As the year winds down to a close, The Real Deal looks back on the big deals, attention-grabbing broker moves and record numbers that made 2014 one for the books.

TRD‘s profile on real estate scion Jared Kushner was the most popular story on TheRealDeal.com in 2014. The in-depth narrative chronicles the young CEO’s unexpected rise to the top of his family’s company and his appetite for megadeals, including the $375 million buy of the “Dumbo Heights” complex in Downtown Brooklyn.

Gary Barnett is no stranger to controversy — and he doesn’t shy away from it either. The Extell chief has been especially vocal about defending the city’s so-called “poor-door,” but he’s also battled — and sometimes bested — many of the city’s biggest developers.

The developer’s 40 Riverside Boulevard project, for instance, will have two entrances: One for the condominium buyers, whose residences will face the Hudson River, and another for tenants, who will live in affordable rental units.

Unlike other big-name developers, the Witkoff Group almost always teams up, not just with equity partners, but with other industry figures who bring specialized expertise to the table. “Savvy strategist” Steven Witkoff has worked with the likes of Horward Lorber, Fisher Brothers, the Macklowe Group, and Ian Schrager, to name a few.

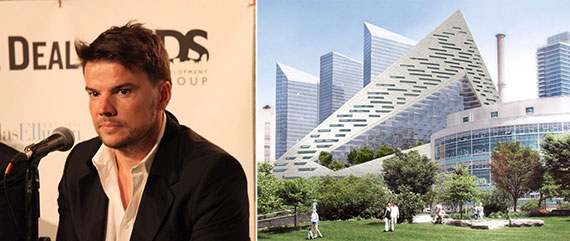

Danish architect Bjarke Ingels is just beginning his New York City tear, with four projects underway in Manhattan and Brooklyn. The starchitect opened his NYC office in September 2010 with just two employees — a number he says has grown to about 100 in only four years.

Among Ingels’ projects in the Big Apple is the pyramid-shaped, 709-unit residential, rental and retail building at West 57th Street he designed for the Durst Organization. The building, which will be one of Manhattan’s largest rental properties, topped out at 43 stories in October.

Michael Shvo, who parted ways with Douglas Elliman to start the Shvo Group in 2004, burst back onto the development scene in May 2013 after a “semi-retirement” during the recession.

Right now, Shvo’s developing condos at 100 Varick Street in Soho and 125 Greenwich Street in the Financial District.

It was a big year for some of New York City’s top brokers, too. Fredrik Eklund — who shot to stardom on “Million Dollar Listing New York” — and partner John Gomes took the No. 1 spot on The Real Deal‘s annual broker ranking.

The pair logged $535.5 million in listings in 2014 (compared to $92.2 million in 2013) and later claimed that they closed more deals this year than anyone in Douglas Elliman’s history.

A strong luxury market in 2014 buoyed Manhattan’s largest brokerages. Firms like Douglas Elliman, the Corcoran Group, Brown Harris Stevens and Sotheby’s International Realty saw the total dollar volume of their Manhattan listings jump year-over-year, according to TRD‘s annual brokerage ranking.

“The luxury market is an extremely important market to be fluent in for any broker, especially now, since there are more high-net-worth individuals living in New York than ever before,” said Wendy Maitland, president of sales at brokerage Town Residential. “It’s not something that happens because you can get a certification or a degree in it. It happens with experience.”

From left: Corcoran’s Pam Liebman, Dubai and Robert Reffkin of Urban Compass

TRD also surveyed brokers across the Big Apple to identify the best amenities at brokerages both big and small. Firms use technology, high commission splits and marketing/advertising support to attract top-notch talent, the survey showed. Platinum Properties even treated its agents to a trip to Dubai.

From left: Bob Knakal and Paul Massey

For commercial brokers, office facilities, training/support and high commission splits are key … but skydiving expeditions (CPEX) and whitewater rafting trips (Eastern Consolidated) aren’t too shabby, either.

On the acquisitions front, the big news was Cushman & Wakefield’s move to buy Massey Knakal for a cool $100 million. Massey Knakal CEO Paul Massey will oversee sales brokerage operations for New York City. Robert Knakal will also fill a key role at Cushman, which aims to ramp up its portfolio of small and mid-sized buildings.

From left: Joe Sitt and Andrew Heiberger

The residential brokerage world saw its fair share of drama in 2014, however. Town Residential top guns Joseph Sitt and Andrew Heiberger found themselves at the center of an ugly — and public — legal battle when Sitt refused to renew Heiberger’s CEO contract on the grounds that he had failed to meet any of the financial targets the two had agreed upon. They eventually reconciled, and Heiberger took back the reins of CEO on Oct. 1, 2014.

From left: Anthony DeGrotta, Neil Binder and Larry Friedman

Neil Binder, co-founder of the Bellmarc Group, was sued by his business partners for allegedly using company funds as his “personal piggy bank.” Amid the shakeup, more than 25 agents flocked to firms like Halstead and City Connections Realty.

Binder ultimately reached a settlement with Larry Friedman and Anthony DeGrotta, who resigned and joined Keller Williams NYC. The accusations, Binder said, “will always haunt me as a personal blemish on my 35 years of pursuing the highest standards in the business.” Coldwell Banker later terminated its franchise agreement with the embattled firm.

Top from left: Eugene Litvak, Fabienne Lecole and Douglas Heddings. Middle from left: Kyle Blackmon, Julia Boland and Leonard Steinberg. Bottom from left: Shlomi Reuveni, Nicole Oge and Jarrod Guy Randolph.

The year also saw some attention-grabbing moves from some of the city’s top brokers. After a decade-plus tenure at Douglas Elliman, Leonard Steinberg announced he and partner Herve Senequier were joining startup brokerage Urban Compass.

Kyle Blackmon

“I knew that when I joined a company like this that the real estate world would take note,” Steinberg said. “I’ve had calls like, ‘Oh my God, Leonard! What the hell are you doing?’ And then they say: ‘You know what? I think it’s brilliant.’ That’s 90 percent of the calls; 10 percent of the people still think I’m completely insane.”

Kyle Blackmon, an elite luxury broker and the holder of the distinction of New York City’s priciest closed sale, also jumped to Urban Compass from Brown Harris Stevens in November.

His departure is Brown Harris Stevens’ highest-profile exit of the decade. An internal BHS memo that made the rounds said that the value of Blackmon’s equity “will be dependent on the success of Urban Compass’ founders implementing their vision of selling their company for substantially more than many industry experts believe is possible – especially considering their recent switch to a traditional brokerage model.”

From left: Ori Allon, Leonard Steinberg, Hervé Senequier and Robert Reffkin

Urban Compass upped its brokerage game with some major pickups in 2014. Besides Steinberg and Blackmon, the techy brokerage hired Jay Glazer, who was Warburg’s top broker in 2013, and Eugene Litvak, whose team was Citi Habitats’ team of the year for overall production and rentals for 2013.

Joshua Kushner

Such high-profile acquisitions, paired with nearly $500 million in listings and a $360 million valuation, had the industry wondering: Is Urban Compass really the future?

What is clear is that 2014 was the year of the real estate tech startup. A report first published by TRD found that investors funneled $743.7M globally into commercial real estate startups between the second quarter of 2012 and the second quarter of 2014. Some of this cash is coming from the early backers of big-name startups like Uber, Instagram and Buzzfeed.

Joshua Kushner, whose Thrive Capital invested in Uber and Instagram, is an investor in at least four industry startups: Hightower, 42Floors, Honest Buildings and Urban Compass.

While some venture capital firms are pouring money into real estate’s tech firms, others have their eyes set on another cash-rich company: WeWork.

From left: Miguel McKelvey and Adam Neumann

The shared office and coworking space provider raised $335 million in its latest funding round. WeWork’s $5 billion valuation puts it in the same league as one of Silicon Valley’s greatest successes, Pinterest, and values it at $1.5 billion more than Trulia.

The milestone capped off a year of benchmarks for New York City real estate.

New York City’s co-op record was broken three times in 2014. Egyptian billionaire Nassef Sawiris bought Edgar Bronfman’s 960 Fifth Avenue penthouse for a record $70 million in June, which was soon upset by Israel Englander’s purchase of the official residence of the French ambassador to the United States for $71.3 million.

From left: Leonard Blavatnik, 834 Fifth Avenue and Woody Johnson

New York Jets owner Woody Johnson ultimately pulled the most money for his 834th Fifth Avenue co-op, which he sold to billionaire Leonard Blavatnik $80 million — $5 million over the asking price — in October. (Click here for The Real Deal‘s list of co-op records that have been set since 2005.)

From left: Ryan Serhant and the $118.5 million unit at the Ritz-Carlton in Battery Park City

In June, a trio of contiguous condos at the Ritz-Carlton in Battery Park City assumed the title as New York City’s priciest listing. The combined 15,434-square-foot unit was listed with Nest Seekers agent and “Million Dollar Listing” star Ryan Serhant for $118.5 million.

That record won’t last long, however. A few months later, the Zeckendorfs announced they would ask $130 million for 520 Park’s penthouse triplex.

Some of the city’s top brokers weighed in on whether that price tag was a bridge too far. “It is an iconic old-world building and it’s not even built yet,” said CORE Group’s Emily Beare.

432 Park Avenue (Photo: DBOX for CIM Group & Macklowe Properties)

As some of the city’s listings reached new heights, so did some of its buildings. 432 Park Avenue officially became the Western Hemisphere’s tallest residential building when it topped out at 1,396 feet in October.

One World Trade Center

One World Trade Center officially went back to work in November. The first wave of Condé Nast employees moved into the $3.8 billion office tower, filling five of the building’s 104 floors.

So, what’s in store for 2015? You’ll have to check out TRD’s last issue from 2014 to find out.