Despite some momentum from tenants relocating from Manhattan, the office leasing market in Northern New Jersey continues to crawl along.

The 26 percent vacancy rate across the

region, which is roughly located north of Newark and east of I-287 in the cities and suburbs near the Hudson River, hasn’t budged much since the end of the recession, brokers say.

“We’ve kind of been stuck in neutral,” said Steve Jenco, a vice president with commercial brokerage Jones Lang LaSalle, who is based in Bergen County. “We’re hitting a lot of headwinds right now.”

Many of those winds can be blamed on the lack of job growth in a state that in March had a 6.8 percent unemployment rate, among the highest in the nation; the U.S. unemployment rate that month was 5.5 percent. And if companies are shedding workers, or even if they’re just not hiring new ones, brokers say, they’re probably not leasing office space.

Also, aging office parks from the 1980s and 1990s have a hard time attracting today’s tenants, who usually want more amenities and smaller floor plans than those kinds of developments provide.

To make matters worse, some big-name, longtime-area tenants, like Hertz, which was in Park Ridge, and Mercedes, in Montvale, recently moved their headquarters to the South, releasing even more empty square feet onto the market.

But the state is taking action. Through the 2012 Grow New Jersey Assistance Program, New Jersey has awarded tens of millions of dollars to companies to encourage them to stay in the state or relocate there. An older effort, the Urban Transit Hub Tax Credit program, has dangled similar incentives, to the tune of billions of dollars.

However, because some companies merely move from one office building in Northern New Jersey to another, the stubbornly high vacancy rate persists.

However, because some companies merely move from one office building in Northern New Jersey to another, the stubbornly high vacancy rate persists.

“It’s like musical chairs, and it’s been an ongoing story in suburban New Jersey,” said Jeffrey Heller, a principal in the Morristown office of Avison Young, the commercial brokerage.

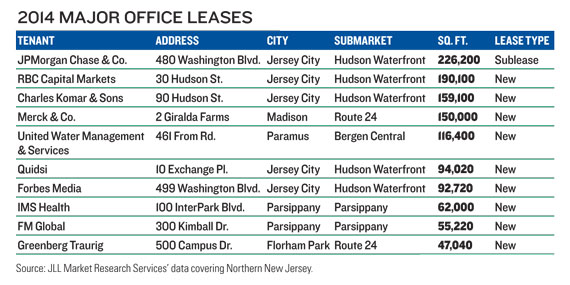

Of the top deals in 2014 — that is, those involving leases or subleases, and not renewals — the biggest, size-wise, was JPMorgan Chase’s deal for 226,200 square feet of space in Jersey City, one of the brighter spots in the area’s market. In taking space at 480 Washington Boulevard, a glassy 32-story tower owned by the LeFrak Organization in the Newport section of the city, the investment bank has expanded its footprint in the area.

Last summer, the bank paid LeFrak $315 million for 575 Washington, a 22-story, 838,000-square-foot tower where JPMorgan had been the sole tenant since 2000, when the building opened.

Though the price appears to be a bargain, brokers say, JPMorgan may have also been enticed to put down roots by a hefty $224 million in tax breaks, phased in over time in exchange for job retention and creation.

Other financial firms have also flocked to the area; 2014’s second largest deal was the Royal Bank of Canada’s 190,100 square feet lease at the Goldman Sachs Tower, a tapered high-rise on the water that at 40 stories is New Jersey’s tallest building. RBC won about $79 million in state aid to relocate from lower Manhattan.

Also lured across the river was Forbes Media, the magazine publisher, which last year got $27 million in exchange for bringing 350 jobs to 499 Washington in Newport, another LeFrak address. (In 2010, Forbes sold its longtime home on Fifth Avenue in Greenwich Village to New York University for $65 million.)

But far more typical are deals like the one announced in April, when New York Life Insurance Company said it would move to the Goldman tower from Parsippany and other locations, enticed by $34 million in incentives from the New Jersey Economic Development Corporation, to be phased in over a decade.

While many landlords struggle to fill floors, a handful are plowing ahead with new projects, like SJP Properties, which in November opened its Waterfront Corporate Center III, a 500,000-square-foot, 14-story mid-rise in Hoboken, and the third piece of a three-tower complex.

While many landlords struggle to fill floors, a handful are plowing ahead with new projects, like SJP Properties, which in November opened its Waterfront Corporate Center III, a 500,000-square-foot, 14-story mid-rise in Hoboken, and the third piece of a three-tower complex.

So far, Pearson, the publishing company, has leased 200,000 square feet across five floors, and will say goodbye to a 400,000-square-foot facility in Upper Saddle River. Pearson, which also has a location in Old Tappan, won $66 million in state tax credits for remaining in New Jersey.

Other tenants in the tower include Jet.com, an online retailer, on a full floor, and Regus, an office suite provider, which also has a floor. The remaining four floors are listed in the high $40s per square foot, said Jeffrey Schotz, an executive vice president of SJP, which is headquartered in Parsippany.

In general, the Hudson waterfront sub-market, which includes Jersey City and Hoboken, outperforms the rest of the state. In the first quarter of this year, its vacancy rate was 16 percent, according to JLL, versus 26 percent across Northern New Jersey. In the I-280 corridor, near Newark, meanwhile, the vacancy rate in the first quarter was 36 percent, the firm said.

“The waterfront is part of the core of the Big Apple, and when the Big Apple is healthy, the waterfront is healthy,” Schotz, of SJP, said.

Charles Komar & Sons moved into 90 Hudson Street.

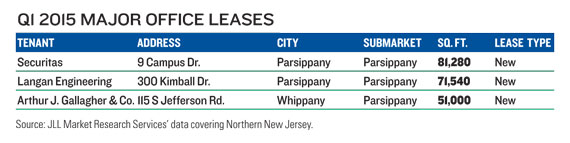

Otherwise, Parsippany, which sits deep in suburbia at the junction of I-287 and I-80 in Morris County, appears to be on the upswing. Two of 2014’s largest deals — IMS Health, with 62,000 square feet, and FM Global, with 55,000 square feet — took place there. And in the first quarter, Securitas, a security firm, leased 81,000 square feet in a Class A complex owned by the Mack-Cali Realty Corporation; at the same time, Langan Engineering inked a deal for 72,000 square feet in a nearby office park where rents are in the mid-$30 range, in a relocation from Elmwood Park.

Still, sluggishness remains. “The office sector has taken the longest to bounce back,” said Elie Sofair, a sales agent with Cranberry Realty, which owns a pair of office buildings in Parsippany that are slated to be carved up to cater to smaller tenants.

Similarly, at 500 Campus Drive in Parsippany, landlord KBS, a real estate investment trust, is renovating Park Avenue at Morris County, a six-building 1990s complex, with a slew of new amenities designed to woo younger tenants.

A gym with a yoga room was installed in 2014, said Heller of Avison Young, and a basketball court will go in this year. KBS also recently launched a shuttle service, via Mercedes-Benz Sprinter vans, to ferry workers to a train station and mall. In 2014, Greenberg Traurig, the law firm, leased 47,000 square feet there, though it moved from nearby.

“There is so much space that’s a dime a dozen,” Heller said. “Suburbia has to reinvent itself.”