How did Manhattan’s luxury market fare in 2016? The optimistic broker or developer might point to the fact that this year will see a record $9.4 billion in closings for apartments priced $4 million and up, according to a new analysis by The Real Deal. But there’s another benchmark that serves as a more current barometer of the market, and it ain’t sitting pretty: sales volume on luxury contracts was down 16.7 percent year-over-year.

A total of $8.94 billion in luxury properties went under contract, according to a year-end report from Olshan Realty [TRDataCustom] that tracks activity on apartments priced at $4 million and up. Last year, that figure was at $10.74 billion. The number of contracts also fell 18 percent year-over-year, to 1,102 from 1,344. And while brokers pointed to a number of luxury properties that have found buyers this year, most said sellers have been forced to lower expectations throughout 2016.

“We are down about 10 to 12 percent from last year,” Douglas Elliman’s Richard Steinberg said of asking prices for luxury pads. “I don’t think we’ll see a significant change until the third quarter of 2017.”

Lisa Lippman

Luxury co-ops took the biggest hit. There were a total of 222 contracts signed in 2016, down 25 percent from 296 last year. The average asking price for a co-op was $7 million, down from $7.2 million. There were 112 contracts on luxury townhouses, compared to 130 last year, and the average ask was $10.4 million, down from $10.9 million. In total, 751 contracts were signed for luxury condos, compared to 904 last year. The average asking price for a luxury condo hit $8 million this year, or $2,929 per foot, up from $7.7 million in 2015, or about $2,825 a foot. However, Donna Olshan, the author of the report, said her “belief is that most of these contracts were done 10 percent below the original asking price.” That was certainly the case at marquee projects such as 432 Park Avenue.

Brokers said that many sellers continue to resist reality.

“It used to be ‘let’s price it at this and see how we do’ — that doesn’t work anymore,” said Lisa Lippman of Brown Harris Stevens. “Some sellers got it… some sellers don’t want to believe it.” Compass’ Toni Haber noted that “some sellers are holding out, and they are going to get less.”

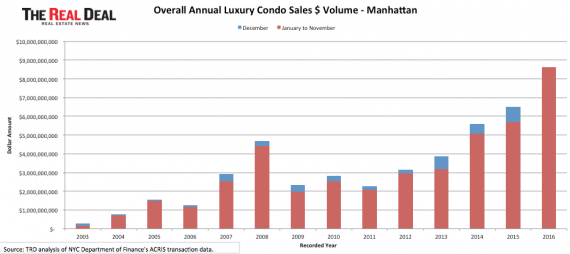

TRD’s $9.4 billion estimate of total closed sales volume for 2016 was calculated by using actual aggregate sales volume through November, plus an estimate for December using an average of the past 11 months. The number reflects activity from the banner years of 2013 and 2014, when high-end inventory was limited and buyers were letting loose after the lean years of the downturn. Closings this year at top-shelf projects such as 150 Charles Street and 432 Park pushed up the sales volume, and drove the average cost of a Manhattan apartment to above $2 million for the first time ever.

432 Park Avenue and 150 Charles Street

But there is a significant lag between signing a contract and closing on a deal, often a year or two when it comes to new developments. TRD’s data show that in 2008, for example, the luxury market reached almost $5 billion in closed sales, following strong years in 2007 and 2006. But from 2009 through 2011, each year saw sales volumes of less than $3 billion.

The question now is, what will 2017 look like? Olshan said buyers likely have a less optimistic view of the market today, and aren’t likely to be looking to score a quick profit.

“I don’t think people are buying now thinking what they buy today is going to worth a lot more tomorrow,” she said. Stribling’s Marcy Grau said that “there’s been an extra layer of carefulness,” though she said there’s been an uptick in activity since the presidential election.

Olshan estimated there are around 700 properties priced over $10 million on the market. Excess pricey product is turning into “luxury mush,” she said.

Developers, are, however, beginning to get the memo, and are taking the road less posh: A September analysis by TRD showed that the target offering price of new condos approved for sale is down 34.4 percent year-over-year.

Douglas Elliman’s Richard Steinberg

While there have been some markdowns on properties priced above $10 million, deal flow in that range saw less of a decrease then the rest of the sector. In 2016, the number of contracts signed in the over-$10 million market declined 5 percent year-over year, according to the Olshan report. Brokers said the $5 million to $15 million market is the weakest part of the luxury market. Douglas Elliman’s Tal Alexander said “trophy properties” are still selling, while the sub-$15 million market has slowed.

“The occupancy plays a big role,” he said. “A lot of the time buyers can’t wait two years.”

Steinberg, who is marketing condos at 432 Park, said consumers in the $4 million to $15 million market in the city generally work in finance, rely heavily on bonuses and do not have excess discretionary income or abundant savings. He said those buyers will continue to be hesitant until the second half of 2017, when Donald Trump’s tax laws and banking regulations become more clear.

“I’ve seen these cycles three of four times before,” he said. “I’m not worried, not even 1 percent, that it will rebound. But it will take time. We always have to work our way through.”