Rising high above Central Park, Extell Development’s One57 is Exhibit A for New York City’s emergence as a playground for the super-rich. It boasts a $100.5 million penthouse that’s currently the priciest apartment ever sold in the city.

But tax breaks at One57 cost the city $65.6 million in property tax revenue, according to a damning new report from the city’s Independent Budget Office. And those subsidies, which underwrote 66 affordable units in the Bronx, could have produced nearly 370 affordable units instead.

The IBO, in a fiscal brief released late Tuesday, used Gary Barnett’s glassy tower as a case study for New York’s 421a program, the divisive tax abatement mechanism that was created to spur affordable housing development and was recently renewed through Dec. 31 by state lawmakers.

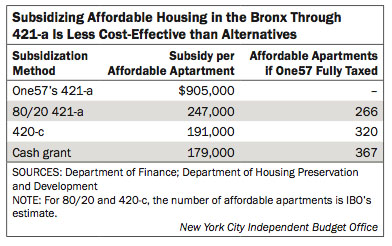

According to IBO’s calculations, One57 produced 66 affordable units in the Bronx at a cost of $905,000 per apartment – that’s half the average sales price of a market-rate apartment in Manhattan and more than five times the $179,000 the IBO reckons it costs, on average, to produce an affordable unit.

“Had One57 not received 421a benefits, its full tax liability could have spurred the construction of 367 affordable apartments in the Bronx instead of the 66 it received through the certificate program,” the report states.

Established in 1971, 421a has drawn the ire of some who say the program isn’t a cost-effective way to develop affordable units. Proponents of the program, such as the Real Estate Board of New York, however, insist it helps create affordable housing that otherwise would not be built.

Prior to the recent renewal, 421a was last modified in 2008, when the city stopped issuing certificates that market-rate developers would buy from affordable housing developers in order to avail of tax benefits. The affordable developers, in turn, would then use the proceeds to build affordable housing elsewhere in the city. But five projects – including One57 – were grandfathered into the old rules.

Extell purchased 421a exemption certificates for $5.9 million from a developer who used the proceeds to finance 66 affordable apartments in the Bronx. According to the IBO report, the affordable developer received a direct subsidy of $89,400 per apartment from Extell’s purchase, compared with the $905,000 per apartment cost to the city.

“Had One57 not been grandfathered under old rules, in theory the city could have collected the building’s full tax liability and dedicated the revenue for affordable housing,” the report said.

Wiley Norvell, a spokesperson for Mayor Bill de Blasio, said “the staggering cost and inefficiency of this program is precisely why the administration sought—and succeeded—in ending 421a tax breaks for luxury condominiums. The practice was just indefensible.”

A comparison of affordable housing subsidies

In comparing the cost of One57’s 421a tax exemption, the IBO report concluded it was far more expensive than other existing programs, including 80/20, in which 20 percent of a project’s units are set aside as affordable, and 421c, which provides a tax exemption to charitable organizations that create low-income housing. The Bronx development created via One57’s development will cost 3.7 times more than units created via 421c, for example.

On Monday, the de Blasio administration said the city financed more than 20,000 affordable housing units in the past fiscal year, representing a $618 million investment. It aims to create or preserve 200,000 affordable homes within a decade.

At One57, Extell sold 36 units at valued at $1.09 billion between July 2014 and June 2015, according to The Real Deal’s analysis of data from the Department of Finance and StreetEasy.

In January, the tower’s $100.5 million penthouse became the city’s priciest closed condo sale. Weeks later, U.S. Attorney Preet Bharara launched an investigation into tax breaks granted to Extell for One57. At the time, the luxury tower was estimated to have received at least $35 million in 421a abatements.

According to the IBO report, in addition to 421a tax abatements, buyers at One57 benefit from what’s known as a “581 discount,” a kind of preferential tax treatment. State law requires the city to value condos and co-ops as rental properties, rather than basing assessments on sales prices. (Citywide, the 581 discount for condos is 82.9 percent, meaning the assessed value is nearly 83 percent lower than its market value.)

Based on a sellout of $2.2 billion, the IBO ran a tax rate simulation and found condo owners saved $16 million in 2014 due to 581 discounts, plus another $9.4 million thanks to 421a.