Rents in both Manhattan and Brooklyn continued to increase in May, with the unflagging economy and tight mortgage conditions paving the way for landlords to hike their rates, according to the new monthly rental market report from Douglas Elliman released Thursday.

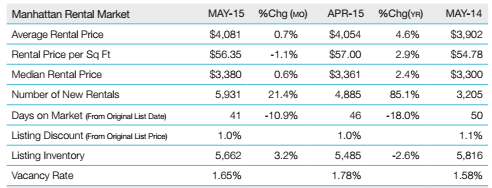

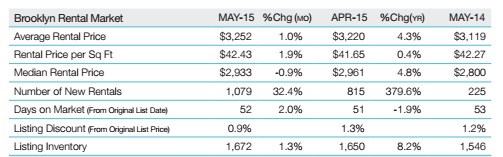

The median rental price in Manhattan was $3,380, up 2.4 percent from the same period last year. In Brooklyn, the median price was $2,933, up 4.8 percent from last year. This was the 15th consecutive month of year-over-year increases in Manhattan. Brooklyn had seen decreases several months ago, but rates continued climbing higher for the second consecutive month in May.

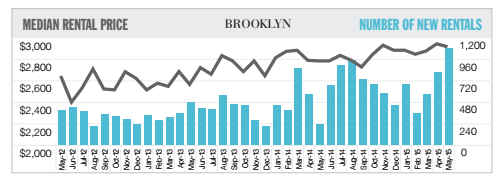

Brooklyn median rental prices and number of new rentals (credit: Douglas Elliman and Miller Samuel)

In April, Brooklyn saw a median record high of $2,961, and the May rate was not far below this level.

“Basically, it’s high,” said Jonathan Miller, president of real estate appraisal firm Miller Samuel and the author of the report. “It’s not trending lower [in Brooklyn]. It’s just kind of hovering or skirting near record levels. It’s been doing that all year.”

In Manhattan, new rentals, including leases for new development buildings as well as older buildings, surged 85.1 percent from last year to 5,981, while in Brooklyn, new rentals were up 379.6 percent to 1,079.

Manhattan rents (credit: Douglas Elliman and Miller Samuel)

Miller said that the majority of these “new rentals” are new leases in old buildings, rather than new development leases, and that the figure is largely driven by New Yorkers switching apartments in an effort to resist rent increases.

“People are seeking out more affordability by not renewing and looking elsewhere, while the new people come in and take their spots. I describe the market as having a lot of churn because people really want to be here, but are trying to find affordable options,” he said.

Brooklyn rents (credit: Douglas Elliman and Miller Samuel)

Meanwhile, landlords have little reason to try and entice prospective tenants. In Manhattan, the percentage of new rentals with concessions was down to a mere 1.5 percent from 5.7 percent last year, while in Brooklyn, only 1.1 percent of new rentals had concessions, down from 7.1 percent last year.

“We went from low to very low [on concessions],” Miller said.

The basic conditions allowing for these increases, according to Miller, are rising employment and a tight market for credit that pushes would-be homebuyers into the rental market.

“I’m not sure what changes this other than a weaker economy and a significant easing of mortgage lending standards, and neither one seem imminent,” he said.

In Queens, the median rental price was $2,597, down 12.4 percent from last year, which Miller chalked up to a random influx of one-bedroom apartments, which are popular in new-construction buildings in the borough.

A rental report by brokerage Citi Habitats, also released Thursday, showed that the most affordable Manhattan neighborhood south of 96th Street was the Upper East Side, with a median rent of $2,450 in May, while the most expensive Manhattan neighborhood was Soho/Tribeca, with a median of $4,298. The second priciest was Gramercy/Flatiron, at $3,995.