After four months of negotiating to buy a 44 percent stake in 10 Hudson Yards, a twist of fate kept Christoph Donner stranded in Los Angeles on the day of the closing.

“I was dialed in via email and phone,” the top real estate executive for Allianz said, recalling the culmination of the German insurer’s largest-ever real estate investment in the United States.

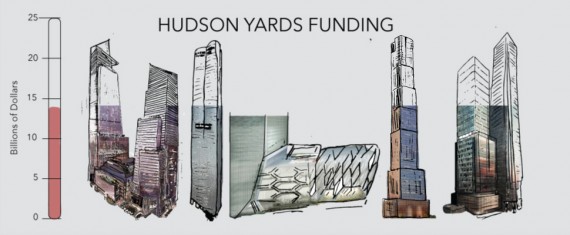

But if the closing was anticlimactic for Donner, the deal itself was a robust endorsement of Hudson Yards, the $25 billion, 17 million-square-foot development by Related Companies [TRDataCustom] and Oxford Properties Group. Despite headwinds in the capital markets, the partners have locked up about $14 billion in debt and equity for the project to date.

In December, Related announced $5 billion in financing for the project’s retail component and an office tower at 30 Hudson Yards. Then in late July came news of a $2 billion capitalization at 35 Hudson Yards, followed by the announcement just a few days later Related and Oxford had refinanced 10 Hudson Yards with $1.2 billion in debt from Deutsche Bank and Goldman Sachs; as part of that deal, Allianz bought Coach’s stake as well as part of the Kuwait Investment Authority’s stake in the building in a transaction that valued the tower at $2.15 billion.

Related Companies’ Jeff Blau

The Allianz deal will serve as a case study for how the developers may finance the next stage of the project, Related’s CEO Jeff Blau told The Real Deal.

“We’ll now have about 10 million square feet under construction, and so I think there’s a certain story around Hudson Yards being able to proceed through different parts of the cycle,” Blau said. “Whether banks are lending or not lending.”

Related’s success at leasing up Hudson Yards — about half of the eventual 10 million square feet of office space is already spoken for — reassures lenders skittish about financing new construction in Manhattan that the complex will continue to have momentum, sources said.

“What’s interesting is they’ve accomplished this in a market that most people would describe as much tighter; capital is much less available,” said Neil Shapiro, a partner at Herrick, Feinstein, which has represented Related but was not involved in the recent recapitalization. “While the market has gotten tighter, the money is only available to the best of the best.”

No two financings alike

Rendering of 15 Hudson Yards

Given the scale of the project — it’s the largest private real estate development in U.S. history — Related tapped a myriad of sources for its money, including conventional lenders, EB-5 investors, opportunistic hedge funds and even the Israeli bond market.

On the Tel Aviv Stock Exchange, it raised 847 million shekels (about $224.98 million at today’s rates) of five-year debt for Hudson Yards last year. Typically, developers pay 5 or 6 percent interest on the Israeli bonds, half of what it would cost in the U.S. for mezzanine debt. Hudson Yards is also the biggest beneficiary of the EB-5 program : Related raised over $600 million for the first phase of the project in 2014 through it, and is reportedly in the midst of raising another EB-5 round. (The firm was also one of the biggest spenders on lobbying for the visa program, according to OpenSecrets).

And for each asset at the project, Related targeted a different breed of investor.

At 35 Hudson Yards, a 1.1 million-square-foot mixed-use tower with an Equinox-branded hotel and luxury apartments, Related tapped opportunistic investors led by the U.K.-based Children’s Investment Fund, which led a $1.2 billion debt financing round. The hedge fund is also a lender on 432 Park Avenue, 30 Park Place and 520 Park Avenue, three of the city’s priciest condo projects, and gave Related $850 million in construction financing at 15 Hudson Yards, a 70-story mixed-use condo and rental tower.

By contrast, 10 Hudson Yards, an office skyscraper fully-leased to the likes of Coach, L’Oreal SAP, and Boston Consulting Group, attracted foreign capital looking to invest in long-term, core assets.

“Capital is absolutely flowing into core, stable assets in New York City and these are investors looking for long-term, steady cash flow,” Blau said.

Rendering of 35 Hudson Yards

And at 30 Hudson Yards, a 90-story, 2.6 million-square-foot office tower, it was all about owner-occupied office condo deals.

In December, Wells Fargo bought its 500,000-square-foot space at the tower for about $650 million, according to Real Capital Analytics. That deal was preceded by buyout firm KKR’s October purchase of the top 10 floors (about 343,000 square feet) for an undisclosed price, as well as Time Warner’s acquisition of a 1.6 million-square-foot office condo (spanning the 14th through 51st floors). Related, too, is purchasing a 270,000-square-foot condo at the tower, where it plans to move its operations from the Time Warner Center.

The KKR and Wells Fargo deals “changed the tenor of Hudson Yards somewhat,” said Cushman & Wakefield’s Dale Schlather, who represented Wells Fargo in its office condo acquisition. “Now all of a sudden you have [Steve Cohen’s] Point 72 looking at Hudson Yards, and [BlackRock’s] Larry Fink is very serious about it.”

David Falk, who is president of the Tri-State Region at Newmark Grubb Knight Frank and who hasn’t been involved in Hudson Yards deals, said tenants are “able to get more bodies into the footprint [at Hudson Yards] because the floor plates are more efficient. So the rent is competitive or less than Midtown, which doesn’t have those efficiencies.”

Fill it and they will come

When making its financing plays for 15, 30 and 35 Hudson Yards, Related had to contend with economic turmoil in the global markets. In December, when Blau announced the $5 billion debt and equity financing deal for 30 Hudson Yards and the retail component, he admitted it had been a slog.

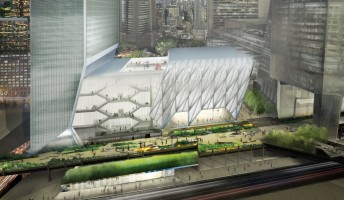

Rendering of the shed at Hudson Yards

“There’s not enough capital,” he told the Wall Street Journal. Stricter regulations, he added, created an environment that “really limits the banks from making these large scale loans.”

But when it came time to recapitalize 10 Hudson Yards and shepherd Coach out of its stake, Related was in a much stronger position, with the building fully leased.

From left: Rendering of 30 Hudson Yards, the shops and 10 Hudson Yards

“Being the smart guys they are, [Related and Oxford] going to cut their best deal when the building is 100 percent complete and the tenants are in and paying rent,” said a source familiar with the project.

“You’ve got one kind of debt when you’re building, but if you get it right during an upswing and the asset value is higher than you had originally, you can maybe get cash out of that first refinancing,” said Jim Costello, senior vice president at Real Capital Analytics.

The lease-up of 10 Hudson Yards wasn’t lost on Allianz, which Donner described as a “very cautious” investor. “Clearly, having a building that is fully leased, and leased to investment-grade tenants, makes it attractive, especially at a time when you could arguably say that U.S. real estate in general has seen a pretty good run up in terms of rent growth and cap rate compression,” he said. Allianz also liked that Hudson Yards had become a neighborhood, rather than just a patch of land.

Allianz’s Christoph Donner

“Although we plan to hold it for the long term, 10 years at least, we want to make sure it’s not a one-off building that’s difficult to sell,” he said.

The pool of potential investors had widened, too. Early on, Related and Oxford scored a $475 million construction loan led by Starwood Property Group, which included an extremely rare construction mezzanine loan. The proceeds came in prior to the equity money, which sources told TRD at the time was unheard of.

“Three or four years ago, only a debt fund like Starwood would take the risk,” said Garrett Thelander, who oversees the day-to-day capital services operations at Cushman & Wakefield. Now, he said, “it’s not easy, but Related has dozens of banks on its list of relationships.”

All quiet on the western front

A depiction of the Hudson Yards master plan (Credit: Hudson Yards)

From the outset, Hudson Yards’ sheer size and capital needs have been the biggest challenge. “They need to go to all hemispheres to raise the debt because it’s a lot of debt they’re raising at one time,” said Thelander, who said if a bank is in one deal at Hudson Yards, they’re not likely to be in another.

The developers are also facing uncertainty in the office market, and a key question is whether they’ll be able to maintain leasing momentum if the market goes sideways. There is also pressure on 15 Hudson Yards, an 88-story residential condo with a projected sellout of $1.74 billion, to deliver profits at a time when the luxury market has taken a hit. The tower is launching sales on Sept. 14.

“Everything that everyone talked about at Hudson Yards for the past five years has been about commercial,” Blau said. He’s betting that there’s pent-up demand for residential product in the neighborhood.

Shapiro questioned whether Related and Oxford’s recent financing deals were the result of wind at the developers’ backs — or a sign that they envision headwinds to come.

“Are they shoring this up because they expect there to be a problem?” Shapiro asked. “My gut is that they’re like everyone else; they have some real concerns and want to make sure they’re well-positioned if the market does have some softening.”

And even if all goes according to plan at the Eastern Yard, there’s still the Western Yard, which stretches from 11th to 12th avenues between West 30th and West 33rd streets. That parcel will have another 2 million square feet of office and 4 million square feet of residential space, and there’s no telling what the market will look like when it comes to pass.

“That’s where the real gravy is for Related,” said Schlather. “The Eastern side will be hugely popular and that will cause the Western side to appreciate dramatically, The thought that you’re going to be alone or that it’s going to be quiet or empty — those days are gone. It’s no longer pioneering.”