New York City had a stellar year in 2015 for building sales — with massive properties like Stuyvesant Town-Peter Cooper Village and 11 Madison trading hands. But while it’s the buyers and sellers who normally make headlines, the brokers on those deals made out pretty well, too.

This month, The Real Deal ranked the top 30 investment sales brokerages for 2015 citywide and by borough.

What we found was that Eastdil Secured not only bested all other firms but also set a city record — $22.7 billion — for the most-ever closed sales in a year by a single brokerage.

The company was miles ahead of its rivals. The other firms in the top five were: CBRE with $8.8 billion, Cushman & Wakefield with $3.4 billion, Rosewood Realty Group with $3.2 billion and JLL and HFF tied with $2.9 billion.

The ranking — which included closed investment sales of $1 million and up, ground leases and leasehold interests — was culled from Real Capital Analytics and CoStar Group, as well as from the firms. Minority-stake deals were not included because they are not generally publicly recorded.

In the years since the mid-2000s boom, the neck-and-neck rivalry between Eastdil and its closest competitor, CBRE, has softened. The two firms are further apart in terms of dollar volume now more than ever.

11 Madison Avenue

Eastdil, which has landed the top spot for five straight years, doubled its 2014 dollar volume of $11.2 billion. The company, whose New York office is led by Douglas Harmon and Adam Spies, even broke its own record from 2006, when it closed more than $14 billion in sales.

While CBRE’s $8.8 billion was up significantly from its $5.4 billion in 2014, it was still $13.8 billion behind Eastdil. That gap was far greater than the $5.8 billion gulf between the two in 2014.

CBRE did have some particularly large minority-stake deals that were not included in the ranking, such as the sale of a 44 percent stake in Trinity Church’s $3.5 billion portfolio for $1.6 billion and SJP Properties’ sale of a 49 percent interest in 11 Times Square for an undisclosed sum — both were purchased by Norges Bank Investment Management, Norway’s sovereign wealth fund. Darcy Stacom and William Shanahan, who lead CBRE’s 10-person sales team, declined to comment. But Eastdil and other firms also had large minority-stake deals.

Still, the shakeout is not going unnoticed.

“One firm really dominates the institutional trophy market,” said Nat Rockett, a top Cushman & Wakefield broker who recently left for Marcus & Millichap. “Other firms are trying to fight back and regain what they’ve lost.”

Interestingly, Stuy Town played a starring role in 2015’s ranking, just as it did back in 2006, when CBRE sold the 11,200-unit rental complex for $5.4 billion and logged its best year with $11 billion in closed sales.

But this time, the sale of Stuy Town, the priciest deal of the year, was brokered by Harmon, with the Blackstone Group and Ivanhoe Cambridge paying $5.3 billion to CWCapital Asset Management.

And, not surprisingly, Eastdil, a division of Wells Fargo, was a ubiquitous player in many of the year’s other priciest deals, from 3 Bryant Park ($2.2 billion) to the Crown Building ($1.8 billion) to the Waldorf Astoria (nearly $2 billion). Harmon and Spies declined to comment.

All of this is not to say that CBRE is struggling. It brokered a record deal of its own: SL Green Realty’s $2.3 billion purchase of 11 Madison Avenue — the largest single-building deal in the city’s history.

But, of course, not every buyer and seller taps the biggest firm in town. “Some people want an alternative to Eastdil and CBRE,” one high-level source said.

The source added: “Some sellers worry, ‘Are Eastdil and CBRE so busy that their deal wouldn’t receive the necessary level of attention?’”

Moreover, New York real estate is a big tent: The investment sales market had a remarkably robust year, ending 2015 with $74.5 billion in activity — up roughly 29 percent from $57.9 billion in 2014, according to CBRE and Cushman & Wakefield.

The new rivalry

If the Eastdil-CBRE rivalry has faded a bit, another has emerged to take its place: Cushman & Wakefield vs. Rosewood Realty Group. Both companies made big gains last year, albeit for different reasons.

Brett White

Cushman & Wakefield saw its standing in the investment sales world rise significantly because of its acquisition of Massey Knakal Realty Services — an outer-borough sales powerhouse, particularly in Brooklyn and Queens. Rosewood, meanwhile, continued racking up sales of big outer-borough multifamily portfolios.

Cushman’s purchase of Massey was the primary reason it ended the year with $3.4 billion in closed sales citywide, up from only $875 million in 2014. Still, the joint firm logged less than Massey Knakal’s 2014 sales, which totaled a massive $3.8 billion.

The company is, however, in the midst of a major transition. After Cushman bought Massey Knakal, the key players on Cushman’s small investment sales team — including Rockett, Helen Hwang and Michael Rotchford — jumped to other firms.

In addition, in September, the private equity giant TPG bought Cushman for $2 billion and merged it with the global firm DTZ. Moreover, the company has a new CEO — former CBRE chief Brett White.

While White has vowed to take on CBRE and JLL, he may be remiss if he writes off Rosewood, which came within roughly $160 million of Cushman on TRD’s ranking.

Aaron Jungreis

Aaron Jungreis’ nine-broker firm is an outlier among a bevy of institutional and global brokerages. The $3.2 billion in Rosewood closings, which came to nearly 150 deals, was up from $2 billion in 2014.

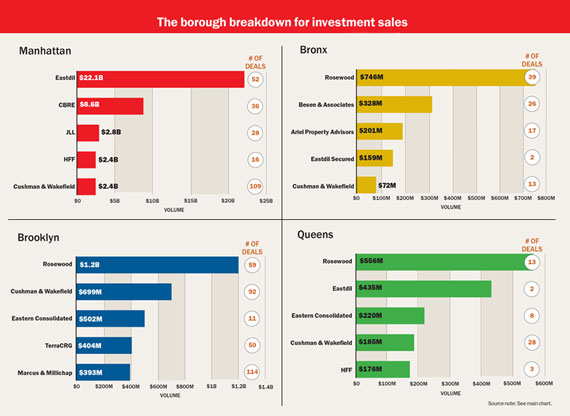

With the exception of Staten Island, Rosewood also brokered a greater dollar volume of business than any other firm in each of the outer boroughs (see charts).

“There’s no territorial system here,” Jungreis said, in a reference that seemed directed at the system Massey Knakal is known for. “We just sell the regular multifamily.”

Rosewood’s recent deals have included the Related Companies’ $112.5 million purchase of 20 buildings in the Bronx — the borough’s priciest portfolio sale of 2015 — and A&E Real Estate’s $360 million purchase of a 32-building Brooklyn-centric package.

Jungreis, who co-founded Rosewood in 2007 with his cousin David Berger, said he’s been trying to do more deals in Queens and take on more multifamily properties with retail.

But other than that, Rosewood’s strategy has not budged much.

One industry source said: “Jungreis doesn’t exactly implement a systematic approach. He doesn’t invest in research, heavy advertising or other types of infrastructure. Instead, he works his relationships through the phones — and it has proven extremely effective.”

Chicago-based JLL’s $2.9 billion in citywide sales rounded out the top five. But the firm’s business is almost entirely concentrated in Manhattan.

Eastdil and CBRE remain powerhouses when it comes to Manhattan’s trophy office towers. But in Manhattan, JLL clocked in at No. 3. The firm’s deals include SL Green’s $365 million purchase of Tower 45 on West 45th Street (with CBRE).

Unlike Manhattan, the outer boroughs do not usually attract the attention of the bigger shops. But that’s not necessarily by choice, one source said.

“It’s hard to break into the Rosewood monopoly,” the source said, referring to the multifamily portfolio space.

Indeed, in the outer boroughs, CBRE lost ground. In 2014, the firm placed No. 1 and No. 3 in Brooklyn and Queens, respectively. But in 2015, CBRE failed to crack the top five in either.

There were, however, plenty of other firms to make the cut in the outer boroughs, including Eastern Consolidated, TerraCRG, Marcus & Millichap, Ariel Property Advisors and Besen & Associates.

Salivating over the $74.5 billion investment sales pie, firms are either hiring brokers or offering new services.

In the past year, mortgage brokerage Meridian Capital Group launched an investment sales division, while debt advisory firm Ackman-Ziff Real Estate announced plans to expand its investment sales team.

Yet the opposite is true for some investment sales shops: Ariel Property Advisors, for example, turned to mortgages as a new line of business.

Paul Massey

Paul Massey, president of New York investment sales at Cushman and co-founder of Massey Knakal, said no matter the size of the brokerage, “the future is in linking debt and investment sales.”

Some note that there are drawbacks to adding too many services. For larger companies like CBRE and Cushman, leasing or property management — not sales — are the big revenue drivers. As a result, those areas are big priorities, making it easier for sales teams to lose their footing, sources said. At companies that stay focused on one area, like Eastdil or Rosewood, however, that is not an issue.

Perhaps to combat that, CBRE has sought to refocus its sales team in recent years and have members of its New York group specialize in areas like multifamily or office. Meanwhile Cushman, of course, bought Massey, which carved out a specialty in outer-borough investment sales.

These specialized skills can come in handy in an unpredictable market, which some are seeing now in New York given the hike in interest rates, the expiration of the 421a tax abatement and some banks pulling back on loans.

“There is still a lot of money out there, but prices will not go up much more,” Jungreis predicted.

Woody Heller, executive managing director at Savills Studley, which ranked No. 9 citywide with $1.6 billion in sales, also said he expects the market to slow down at some point in 2016 and continue to soften over the next few years

“We’re going to look back on 2015 as the high point in this cycle,” Heller said.