The residential sales markets in Queens and Brooklyn saw an increase in activity toward the end of 2009, with Queens seeing a dramatic 50 percent uptick over the third quarter and year-over-year, according to fourth-quarter market reports from Prudential Douglas Elliman released today.

Meanwhile, prices in both boroughs continued a steady decline.

Several market factors conspired to turn the traditionally slow season into a more active one, according to appraiser Jonathan Miller, head of Miller Samuel and preparer of the report: the loosening of credit, the extension of the first-time homebuyer tax credit and the steady decline in prices.

“The takeaway [from the reports] is that we saw a continued uptick in sales activity… in the fourth quarter — more brisk than the third quarter,” Miller said.

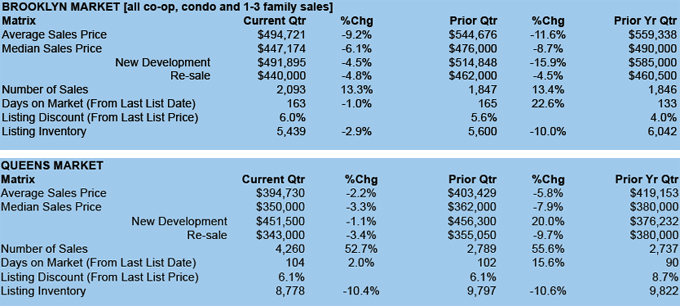

In Queens, the fourth quarter of 2009 saw 4,260 home sales, up 52.7 percent from a quarter earlier and 55.6 percent from the same three months in 2008. The number of sales in Brooklyn during the fourth-quarter 2009 reached 2,093, up a more modest 13.3 percent from the previous quarter and 13.4 percent over the same quarter a year earlier, the Elliman report shows.

Meanwhile, prices declined in both boroughs.

The average sales price in Queens was $394,730 in the fourth quarter, down 2.2 percent from the previous quarter’s average of $403,429, and 5.8 percent from fourth-quarter 2008’s average sales price of $419,153.

The average sales price in Brooklyn during the last quarter dropped a greater 9.2 percent to $494,721 from $544,676 in the third quarter of 2009, and down 11.6 percent from the fourth quarter of 2008 when the average sales price in Brooklyn was $559,338.

Miller said that the price decline was expected due to seasonal price trends and pent up inventory.

The price drops are also likely in large part because developers have been cutting prices to increase sales.

But while the uptick in sales activity in Brooklyn and Queens is a good omen, Miller said it is too soon to call a bottom.

“The good news is credit isn’t getting any tighter — the bad news is it can’t get any tighter,” he said. “We’re looking at… best case scenario, a market moving sideways.”

A market report on home sales prices released yesterday by the Real Estate Board of New York showed similar prices and downward direction.

Brooklyn average home sales prices dropped to $499,000 in the fourth quarter of 2009, down 7 percent from the third quarter’s average price of $534,000 and a 10 percent drop from the fourth quarter of 2008, when the figure was $555,000, REBNY figures show.

In Queens, REBNY says, the fourth quarter average home sales price dipped to $398,000, 2 percent from the previous quarter when the average price was $406,000, and down 5 percent from the same quarter a year earlier, when that figure was $420,000.

Miller noted that neighborhoods, in which new developments dominate, like Williamsburg and Greenpoint, will have a rougher road to recovery because they’re not able to as nimbly maneuver the changing market conditions. These neighborhoods tend to struggle because there are more units to offload in a crowded market and it’s often not easy to slash prices in large projects.

As The Real Deal previously reported, new developments like Williamsburg’s 80 Metropolitan often cling to prices that seem unrealistic for market conditions because such cuts have to be cleared with lenders first.

While some market reports have suggested that Williamsburg and Greenpoint, considered North Brooklyn in Elliman’s report, is alive with activity, Miller is more skeptical.

“Anywhere there’s a high concentration of new developments,” will see slow market adaptability, Miller said, noting that about 75 to 85 percent of sales activity in Williamsburg and Greenpoint over the last two years has been new construction. “Sales activity in ‘North Brooklyn’ is half what it was a year and a half ago.”