UPDATED, Feb. 1, 9:30 p.m.: Few of the city’s residential brokerage were sorry to see 2017 close out. Why would they be? Looking back, the year was marked by buyer uncertainty, heavy discounting and unapologetic recruiting as top firms sought to maintain revenue in an unforgiving market.

Against that backdrop, The Real Deal brings you its annual top brokerage ranking, which unlike in the past is based on dollar volume of closed deals in Manhattan rather than listings.

To determine who closed the most deals in 2017, we pulled thousands of Manhattan listings from On-Line Residential and then cross-referenced them with closed sales in public records — a firm needed to have either publicly listed the property or acted as its new development sales agent to get credit for a deal.

Leading the pack was the Corcoran Group, which took the top spot with $6.29 billion in closed Manhattan deals for 2017. That haul — up 3 percent from $6.13 billion in May 2016 — was driven by the firm’s new development marketing wing, Corcoran Sunshine, which sold millions of dollars of properties in buildings like 56 Leonard and the Greenwich Lane.

As usual, the firm was followed by its larger rival Douglas Elliman, which logged $5.23 billion in closed sales — down 4 percent from $5.42 billion in 2016.

Related: Who’s listing the most

Rounding out the top five were Stribling & Associates with $1.58 billion, Compass with $1.37 billion and Sotheby’s International Realty with $1.35 billion.

Collectively, the Top 25 firms closed $21.2 billion worth of listings in 2017, according to TRD’s analysis. That was up slightly from 2016’s $20.8 billion and 27 percent more than 2015’s $16.5 billion.

But the numbers don’t tell the full story. The stats in 2017 saw an artificial boost because many of the deals struck during 2015’s condo boom finally closed. In reality, it was a tough year for Manhattan’s residential brokerages as they grappled with a glut of expensive new developments and luxury resales lingered on the market.

Pam Liebman, Andrew Heiberger and Howard Lorber

“Anyone who tells you it was great is lying,” said Shaun Osher, the CEO of boutique brokerage CORE, adding that last year’s absorption was the slowest in two years.

“It was one of the more miserable years to be a real estate agent,” said Osher, whose firm ranked No. 10 with $347.8 million in closed sales.

‘Recruiting machines’

Amid 2017’s market turmoil, firms ramped up recruiting — while agents jockeying for sweeter commission splits happily complied.

Things came to a head in early December, when Compass — fresh off a $450 million investment from Softbank — vowed to use the funds to turbocharge its growth both nationally and in New York.

By the end of the month, the firm, which is headed by CEO Robert Reffkin, had hired 50 more agents in Manhattan to close out the year with 713 agents in the borough, up from 300 in 2016.

“The word ‘slow’ is not part of the Compass vocabulary,” said Maelle Gavet, the COO of the firm, which is now valued at $2.2 billion.

Among the firm’s big-name hires were Halstead Property’s Brian Lewis, Nest Seekers International’s Silvette Julian and Corcoran’s Fabienne Lecole.

But unlike 2013, when Compass’ aggressive hiring caught its rivals off guard, this time the upstart firm wasn’t the only one in recruitment mode.

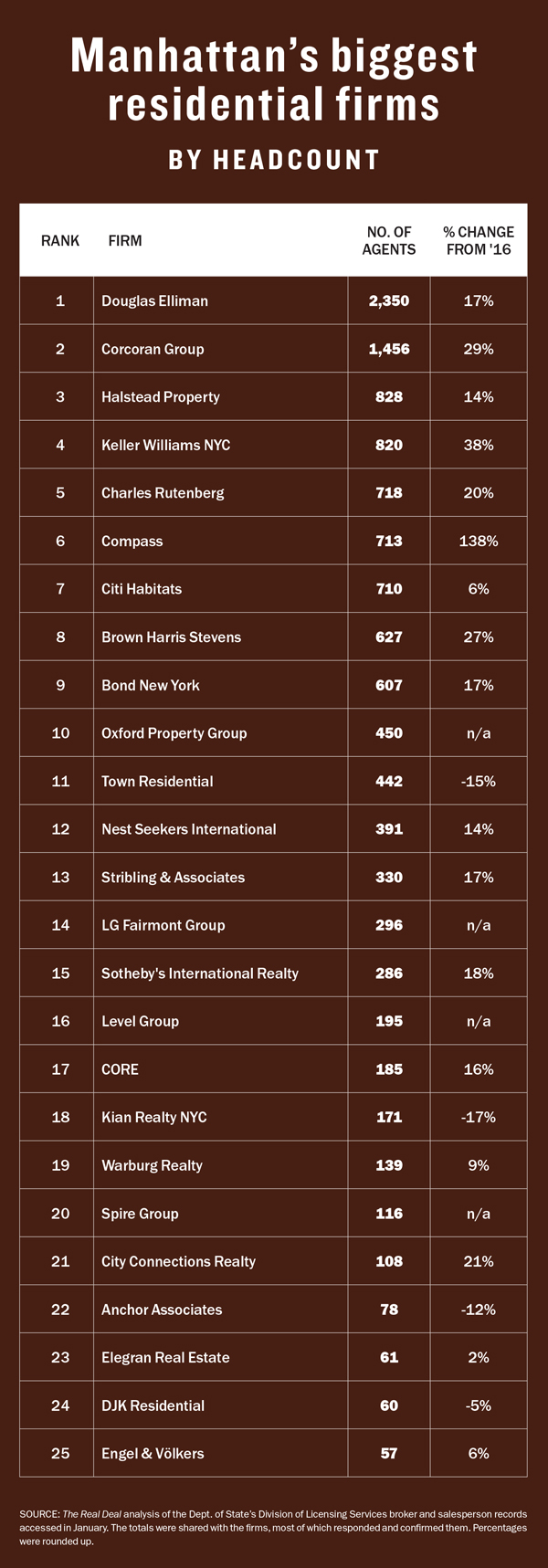

Those efforts were evident in the firms’ headcounts, which TRD determined by reviewing broker licensing records filed with the state Department of State.

Taking the No. 1 spot on that portion of the ranking was Elliman with 2,350 Manhattan agents, up 17 percent from 2,010 in May 2016.

It was followed by Corcoran with 1,456 (up 29 percent) and Halstead Property with 828 (up roughly 14 percent).

Update: After publication, Brown Harris Stevens told The Real Deal it closed $1.7 billion in 738 Manhattan sell-side deals in 2017.

In the No. 4 spot was Keller Williams NYC — part of the fast-growing national franchise — whose 38 percent gain was second only to Compass, whose headcount jumped 138 percent. KWNYC finished the year with 820 agents, up from 593.

“Agents know it’s a challenging market, so they’re looking to make sure they’re at the right place,” said Steven James, CEO of Elliman’s New York brokerage. “They’re independent contractors, so if they don’t make sales, they don’t get paid.”

For Corcoran — as well as sister firms Citi Habitats and Sotheby’s — the hiring spree was a tactical move started in February 2017 by parent company Realogy, which on Jan. 1 brought in new CEO Ryan Schneider.

And Realogy’s three NYC brands are still in growth mode.

Corcoran CEO Pam Liebman — who hired new development guru Vickey Barron from Elliman in 2017 — said that in the last year the firm “really gave an extra push” on the recruiting front.

And even firms that haven’t historically been aggressive at wooing new agents ramped it up in 2017.

“Our focus has never been about size,” said Hall Willkie, who runs Brown Harris Stevens with Bess Freedman. “It’s about being good.”

Nonetheless, Freedman said the white-shoe firm has made a concerted effort over the last year to target and groom new brokers. In 2017, it increased its headcount by 27 percent, adding more than 130 agents for a total of 627.

“At some point, you have to be willing to embrace the fact that the future is getting younger,” she said. “We want the older generation meshed with the new.”

“At some point, you have to be willing to embrace the fact that the future is getting younger,” she said. “We want the older generation meshed with the new.”

Sources said the unabashed recruiting is the new normal.

Three years ago, as firms poached top agents from rival brokerages, those tactics spawned a series of lawsuits over noncompete agreements. While that era of litigation seems to have subsided, ruthless poaching — now involving lesser-known agents — has not.

“Every one to three years, when residential agents’ contracts expire, they are openly shopping around the deal they have with the competition,” said Andrew Heiberger, CEO of Town Residential.

Still, in 2017, Town was one of the only big firms whose ranks shrank — contracting by about 15 percent to 442 from 523 in 2016. Heiberger called the lack of loyalty among agents “disheartening” and “hurtful.”

“One of the reasons I take it more personal than most is I’m the owner and founder,” he said. “I have skin in the game.”

Another brokerage head said startups like Compass — and before that Town, which launched in 2010 — changed “the rules of engagement” in the residential world.

“It changes the mentality of agents,” said the executive, who asked to remain unnamed. “A lot of agents who haven’t earned certain splits or credibility, or don’t have the book of business to qualify for those terms, are getting them anyway.”

Gavet acknowledged that Compass’ venture-capital war chest is key to the firm’s recruiting operation. But she said it’s “not for the reasons usually mentioned in the press,” referring to Compass’ reputation for big bonuses and high splits.

“It means we can go faster in financing new offices, we can hire staff faster, we can really invest more in our technology, we can invest more in our agents,” she said.

To that end, in 2017, Compass opened three new NYC offices — on the Upper West Side, the Upper East Side and Cobble Hill. It now has a total of 150,000 square feet citywide, including 115,000 square feet at 90 Fifth Avenue, where it occupies seven of the building’s nine floors. And Gavet said the company is considering opening in Brooklyn Heights and Bed-Stuy.

Several established firms, however, said it’s not financially worth it to collect warm bodies.

Halstead’s Diane Ramirez said she doesn’t entice new recruits with unsustainably high splits. And Warburg Realty’s president, Clelia Peters —whose firm closed $202.5 million in sell-side deals with 139 agents — said the math for hiring high-profile agents doesn’t usually work.

“The economics of recruiting star agents is more about marketing than helping the bottom line,” said Peters, who noted that Warburg has a “significant” roster of agents who consistently produce. “That’s a group of agents that’s generally ignored by many of the largest firms.”

“The economics of recruiting star agents is more about marketing than helping the bottom line,” said Peters, who noted that Warburg has a “significant” roster of agents who consistently produce. “That’s a group of agents that’s generally ignored by many of the largest firms.”

Smaller firms, in particular, have a lot riding on strategic hires.

Mike Greenberg, CEO and general counsel of the 195-agent Level Group, said hiring the right broker is key to profitability in a tough sales environment.

“We’ve been very careful to hire new agents to our firm who are experienced and capable,” said Greenberg, whose firm ranked No. 25 on the closed-deal ranking with $33.7 million in sell-side sales. “By raising the percentage of agents who are productive, it’s helped the bottom line of the firm.”

‘The voice of reason’

For nearly all firms, the key to closing deals in 2017 was getting sellers to reduce prices.

More than 45 percent of all co-ops and condos in Manhattan sold for less than their asking price last year, according to data from appraisal firm Miller Samuel.

CORE’s Osher said that for most sellers in 2017, the reality of the market correction had still not seeped in, leading to fewer trades and longer marketing time.

“We definitely adjusted pricing, and that’s how we sold a lot of our inventory,” he said, noting that agents often had to be “the voice of reason” inside sellers’ heads.

And the luxury market saw more cuts than the rest of the market.

According to data from Corcoran, 70 percent of properties listed for over $5 million saw a price chop in 2017. For properties below $5 million, it was closer to 55 percent.

Overall, however, both the number of sales and the dollar volume actually rose by 4 percent each — to 11,927 transactions valued at $24.5 billion, Miller Samuel data show.

But the majority of firms still did fewer deals in 2017 than in 2016, according to TRD’s analysis. Only nine of the Top 25 firms posted higher sales volumes.

Corcoran was one of the nine. Despite closing fewer sell-side deals in 2017 than 2016 — 1,960 versus 2,250 — the firm benefited from higher average new development prices.

Elliman, meanwhile, closed 2,380 deals — down 24 percent from 2016’s ranking, TRD’s data show. And, its total dollar volume dropped only 4 percent.

Elliman’s James said Manhattan’s one- and two-bedroom market is “tight as a tip” with demand outpacing inventory. The market up to $3 million, he added, was “pretty damn strong.”

Among the top 10 firms, Compass saw the strongest improvement — by a lot. The firm’s $1.37 billion in sales was up a monstrous 106 percent from $663.3 million in 2016. Stribling and Sotheby’s followed with dollar volume up 73 percent and 59 percent, respectively.

On the full ranking, No. 16-ranked Elegran Real Estate showed a sizable gain at 90 percent, closing $83.6 million deals, up from $44 million.

Stribling President Elizabeth Ann Stribling-Kivlan had two words to describe her firm’s strategy for closing sales in 2017: value play. “What Lehman taught people is to care about their pennies,” she said. “Just because you can afford it doesn’t mean you’re going to overpay for it.”

But some firms saw their numbers decline — whether because of a slower market or because they did more buy-side business.

Town, for example, finished the year with $659.6 million in closed listings, down 24 percent from $872.9 million. (TRD’s data show Town sold 321 exclusives, down from 413 in 2016.)

Town’s Heiberger, however, said that while down, his internal numbers — which include buy-side deals — showed a lower drop of 15 percent. He said Town sold just under $2 billion worth of real estate in 2017 versus $2.35 billion in 2016.

“I’m not going to apologize for doing $2 billion in sales,” said the CEO, noting that 2017 market saw “the biggest market correction since 2008.”

He said Town has sold $13 billion worth of real estate over the last seven years: “In the macro sense, we’ve had tremendous success.”

Top firms with a heavy focus on luxury were indisputably stung by lower prices and fewer deals.

According to TRD’s analysis, BHS’ sell-side volume dropped 47 percent to $1.07 billion and CORE finished 27 percent down.

(BHS, however, was one of the few firms that did not provide TRD with any additional information during our vetting process and therefore likely saw its numbers undercounted.) The firm said its internal numbers — which reflected both buy- and sell-side deals — showed dollar volume dropping, but by a far lower 11.1 percent. Its total number of sales dropped by 0.8 percent, it told TRD. That dollar volume dip speaks directly to the softening prices.

“You don’t see cowboys anymore” making crazy offers, Freedman said. “It’s not a moment for aspirational pricing.”

She noted that BHS and its competitors continued to transact — albeit at lower price points.

“Price sensitivity was a constant, which is a good thing,” Willkie said. “Buyers are willing to sign contracts and close on properties when the price is justified by comparable sales.”

City Connections Realty founder David Schlamm — whose firm merged with DSA Realty in January 2017 — concurred.

“Deals aren’t happening as fast, but they are getting done,” he said. “If there’s a two-bedroom under $2 million in a condominium, it’s going fast.”

But for properties $4 million and up, he said, buyers have the upper hand.

CORE — like other firms — leaned heavily on the market’s bread and butter, one- and two-bedroom apartments.

“The press generally loves to romance the luxury market,” Osher said, “but we don’t rely on those. I don’t think anybody does. There aren’t that many of them.”

Liebman agreed. “A big push was to get sellers to understand that the dynamics of the market had shifted,” she said. “The sentiment was, prices won’t continue to rise.”

For those selling new development, success often boiled down to the concessions or discounts that developers were willing to swallow.

Corcoran benefited from closing legacy contracts at several new developments — including Silverstein Properties’ 30 Park Place and Corigin Real Estate Group’s 20 East End Avenue (both designed by Robert A.M. Stern) — where contracts were signed a few years back.

More recently, some developers have been far more apt to negotiate than others.

At 432 Park, which is being marketed by Elliman and is move-in ready, two mega-deals closed at the tail end of 2017 — one for $60 million (down from $90 million) and the other for $91.1 million (down from $120 million).

But down the block at 220 Central Park South, brokers said, there are no such discounts because the building is still under construction and the developer can afford to hold out for higher prices.

Adam Modlin, founder and CEO of the Modlin Group — who in April closed on the sale of actress Demi Moore’s triplex at the San Remo for $45 million, down from an initial $75 million — challenged the notion that the luxury market is soft.

“The headlines read that there was a $30 million discount,” said Modlin, whose firm clocked in at No. 18 with $83.2 million in closed deals, of Moore’s pad. “But when I tell you that sale that was recorded is the largest sale in history for a co-op on the Upper West Side, that suggests a robust market.”

He conceded that big-ticket properties can take a year or two (or more) to sell, but insisted that the timeline was not out of the ordinary.

“For the owner, it may take them that amount of time to marinate on the market and get comfortable to the actual value of what their property is,” he said. “No seller wants to leave money on the table.”

But he said buy-side deals represented two-thirds to three-quarters of his 2017 sales volume, and he acknowledged that buyers have more leverage in today’s market.

“[Sellers] are more flexible, and there’s a better opportunity to buy if you’re ready, willing and able to close a deal.”

Correction: Due to research errors, the original version of this story undercounted closed sell-side deals for both Town Residential and Nest Seekers International. Both the story and chart have been updated with the firms’ accurate numbers. The change also bumped Nest Seekers up to No. 9 on the chart, which changed the rankings of several other firms.

Update: After publication, Brown Harris Stevens told The Real Deal it closed $1.7 billion in 738 Manhattan sell-side deals in 2017.