Cash is still king in Manhattan, where the majority of condos sold so far this year have been scooped up in all-cash deals.

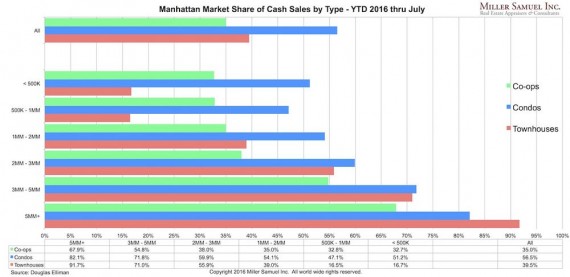

A whopping 56.5 percent of condo sales were all-cash between January and July, according to appraisal firm Miller Samuel. By comparison, 35 percent of co-op sales were all-cash during that time, as were 91.7 percent of townhouses over $5 million, the firm wrote on Curbed.

In the condo market, 82.1 percent of deals over $5 million were all-cash.

Still, there could be change underfoot.

Despite the high prevalence of all-cash deals, the number did drop around 2 percent during the first half of 2016 compared to the same time last year. The most significant decline — roughly 5.5 percent — was in the $2 million to $3 million category, thanks to lenders’ increasing comfort with financing, Miller Samuel reported.

“This slip in the use of cash suggests that credit is improving slightly, a trend that will hopefully continue,” Miller Samuel founder Jonathan Miller said. “Housing in NYC won’t truly normalize until credit conditions return to sanity and cash is not necessarily king.”

For what it’s worth, Miller did not touch on the U.S. Treasury’s new disclosure rule that applies to cash buyers above the $3 million market. Starting in March, the government required title companies to disclose the identities of all-cash buyers purchasing Manhattan real estate through a shell company. Last month, Treasury officials expanded the rules though it still largely lacks teeth. [Curbed] — E.B. Solomont