Marina Tencza and husband, Darius, are demanding their money back for an apartment they moved into at the Arris

Marina Tencza and husband, Darius, are demanding their money back for an apartment they moved into at the ArrisSo far this year, federal judges have ruled on the first three cases in which New York City buyers are attempting to invoke a previously unknown law, the Interstate Land Sales Full Disclosure Act, to quash their apartment contracts based on the developers’ failure to file all the necessary paperwork.

Two of the decisions were in the developers’ favor, and the most recent one, handed down this month, was in the buyers’ favor.

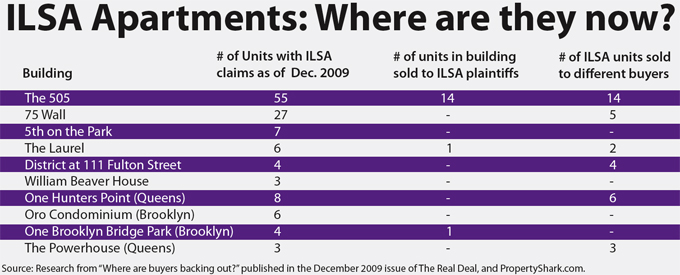

Meanwhile, a search of the federal district court’s website revealed that only a handful of new ILSA cases have been filed in 2010, including possibly the first from buyers who have actually been living in their apartment — for nearly two years (see a chart about the ILSA apartments below).

The Real Deal wrote about 124 apartments tied up in such disputes throughout 11 buildings in the city last December, when the economy was at its low and many believed the law could have a destabilizing effect on the real estate market if wielded by enough buyers.

We checked up on the status of those 124 apartments using real estate data aggregator PropertyShark.com, and found that 50 are now being occupied, some by the former plaintiffs.

Only three buildings in the city still have a significant number of vacant apartments that the developer had thought he sold before being slapped with ILSA suits — the 505, 75 Wall, and 5th on the Park, where the developer won his case earlier this year — indicating that the courts’ interpretation of the law poses more significance to individual buyers and developers than the real estate market as a whole.

Barring all technicalities under debate, the 1968 law essentially dictates that a developer of land subdivided more than 99 times file an exhaustive property report with the federal government, and provide that report to buyers, before any contract is signed. Hardly any developers in the city even knew the law existed before it started being used against them when the real estate market began heading south.

The new cases filed this year are in buildings such as the District, where the judge ruled in favor of three separate buyers earlier this month, and W Downtown Hotel & Residences in Manhattan; Toren in Downtown Brooklyn; and Arris Lofts in Queens.

The Arris Lofts case was filed by Darius Tencza, a financial attorney who declined to comment, and his wife Marina. They were featured in The Real Deal’s September 2008 issue as the giddy buyers of their now unwanted apartment, which was the most expensive sale in Queens, a $3 million penthouse with sprawling terraces overlooking Long Island City in all its post-industrial glory.

“To my knowledge, this is the first [ILSA] case in New York where the plaintiff has actually been living in the apartment for two years,” said attorney Bruce Lederman, who is representing the Arris Lofts developer, the Andalex Group.

He acknowledges that the developer of the condo, with 237 apartments, did not file a property report but is arguing that Tencza missed the statute of limitations — which is three years after the contract is signed — by a few days. And besides, he said, “the law shouldn’t permit a guy to live in the apartment for two years and then say, ‘You know, I really don’t like it,’ and try to give it back.”

There aren’t likely to be many more Tenczas going forward because the statute of limitations is running out for boom-year buyers hard-pressed to find any major problems with their apartments besides the price. There are other laws they can invoke for issues like fraud or poor workmanship.

Attorney Lawrence Weiner said that since he won the three District cases, “I’ve been getting a lot of calls about potential new matters. But sometimes they purchase condominium units that ILSA wouldn’t apply to [such as in buildings that have fewer than 100 units], and some of them are just barred from filing because of the statute of limitations now.”

He said he doesn’t plan to file any new cases at this time.

The 505 in Hell’s Kitchen, was the building that had the most ILSA cases in the city with contracts for 55 of its 108 apartments in dispute at one point; 14 of the plaintiffs ultimately closed, most with no discount.

One of the plaintiffs who closed was a “ringleader” in recruiting others to file lawsuits against the builder, Parkview Developers, via a Facebook page set up to help buyers socialize before construction was finished. He did not return calls for comment.

Another 14 apartments were sold to different buyers. Weiner, who has clients at the building, said the plaintiffs who put down deposits on those apartments are still fighting for their money back.

“In the realm of the marketplace, this is a pimple, not even a pimple,” said Halstead Property’s Stephen Kliegerman, who is handling marketing for the 505.

While that may be true for the most of the city, the 27 units in dispute at the 505 are worth a total of around $21 million. But Parkview has asserted that the building is in good financial standing, and there are no liens filed against it.