The revenue for Stuyvesant Town and Peter Cooper Village has risen steadily over the past few years, and one path to growth has been the murky practice of “flex” rentals, an analysis by The Real Deal of Department of Buildings records shows.

The 11,232-unit complex on Manhattan’s East Side boasts about 5,000 free-market rentals, including dozens of current listings for one-, two- and three-bedroom units. But about a third of the apartments being actively marketed by the property’s management firm, CompassRock Real Estate, are in the grey area of flex rentals — units with partitioned rooms that can rent for significantly more than traditional apartments.

Behind the story:

Stuyvesant Town and Peter Cooper Village

CompassRock Real Estate

Blackstone Group

Level Group

Though it’s unclear how much additional revenue flex units have contributed to the overall bottom line, total revenue at Stuy Town increased from $357 million in 2013 to $383 million in 2014, figures from securitized loan data firm Trepp show.

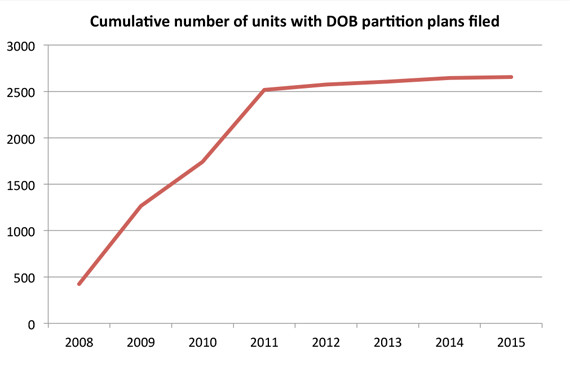

TRD analyzed more than 1,700 DOB alteration permit applications going back seven years and found that during that time, the complex’s owners filed plans to create partitions — which typically result in a new room — in 2,656 apartments in the 110-building complex.

Often, those units are now flex units, a sample comparison of the data reveals.

“The term ‘flex’ in an ad or listing for an apartment, or the words ‘home office,’ almost always implies someone in occupancy has the ability to use that [additional room] as a bedroom,” said Lawrence Link, president of residential-focused brokerage firm Level Group.

“It’s a grey area in the industry,” Link said, although he did not comment on the specific Stuy Town units. CWCapital Asset Management, which for now controls the property, did not respond to a request for comment.

Following a request for comment yesterday from TRD, CompassRock removed the range of asking rents from the flex units on the floorplan comparison page of its website, replacing them with: “Call for pricing.”

For CWCapital, an increased number of flex units is simply good economics: With more bedrooms comes more potential revenue, at a relatively low expense.

Flex apartments in Stuy Town are commanding premiums as high as 13 percent above that of non-flex units. A flex two-bedroom at Stuy Town leases for as much as $4,705, far above the top rate for a regular two-bedroom at $4,158, according to a review of apartments on the Stuy Town leasing site.

Just as its total impact on revenue remains cloudy, it’s unclear what the current configuration of units in Stuy Town is. In 2006, Stuy Town-Peter Cooper Village had 5,744 one-bedrooms, 4,977 two-bedroom and 511 three-, four- and five-bedroom apartments, an offering memo from that year stated.

That year, Tishman Speyer, along with partners, bought the property for $5.4 billion. By 2009, the landlord was conducting inspections to determine if tenants were installing illegal walls and not forking over additional revenue. Tishman then sought to remove the offending walls or replace them with legal walls.

The bulk of the partitions, pegged at 2,517, were filed between 2008 and 2011. (Tishman turned the property over to CWCapital in 2010.) Since 2012, filing activity has slowed greatly, with just 139 applications made.

The surge in partitions was “reflective of an effort at the time to raise rents,” said City Council Member Daniel Garodnick, who represents the complex. “That included a lot of students and others who treated the community more like a dorm than homes.”

Blackstone Group announced last month it would purchase the massive housing development for $5.3 billion, in partnership with the Canadian pension fund Ivanhoe Cambridge.