Almost no one is selling new development condominiums in the Bronx right now, but it wasn’t always that way.

The Bronx saw relatively robust (but still lacking) condo development in the years before the 2008 financial crisis. While rental development volume has recently spiked in the borough, new condo construction never bounced back after the crash.

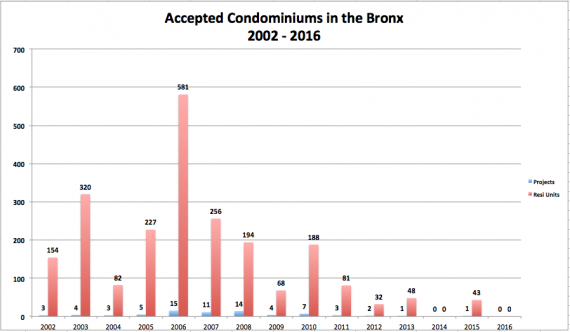

Just four new condominium projects were accepted by the New York State Attorney General from 2012-2015, with a total of 123 new residential units approved for sale. By contrast, 45 new projects comprising 1,258 units were approved between 2005-2008 in the Bronx, according to an analysis by The Real Deal of condo filings with the Attorney General’s office.

The reason? The economics of rentals in the borough are just too good right now, said appraiser Jonathan Miller, principal at Miller Samuel.

“The focus on rental is the Bronx being influenced by its neighbors,” he said. With rental prices at record heights in neighboring boroughs, the Bronx’s much lower land prices – about $50 per foot as of late last year, compared to $233 per foot in Brooklyn, according to Ariel Property Advisors – have made it a hub of relative affordability, Miller said.

Indeed, multifamily sales and new development in the borough have expanded steadily over the past years. Sales volume rose to $2.76 billion in 2015 from $1.28 billion in 2012, according to Ariel Property Advisors.

Big name developers and investors have moved in, including – somewhat infamously – Joseph Chetrit’s Chetrit Group and Keith Rubenstein’s Somerset Partners, who threw a widely criticized, celebrity-heavy party in the borough a few months ago to celebrate their planned six-tower Mott Haven residential development. The partners have already filed plans with the Department of Buildings for two towers totaling 1,200 Units along the Harlem River in Port Morris, and as Rubenstein previously told TRD, they’ll be rentals.

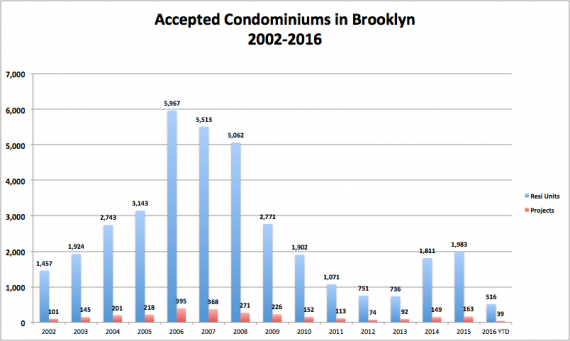

In Brooklyn, for example, developers had 478 individual condo plans approved during 2012-2015, about 40 percent of the 1,252 projects approved in 2005-2008. In the Bronx, the 2012-2015 figure was just 9 percent of what was approved in 2005-2008, according to TRD’s analysis.

Source: TRD analysis of NY State AG condo filings through March 2016

Joshua Weissman, a principal at Bronx rental builder JCAL Development, was among the active condo developers in the Bronx between 2006 and 2008, while with the now defunct Jackson Development Group. He says that post-financial crisis the feeling toward condos has mostly remained bearish the borough, even while it has flipped elsewhere.

“Developers haven’t had the confidence to do [condos] again,” he said, adding that it’s more difficult to obtain financing for condos in the Bronx than it is in other boroughs.

However, there is a possible turn on the horizon. Weissman and other local builders are eager to see what happens with Tahoe Development’s 50-unit project at 221 East 138th Street in the Lower Concourse Rezoning Area in Mott Haven. Last month, Tahoe’s Anthony Gurino announced that the project would be going condo. An offering plan has yet to be filed with the Attorney General’s office.