Bill Ackman’s Pershing Square Capital Management hedge fund may be bleeding money, but he thinks his real estate investments are going to do just fine.

Ackman’s fund is down to managing $11.4 billion in assets from $20 billion in March of 2015, according to Vanity Fair.

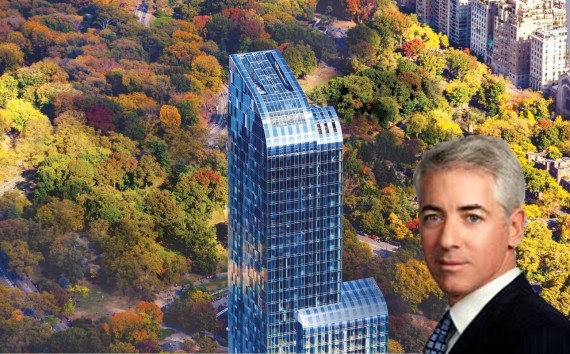

But the magazine also reported that the hedge funder, the son of Ackman-Ziff [TRDataCustom] co-founder Larry Ackman, thinks he can someday flip the One57 pad he bought last year for $91.5 million with investors for “fun” for more than five times the price he paid.

At the time he bought it, Ackman “seemed more nervous about losing his view than ever losing his shirt,” Vanity Fair wrote.

The silver-haired finance mogul thinks he can sell the unit for $500 million, despite the fact that other investors have taken big haircuts on their units amid a slowdown in the ultra-luxury residential market.

Last year, Ackman bought the former Ford building at 787 11th Avenue with Georgetown Co. for $225.5 million. The partners are marketing the office space with asking rents in the mid-$70s, and the hedge funder plans to relocate his offices there.

Ackman, an avid tennis player, has mulled the idea of Building A Tennis Court on top of the building.

The Vanity Fair story revealed that he ungraciously took a charity tennis game with John McEnroe quite seriously, slamming a shot into the former sporting pro’s body and walking away without apologizing. [Vanity Fair] – Rich Bockmann