One of New York City’s busiest real estate firms is putting up 100 studios and one-bedroom apartments on Staten Island, perhaps taking advantage of the city’s shortage of small dwellings.

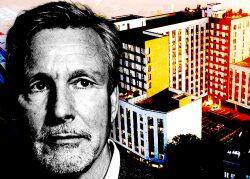

Madison Realty Capital has filed plans for a seven-story mixed-use building at 364 Bay Street in Tompkinsville, the Staten Island Advance reported. The property houses a two-story commercial building, where Crunch Fitness is a tenant.

It’s not clear if Crunch will have to leave. No demolition permits have been filed, so it is conceivable that the project could happen around it. The property also housed Gotham Motorcycles, but is largely vacant today.

The development is slated to include 115 residences, broken down into 49 studio apartments, 51 one-bedroom units and 15 two-bedrooms. The development will also include a cellar, an 86-foot-long rear yard, 55 enclosed parking spaces and 87 open parking spaces.

Much of New York’s housing stock dates back to an era when household size was significantly larger than it is today. As of 2019, it ranged from 2.1 persons in Manhattan to 3 persons in Queens. Staten Island’s average household size was 2.85.

The paucity of small apartments forces many single New Yorkers to find roommates and lease multi-bedroom apartments, which makes those units more expensive for families.

According to YIMBY, the Staten Island project is slated to be 65 feet high and span 132,000 square feet, 22,000 of which will be commercial space. AM Architecture is the architect.

Read more

No completion date has been announced.

The parcel is not far from a significant development site in the Stapleton neighborhood. In January, BFC Partners closed on the property at 475 Bay Street, aided by a $99.8 million mortgage from the New York State Housing Finance Agency.

Plans for a project there were first filed two years ago. The 250,000-square-foot development will be 100 percent affordable and include 269 units, 9,000 square feet of ground-floor retail, a rooftop recreation area, an indoor fitness area, a children’s playroom and a lounge.

Madison Realty Capital is one of the fastest-growing lenders in commercial real estate, counting $20 billion in debt and equity deals. In December, the company cut its biggest construction check ever, a $485 million loan for Harridge Development’s Crossroads Hollywood project in Los Angeles.

[SI Advance] — Holden Walter-Warner