The ever-increasing throngs of brand-hungry shoppers traipsing through Manhattan has resulted in record retail deals this year. And it’s the usual suspects who are pouncing on the opportunity.

Chanel, Giorgio Armani and Old Navy were among the retailers at the forefront of Manhattan’s largest retail investment sales of the year. Retail condominiums at the World Trade Center complex and St. Regis New York topped the list of the 10 priciest deals, which included ones that were pending or were minority stakes. Real Capital Analytics and news and brokerage reports provided the data.

Crown Acquisitions, Vornado Realty Trust and Jeff Sutton’s Wharton Properties were especially active. These three investors acquired just nearly 100 properties valued at a total of more than $9 billion between January 2012 and November 2014, as The Real Deal reported earlier this month.

1) World Trade Center retail condo

A rendering of the street-level retail for 4 World Trade Center, left, and 3 World Trade Center

Buyer: Westfield Group, Seller: Port Authority of New York & New Jersey, Price: $800 million.

Australian mall giant the Westfield Group closed on the remaining 50 percent interest in the World Trade Center retail complex in January. The transaction valued the entire 365,000-square-foot property at $1.6 billion. In 2011, Westfield paid $600 million for the initial 50 percent stake. All told, the firm has invested $1.4 billion to date.

2) St. Regis New York retail condo floors 1-5

Buyers: Vornado Realty Trust and Crown Acquisitions, Seller: Richemont, Price: $700 million.

Vornado and Crown closed on 24,700 square feet of retail space plus air rights at the St. Regis Hotel at 2 East 55th Street and a neighboring townhouse at 697 Fifth Avenue. Richmond, the parent company of Cartier, bought the property in 1917 in exchange for a strand of pearls valued at the time at $1 million, as TRD reported. Cartier chose not to be the property owner. Richemont sold the building for more than $3 million to Phoenix Mutual Life Insurance, but remained as a tenant. Over the course of that last lease, the annual payments rose to about $7 million, city records show. And during the approximately 15 years of that lease, the value of Retail Space On Fifth Avenue exploded.

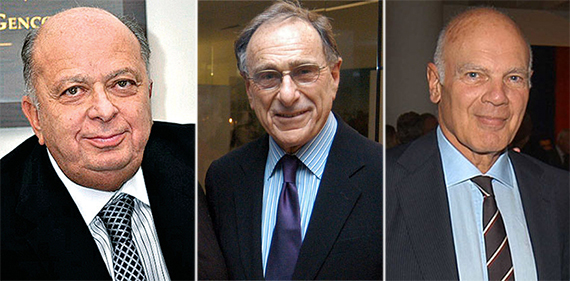

From left: Stanley Chera, Harry Macklowe and Steven Roth

3) 432 Park Avenue retail condo

Buyer: Macklowe Properties, Sellers: CIM Group and Macklowe Properties, Price: $450 million.

Harry Macklowe is in contract to acquire the 74,816-square-foot retail condo at the 70-story residential tower. CIM Group, with Macklowe in a small position, is selling the space. The two parties are developing the tower, which is expected to open next year.

4) Old Navy flagship store at 144-150 West 34th Street

From left: Doug Harmon, Adam Spies, 144-150 West 34th Street, and Barry Sternlicht

Buyers: Starwood Capital Group and Crown Acquisitions, Seller: KLM Construction, Price: $252 million.

Stanley Chera’s Crown showed up again on the list, this time partnering with Barry Sternlicht’s Starwood. The buyers acquired the four-story, 77,760-square-foot building entirely occupied by Old Navy. Doug Harmon and Adam Spies of Eastdil Secured represented both parties. Air rights would allow for the site, Between Broadway And Seventh Avenue, to be redeveloped into a 300,000-square-foot hotel and retail tower, as TRD reported.

5) Giorgio Armani building at 760 Madison Avenue

Buyer: SL Green Realty, Seller: Estate of John S. Weatherly, Price: $232.4 million.

SL Green paid $232.4 million for the land beneath the 16,468-square-foot Giorgio Armani building, according to Real Capital Analytics. Massey Knakal Realty Services’ Paul Massey, Guthrie Garvin, Michael Gembecki and Tyler Hughes were the brokers on the deal. The purchase was part of a $282.4 million package including 19-21 East 65th Street.

401 West 14th Street and TIAA-CREF CEO Roger Ferguson (inset)

Buyer: TIAA-CREF, Seller: Clarion Partners, Price: $168 million.

TIAA-CREF took a minority stake in the 64,226-square-foot Apple store building in the Meatpacking District. Eastdil Secured’s Douglas Harmon, Adam Spies and Kevin Donner marketed the minority stake. Taconic bought the building in 2005 for about $37 million, and leased 46,000 square feet on the lower level, ground, second and third floors to Apple for 15 years, with a 10-year extension option.

7) 522 Fifth Avenue retail condo

Buyers: Ashkenazy Acquisition, Deka Immobilien and General Growth Properties, Seller: Morgan Stanley, Price: $165 million.

Ashkenazy Acquisition and partners plan to renovate and redevelop the space occupied by shoe store Camper and sporting goods shop Orvis. Both tenants are soon vacating the property. The condo offers 7,600 square feet on the ground and 16,000 square feet, and is being marketed as a flagship location for a retailer, GGP CEO Sandeep Mathrani said during an October earnings call. Savills Studley represented the buyers, while CBRE represented Morgan Stanley.

8) Chanel at 733-739 Madison Avenue

Buyer: Chanel, Seller: Louis and Anne Abrons Foundation, Price: $123.8 million.

Chanel came close to setting a price-per-square-foot record for single retail units when it bought one of the co-ops it currently occupies as a tenant. An affiliate of the French fashion company also agreed to pay $18,000 per month in maintenance fees. The Chanel Fine Jewelry space spans a mere 3,950 square feet. CBRE represented the buyer.

9) 981-989 Third Avenue

Buyer: Macklowe Properties, Sellers: SL Green and Emmes & Co., Price: $100 million.

Macklowe Properties is looking to demolish a trio of retail buildings totaling 42,000 square feet near East 59th Street to make way for a retail-and-residential tower. Sl Green Sold 981 Third Avenue and 983 – 987 Third Avenue for $69 million, while Emmes sold 989 Third Avenue for $31.3 million. Together, the Upper East Side properties offer 90,000 buildable square feet. Massey Knakal Realty Services’ Bob Knakal and Clint Olsen represented the sellers.

Buyer: The Fasanos and JHSF Participacoes S.A., Seller: Extell Development, Price: $95 million.

The hotel and restaurant investment family the Fasanos and construction firm JHSF Participacoes S.A., plan to raze the existing 20,800 square feet of retail at this site and build the Fasano Hotel & Residences. The property last sold for $80 million in 2011, data showed.