Source: PropertyShark

New York City foreclosure activity in the fourth quarter saw a precipitous drop following lawsuits that exposed shoddy paperwork from banks, new figures from PropertyShark show.

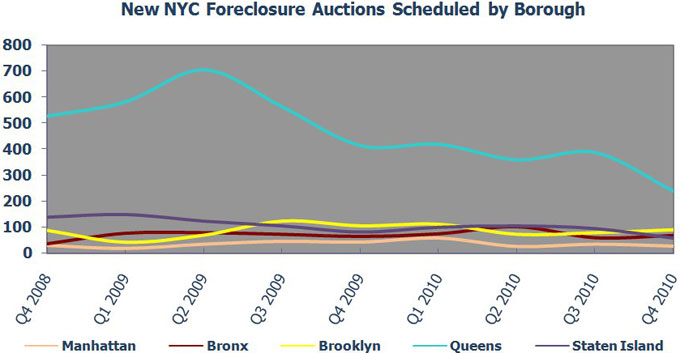

Scheduled foreclosures dropped 26 percent compared with the third quarter, and stood 32 percent below 2009 fourth-quarter levels. Queens retains the largest portion of the city’s scheduled foreclosures, at 49 percent of the total. Manhattan has just 6 percent while Brooklyn clocks in at 19 percent.

Lis pendens, the first notices homeowners receive of foreclosure, settled at the lowest rate since the fourth quarter in 2008. Citywide, banks delivered 2,913 notices last quarter, 30 percent fewer than in the third quarter of 2010.

As States Across The Country Investigate Foreclosure Law Compliance And Court dockets swell with lawsuits alleging flawed paperwork and wrongful foreclosure, banks and mortgage servicers are proceeding more cautiously in initiating foreclosure actions.

“Banks are less likely to file a lis pendens or take it to auction in this environment,” said Brian Scully, PropertyShark’s director of marketing. But he said the slowdown could be good for the economy. “Homeowners aren’t losing their homes, so they have a chance to come up with a solution. And that means less people under serious distress or imminent problems.”