source: Global Property Guide

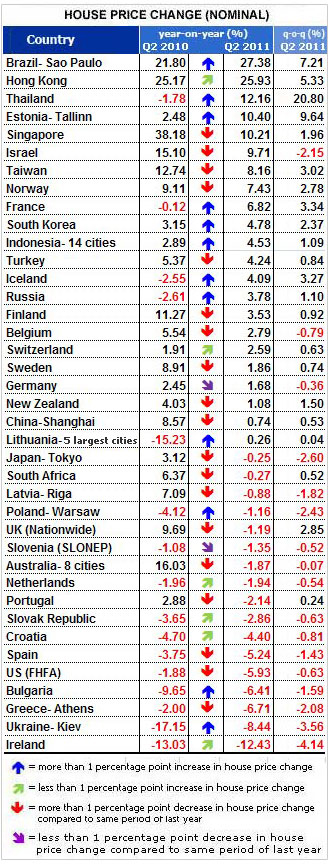

The world’s housing markets were ostensibly weaker on balance during the year ending in the second quarter of 2011 than in previous years, according to the first-ever published residential market survey covering the second quarter by the Global Property Guide.

The Unites States and European housing markets fared particularly poorly, the report shows. U.S. home prices fell by over 9 percent since the second quarter of 2010 and home values were pushed down by foreclosures despite the lowest mortgage rates in half a century. The key factor driving U.S. foreclosures was the persistently high unemployment rate, the report says, which stood at 9.1 percent in the second quarter.

Few European housing markets improved; the worst-hit countries were Ireland, Greece and Spain, all of which performed worse than in 2010.

Globally, more housing markets experienced price falls than rises. Out of 26 countries with price falls, 18 saw accelerated rates of decline.

“House prices are still over-stretched in many countries, and developed world economies are still weak, so price-falls were to be expected,” said Matthew Montagu-Pollock, publisher of the Global Property Guide. “Low interest rates will be positive for housing, but only if the underlying economies recover. And recovery will ultimately bring a sting in the tail because higher inflation would eventually bring higher nominal interest rates, choking strong upward house price movements.” — Katherine Clarke