|

Long able to stave off the foreclosure crisis, Manhattan seems to have gotten a reality check. Foreclosure activity in the borough shot up 549 percent between January and February, with 331 residential properties receiving some type of foreclosure filing last month, according to a nationwide report released this week by RealtyTrac.com, an online resource for foreclosure data.

The report tracks the number of properties — individual-owned homes, developer-owned units and entire buildings — with foreclosure filings in February, including default notices, auction sale notices and bank repossessions. Although RealtyTrac.com has been criticized for over-inflating numbers, in the case of Manhattan, by applying a single lis pendens filed against a developer to multiple units (one building last month was counted 232 times, as one filing for each unit), the percentage change helps gauge overall movement in activity on a month-to-month basis.

Daren Blomquist, a spokesman for RealtyTrac, explained that his company sometimes tracks apartments owned by a single developer in financial peril separately because they are separate housing units being foreclosed upon, regardless of the fact that they exist inside one building.

He said that although the actual number of filings last month, 331, is relatively small, it’s significant, especially if the rate is continued at a sustained pace, because Manhattan has historically had very little foreclosure activity. According to his firm’s data, over the past year, activity ranged between 56 and 87 filings per month.

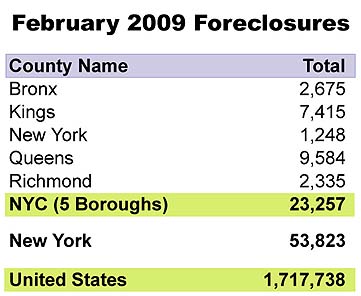

Overall, there are 1,248 residential properties in Manhattan in the foreclosure process, with high concentrations uptown, listed on RealtyTrac.com, most of which were in lis pendens, the first step in the foreclosure process.

Manhattan’s percentage increase soared above the other four boroughs, while it still ranks last citywide in terms of the number of housing units in foreclosure. The Bronx saw the next highest percentage increase, 33 percent, while Queens was the only borough that saw a decrease in activity last month, 11 percent, to 556 filings.

Queens, where a protest was held last month calling for a one-year moratorium on foreclosures, ranks first citywide in total foreclosure activity, with 9,584 homes in some stage of foreclosure. Brooklyn is second with 7,415 homes; followed by the Bronx with 2,675 homes; then Staten Island with 2,335 homes.

“Manhattan and Brooklyn are gaining ground on Queens, which has seen significantly more activity up until recently,” said Jonathan Miller, president of appraisal firm Miller Samuel.

“The jump in Manhattan and Brooklyn volume, if continues as expected, has implications for future downward pressure on price trends.”

On a nationwide basis, the number of active foreclosure auctions, one in every 345 homes nationwide was scheduled for foreclosure auction last month, despite recent legislative efforts to stymie foreclosures, according to RealtyTrac.com.

Foreclosure activity increased nearly 30 percent in the country between Feb. 2008 and Feb. 2009, with one out of every 440 homes in the United States receiving a foreclosure filing just last month, the report shows.

New York State saw a 23 percent increase in such filings between January and February, with one out of every 1,846 homes receiving some type of notice.

New York ranked 35 out of 50 states in the nation for foreclosure activity in February. Nevada ranked first with one of every 70 homes receiving a notice, Arizona second and California third. Nebraska had just 13 homes in some stage of foreclosure, the lowest in the nation.

“These properties enter the market and compete with existing housing stock for sale that’s not distressed,” said Miller, the appraiser. “It does provide opportunities [for buyers], but it’s also evidence of a weaker economic climate, so it doesn’t do much to help consumer confidence. For the consumer, in general, it’s another piece of negative economic news that continues to cause people to pull back on their purchase activity.”