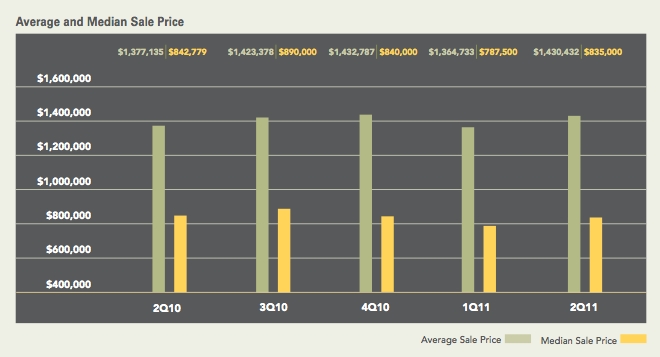

Chart of Manhattan sales prices (Source: Halstead Property)

The Manhattan residential real estate sales market can best be characterized as stable, according to second-quarter reports issued today by the city’s largest real estate brokerages, signaling strength amidst an uncertain economic climate elsewhere in the country. Reports from Prudential Douglas Elliman, the Corcoran Group and data from sister firms Halstead Property and Brown Harris Stevens show mixed but healthy indicators. In a still strict lending environment, it comes as little surprise that the best performing sectors of the market — the top end of the market where buyers are wealthiest, and the bottom end of the new development market where units qualify for Federal Housing Authority-approved loans — were those where financing came easiest.

Though some year-over-year numbers were skewed because of the looming expiration of the homebuyer’s tax credit, which was slated to expire June 30, 2010 before a three-month extension was enacted, the firms’ experts said much of the remaining variance can be explained by normal statistical fluctuation.

According to Elliman’s report, the median sales price rose 8.7 percent over the first quarter to $850,000, but dropped 5.5 percent from the same period a year ago. The volume of sales spiked 10.7 percent to 2,650 from the first quarter, but dipped 3.8 percent year-over-year — a solid standing considering the looming expiration of the homebuyer’s tax credit, according to appraiser Jonathan Miller of Miller Samuel, who prepared Elliman’s report.

“The market is stable,” he said. “The key indicators were mixed, but consistent with long-term historical trends.”

For example, even though Elliman’s report shows the average listing remained on the market for 132 days, a 29.5 percent year-over-year increase, it’s actually consistent with the 10-year average Miller calculated of 127 days. The number was deflated in the second quarter of 2010 because buyers rushed to sign in time to qualify for the tax credit.

The big sore spot in the market was the median sales price of new developments, which plunged 15.7 percent from last quarter, and 19 percent from the year before, to $1.13 million. Miller said this was consistent with the fact that the average sale in a new development was about 15 percent smaller in physical size than previous quarters. Those smaller units require buyers to borrow less, and have price points that qualify for special loans, and therefore dominated the market, Miller said.

Still, according to identical market reports issued by Halstead and BHS, both part of Terra Holdings, the average price per square foot of a unit in a new Manhattan development fell 9 percent in the second quarter to $1,069.

“Many new units developed a few years ago were priced aggressively for that market,” Jim Gricar, general sales manager at Halstead, said. “Now, in many cases, the market has caught up to them.”

The Halstead and BHS reports show a 1 percent decline in the median price of a Manhattan home, to $835,000, compared to the same period a year ago. But the average apartment price rose 4 percent over that same period, and across all Manhattan neighborhoods those gains were powered by apartments with three or more bedrooms. In particular, on the Upper East and Upper West sides, units with three-plus bedrooms accounted for more than a fifth of all sales, and average prices roses 15 and 19 percent, respectively, over the prior year quarter.

“Buyers with the means to buy at the upper end of the New York market are, in fact, buying,” Gricar said. “They’re helping out the rest of the market.”

Because many of those buyers are foreigners paying in cash, or are among the very richest of buyers, financing is not an issue for them. They’ve returned to the market, Gricar and Miller both said, now that prices have shown stability.

Corcoran’s report corroborated many of the aforementioned findings. Its report shows a median sales price of $830,000, a 4 percent increase over last quarter, and 6 percent greater than the same period a year ago. Though sales volume was down 14 percent versus the artificially high rate of the second quarter of 2010, at 3,180 sales it was down just 7 percent from the trailing five-year average, according to the report.

The median price of new development sales was $979,000, 15 percent less than last quarter, and 20 percent off the median price achieved a year ago. While the luxury end of the market posted modest price gains over last year, it actually declined somewhat from last quarter, when a single $48 million transaction heavily impacted the figures. However, re-sale co-ops posted a median sales price of $4.35 million, 18 percent above last year’s price, which the report attributes to growth in sales greater than $9 million.

Corcoran President Pamela Liebman did not respond to a request for comment.