certainty of closing [a loan] or holding on to their pricing,” said Garrett Thelander, executive managing director at Cushman & Wakefield.

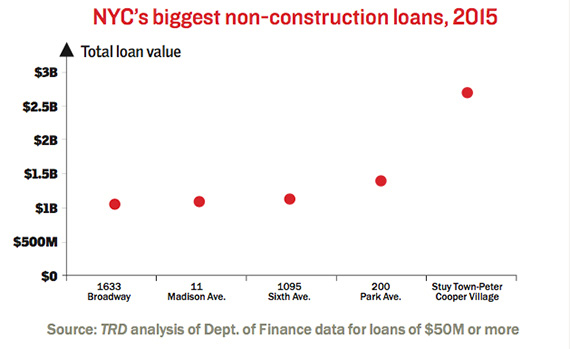

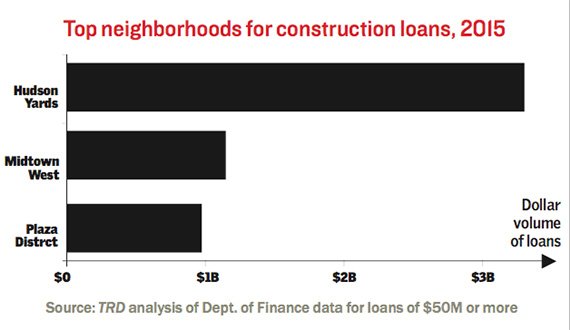

In 2015, lending boomed, with $64 billion in loans above $50 million, an analysis by TRD of NYC Department of Finance records showed. The Plaza District was the most active neighborhood for commercial loans, with more than $5.6 billion in secured debt. The bulk of the debt issued last year was for cash- flowing assets. Indeed, the 11,200-unit residential complex Stuyvesant Town and Peter Cooper claimed the largest loan at $2.7 billion.

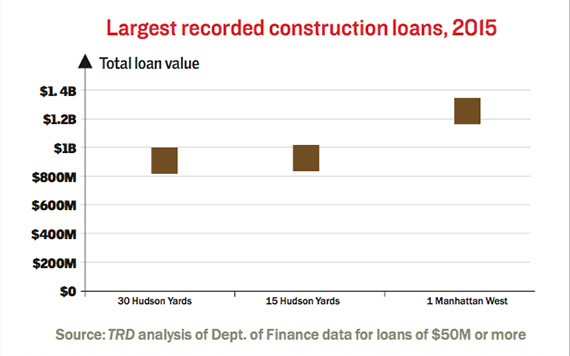

For new construction, the largest loans went to Brookfield Property Partners for 1 Manhattan West, which received $1.25 billion in debt from a consortium of lenders. Related, meanwhile, received a $930 million loan for the condo and rental building 15 Hudson Yards and a $918 million loan for the office building at 30 Hudson Yards. However, some insiders say the appetite for construction debt started cooling late last year. “There has been a tremendous pause in new originations,” said Eastern Consolidated’s Sam Zabala.