After a successful first quarter that saw positive shareholder returns and price performance virtually across the board, major New York-focused real estate investment trusts gave it all back in the second quarter – and then some.

SL Green Realty, Vornado Realty Trust, Boston Properties, Equity Residential and AvalonBay Communities all reported negative returns in the second fiscal quarter of 2015, with ongoing concerns over a potential hike in interest rates later this year.

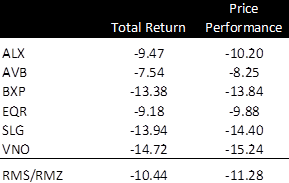

While REITs underperformed nationwide – the MSCI US REIT Index recorded returns of -10.44 percent in the quarter – several New York firms fell short against both that standard and the S&P 500 Stock Index, which recorded total returns of 0.28 percent last quarter.

Steven Roth-led Vornado reported returns of -14.72 percent in the quarter, coupled with a 15.24 percent drop in the company’s stock price over the period, according to data from Midtown-based investment banking firm Sandler O’Neill + Partners.

SL Green and Boston Properties also saw declines by both measures, with total returns of -13.94 percent and -13.38 percent, respectively. SL Green’s stock price fell 14.4 percent in the period, while Boston Properties’ dropped 13.84 in the second quarter.

In wake of a very strong first quarter for all three of those firms, the major New York office REITs “got killed in the second quarter,” Sandler O’Neill analyst Alexander Goldfarb told The Real Deal.

“A lot of that is driven by interest rate concerns,” Goldfarb noted, with the likes of Goldman Sachs recently expressing reservations over both SL Green and Vornado’s debt exposure in the event that the Federal Reserve decides to hike rates later this year.

“What’s interesting is that real estate fundamentals haven’t changed,” Goldfarb added. “New York office (rents) continue to accelerate, institutional capital continues to flood the market and push valuations higher for prime real estate, which is what the REITs tend to own.”

Residential-focused REITs Equity Residential and AvalonBay performed somewhat better in the second quarter– with EQR recording total returns of -9.18 percent to go with a 9.88 percent decline in stock price, while AVB had total returns of -7.54 percent coupled a stock price that fell 8.25 percent.

Both Equity Residential and AvalonBay benefitted from “exposure to the West Coast [market], which has been on fire,” Goldfarb noted, while apartment market fundamentals “as a whole have accelerated this year” and helped residential firms.

REIT performance in the last half of the year would continue to be dictated by the Fed’s approach on interest rates, Goldfarb added; a rate hike appears likely and would provide the central bank with a “cushion” that would give it with “ammo to fight” the next economic downturn.