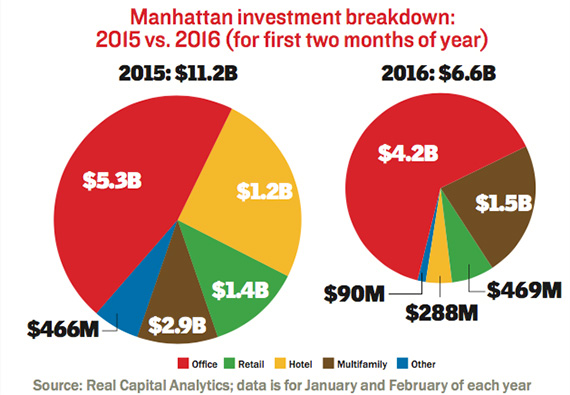

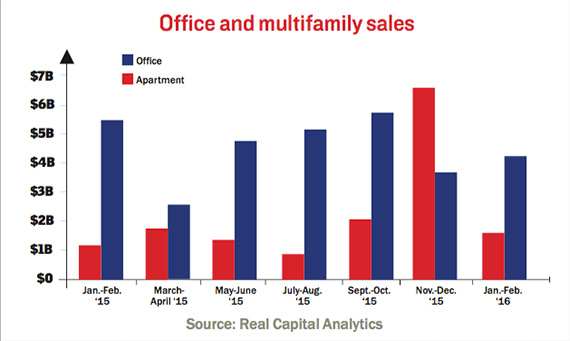

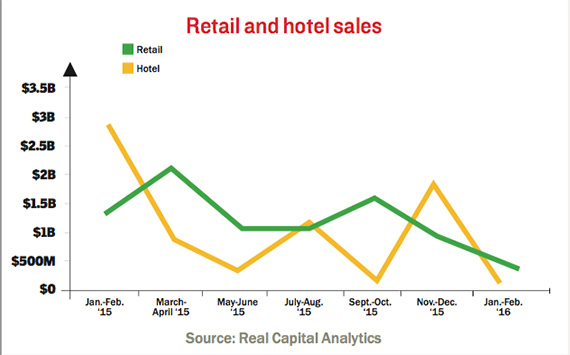

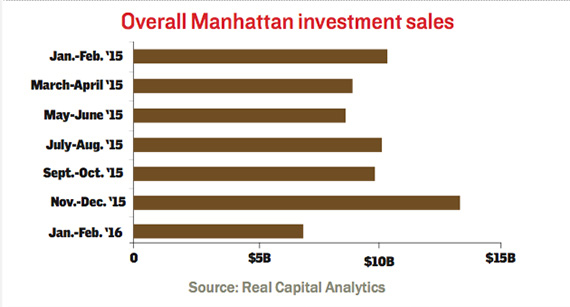

From the April issue: Manhattan building buyers put the brakes on in early 2016 compared to the brisk shopping they were doing in 2015. Buyers spent a combined $6.3 billion at the start of the year, a TRD review of Real Capital Analytics data revealed. That was 43 percent lower than the two-month average over the past year. However, the decline was not a surprise given 2015’s record activity.

“It’s more of a haircut than a beheading,” said Will Silverman of brokerage Hodges Ward Elliott.

Silverman said that fears from last fall have been at least partly allayed. That renewed optimism stems from foreign investors continuing to make significant U.S. property purchases. It’s also a realization that the slowdown in the high-end condo market may not mean the entire residential market is in trouble. One of the other factors tamping down sales activity may be investors’ willingness to step in to recapitalize properties. That’s prompting owners to decide against selling. “They kind of want it both ways,” Silverman said. “The landlord says, ‘I like where we’ve been, [but] I’d like to take some chips off the table.’”

Some dealmakers said contract activity was up this year. “A year ago sellers were in an F-U mode, take it or leave it,” said Jack Terzi, CEO of retail-focused investment and brokerage firm JTRE. “It did slow down at the end of the year [but now] deals are getting done,” Terzi said.