New York City real estate families — which have for generations invested and developed their own projects — are getting into a new game.

As banks have scaled back their luxury condo construction lending or stepped away from the market altogether, family-led development companies and other family-run firms have emerged as alternative lenders — joining hedge funds, private equity funds and others looking to fill the void.

In the last 12 to 18 months, these family-driven operations have quietly crept in as silent partners on New York projects that have struggled to lock in financing from more traditional lenders, several sources told The Real Deal.

“Private lending has really picked up in the last year, particularly the last six months as family offices or real estate developers who are not traditionally lenders have looked to deploy capital,” said Jonathan Aghravi, managing director in the capital advisory division of commercial brokerage Eastern Consolidated.

Aghravi said he gets at least a few calls or emails a week from lenders, including family-run companies, looking to connect with developers in need of debt. The loans run the gamut from mezzanine financing to bridge loans to first mortgages and range from as little as $2 million to as much as $200 million. And a variety of different family-run operations — from more institutional players to developers to so-called family offices, which are set up to manage the personal wealth of many top real estate families, are getting in on the action.

Among the companies wading into the lending game are the Hakim Organization, which reportedly owns more than $1 billion worth of New York City real estate, and Mack Real Estate Group, which is run by the father and son duo William and Richard Mack. (Sources largely declined to name specific family offices because those firms generally shun the spotlight.)

Among the companies wading into the lending game are the Hakim Organization, which reportedly owns more than $1 billion worth of New York City real estate, and Mack Real Estate Group, which is run by the father and son duo William and Richard Mack. (Sources largely declined to name specific family offices because those firms generally shun the spotlight.)

“There is a continuing attempt to maintain privacy,” said Scott Singer, president of the boutique financial intermediary Singer & Bassuk Organization, adding that developers are also reluctant to share that they are getting financing from outside sources.

For the more institutional family operations, publicity is not a bad thing.

Mack Real Estate Credit Strategies, Mack Real Estate Group’s lending arm, made headlines recently after financing deals including a $200 million loan for the acquisition and predevelopment of a property assemblage by Kuafu Properties, which is planning a luxury residential tower at 151 East 60th Street. It also provided a $70 million loan for capital improvements at 88 University Place, an 11-story office tower, where the owner, an investment group led by the fashion designer Elie Tahari, signed a lease with office-sharing giant WeWork to occupy eight floors.

Richard Mack said Mack Real Estate Credit Strategies, which he manages with former Blackstone Group managing director Peter Sotoloff, has “done about a billion dollars in loans since we opened for business about nine months ago.”

The Hakim Organization, which is run by Kamran Hakim, did not respond to requests for comment.

Money at a price

While these family-led lenders are stepping into the fray, the loans they are offering up don’t come cheap.

They typically have a minimum interest rate of 7 percent to 8 percent, and in some cases a rate as high as 18 percent, according to the heads of several family firms and brokers who help facilitate the loans.

By comparison, banks are generally lending at a rate of 3 percent or 4 percent in today’s market. Of course, there is a reason alternative lenders charge more: They are taking on riskier deals than banks are financing.

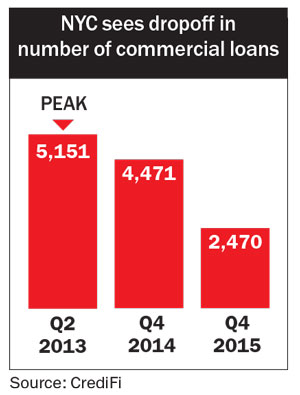

Still, as lending activity drops — it peaked in 2013 — developers have become more willing to accept those higher rates.

The total number of commercial real estate loans, including construction loans, in New York City dipped to 2,470 in 2015’s fourth quarter from 4,471 in 2014’s fourth quarter and a peak of 5,151 in 2013’s second quarter, according to the data provided to TRD by commercial lending data firm CrediFi. Dollar volume also dropped to $17.2 billion in the 2015’s fourth quarter from $29.4 billion the year before.

Michael Rudin, vice president of Rudin Management, the third-generation family development and investment company, said there are more opportunities for family-run developers and alternative players to step in as lenders these days.

Michael Rudin, vice president of Rudin Management, the third-generation family development and investment company, said there are more opportunities for family-run developers and alternative players to step in as lenders these days.

“Somebody might be desperate to bring more debt into the deal and willing to pay a premium for it,” said Rudin, who noted that his firm has looked at a variety of projects, but has not yet invested in debt.

“If the deal goes sideways, the family office can provide resources and assistance, and could have an easier shot at taking control of the deal,” he added.

Imperfect assets

Indeed, taking control of a property in the event of a developer default is likely more appealing to a family real estate firm that actually works in real estate, than to a bank that works in finance.

In addition, while private lenders have come under increased government scrutiny in the aftermath of the 2008 financial crisis, they are still not subject to the same stringent regulations that banks are — in part because their investors are mostly high net worth rather than retail investors.

Still, there are risks for family-run firms, especially if their end game is to wrangle the property from the developer.

“Debt may be an inexpensive way to establish control, but it’s not as secure as if they had an equity stake,” said Marc Halsema, managing director of global family office services at wealth management firm, Clarfeld Financial Advisors.

But family firms can be nimbler than larger lenders, said Dani Evanson, managing director at the California-based RMA, a real estate and investment advisory company that works with New York-based family offices.

“It’s a win-win for them because they’re creating a yield by being a lender, but at a low risk,” said Evanson. “If you have a perfect asset you’re going to have loan options. It’s when there’s risk that the banks and lending platforms get uneasy, and family offices can come in.”

Mack — whose family built its fortune through its mega fund manager Apollo (now known as AREA Property Partners) — said he thinks there is more family lending to come.

“I don’t think this trend of private lending is likely to be diminished any time soon,” he said. “In fact, I think it’s going to accelerate.”