Steve Croman, the Manhattan landlord who was arrested Monday on charges including grand larceny and a scheme to defraud, took in at least $63 million in gross income in 2014 from his Manhattan rental portfolio, according to The Real Deal’s analysis of data from the Department of Finance.

Croman [TRData], who operates under the brokerage Croman Real Estate Inc.[TRData] and his management firm 9300 Realty Inc., was charged on Monday with 20 felonies. The New York Attorney General alleged that Croman secured $45 million in loans by inflating his rental income in mortgage documents submitted to Capital One and New York Community Bank.

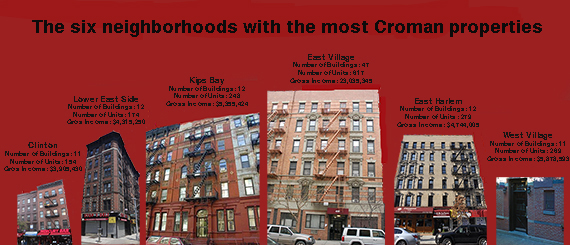

TRD dug into public records to figure out his revenue and expenses from 145 buildings, which was used to estimate his net income. The city reports gross income and expense figures for most commercial properties in tax assessment filings. Croman’s holdings include 2,499 total units, more than a quarter of which are located in the East Village.

Finance records show Croman reported expenses for 95 of his properties and earned a net operating income of $27.5 million on those buildings, according to the city’s estimates. Net operating income for the other properties in his portfolio was not available.

Croman’s highest-earning building among the properties for which data is available is a 74-unit rental located at 252 Mott Street in Nolita, the only property he owns in the neighborhood. He earned an NOI of $1.5 million from the building, which is set to see its city-assessed market value increase 53 percent to $12 million in the upcoming tax year.

At six of his properties — 380-382 East 10th Street, 145 East 26th Street, 44 Avenue B, 20 Prince Street, 199 East 3rd Street and 325 East 5th Street — Croman was charged with changing the rent rolls in an effort to make the property’s income appear higher than it was. In one instance in 2012, Croman reported that all 20 units at 380-382 East 10th Street were market-rate, according to Department of Finance records reviewed by TRD. However, all 20 units were listed as rent-stabilized in the prior year, and 10 were marked as rent-stabilized in 2013. At present, three of the apartments are listed as rent-stabilized.

In addition to the criminal charges, New York Attorney General Eric Schneiderman filed a civil lawsuit against Croman, his companies and one of his top employees, who is accused of spying on and intimidating tenants. The suit accuses Croman of pressuring his property managers and supervisors to secure buyouts from rent-regulated tenants. Croman allegedly provided his employees with bonuses of up to $10,000 for each buyout. According to Schneiderman’s lawsuit, Croman was known for walking through his office chanting, “buyouts, buyouts!”

Note: Sums from two properties were excluded because no gross income was reported