A number of massive residential deals have closed recently in the Hamptons, showing that the East End’s luxury market is still capable of creating new local records, albeit amid a slowdown in sales volume this year.

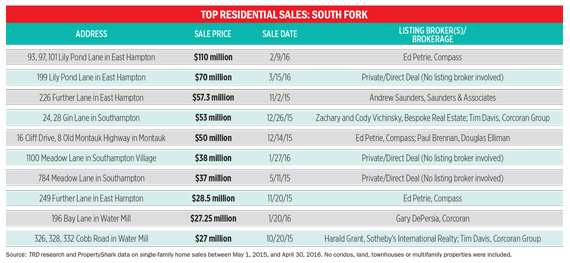

At the top of The Real Deal’s list of the priciest residential sales during the yearlong period ending in April is the $110 million sale of 93, 97 and 101 Lily Pond Lane in East Hampton, sold by hedge funder and notorious property flipper Scott Bommer of SAB Capital in February. Real estate brokers said the buyer was Michael S. Smith, CEO of Freeport LNG Development. The listing broker was Ed Petrie of Compass. The sale was the second-largest residential deal ever made in the Hamptons; the priciest estate to ever change hands was a $147 million oceanfront property in East Hampton, bought by billionaire investor Barry Rosenstein of Jana Partners in 2014.

Bommer bought the Lily Pond Lane properties — which include 284 feet of oceanfront and an 8,000-square-foot stucco mansion — for $93.9 million in 2014.

Coming in at second place is the nearby 199 Lily Pond Lane, which sold for $70 million. Entertainment mogul David Geffen bought the two-acre property from the estate of Josephine Chaus, the late fashion impresario.

Cody Vichinsky

The five most expensive residential sales on TRD’s list all sold near the $50 million mark or above. A $57.3 million home at 226 Further Lane in East Hampton scored third place on the list, in a deal that was brokered by Saunders & Associates. A $53 million estate at 24, 28 Gin Lane in Southampton was the fourth-priciest residential sale.

The fifth-place winner — a Montauk estate at 16 Cliff Drive, once owned by Andy Warhol — set a record for the hamlet when it sold for $50 million to the financier and art collector Adam Lindemann in December. The seller was J. Crew CEO Mickey Drexler, who bought the property for $27 million in 2007.

“Our high-end market has been fantastic,” said Cody Vichinsky of Bespoke Real Estate, who, with his brother Zachary, handled the sale of 24, 28 Gin Lane.

Transactions like those on TRD’s list helped push the average sales price in the Hamptons up 7.4 percent year over year, to $1.89 million in the first quarter of 2016, making it the highest first-quarter result in eight years, according to the Manhattan-based appraisal firm Miller Samuel. The average sales price for the luxury market, which represents the priciest 10 percent of sales, also jumped year over year, rising 11.6 percent to reach $8.81 million.

One prominent sale at the end of June was too late to make our list of top deals: After lingering on the market, Richard Gere’s 6.2-acre North Haven estate, which was listed at $36.5 million, reportedly sold to Matt Lauer.

But brokers said that sales of luxury waterfront estates weren’t as brisk in early 2016 as they had been a year earlier. And there has been a marked slowdown in the luxury segment since late 2015, although since the financial crisis, the fourth quarter has typically been the strongest in terms of volume for the Hamptons high-end market. The number of luxury sales that closed in the first quarter of 2016 fell to 45, down from 62 in the fourth quarter of 2015. The average luxury sales price declined 28.4 percent from the previous quarter.

“Anything on the ocean in East Hampton that’s on the market now that hasn’t sold would have been sold six months to a year ago,” said Paul Brennan, a Douglas Elliman broker, who was co-listed with Ed Petrie on the deal for the 16 Cliff Drive home.

Indeed, some owners of high-end homes are reducing their asking prices. Related Companies CEO Jeff Blau shaved $5 million off the asking price of his six-bedroom, six-bathroom Bridgehampton mansion, reducing it to $27 million a year after putting it on the market in June 2015.

And Lindemann hasn’t sold his other Montauk home, located a few doors down from the former Warhol compound that he purchased. Situated at 406 Old Montauk Highway, the property has been listed for $29.5 million since late 2015.

The number of sales in the Hamptons at or above the $10 million threshold fell to nine during the first quarter of 2016, down from 26 in the previous quarter and down from 13 in the first quarter of 2015. Overall, there were 437 residential sales during the first quarter of 2016, down 19.2 percent from the same year-ago quarter, according to Miller Samuel.

Jonathan Miller, Miller Samuel’s CEO, said that although the Hamptons market is slower than it was a year ago, it is stable.

“The record or near-record sales activity in the prior couple of years was a release of pent-up demand built up since the financial crisis,” Miller said. “That demand has been satiated, and now sales levels are more consistent with long-term trends.”