Long a symbol of urban decay, the South Bronx is booming with new construction these days as developers — big and small — clamor for a foothold there.

Buoyed by cheap land and financial backing from the city, affordable-housing builders have racked up the lion’s share of projects over the last four years, according to an analysis by The Real Deal of building permits and offering plans filed between Jan. 1, 2011 and July 31, 2015.

Overall, there are more than 11.5 million square feet of residential real estate under development in the Bronx, where the city of New York is driving most of the development.

Through partnerships with developers, the city’s Department of Housing Preservation and Development, and the New York City Housing Authority spearheaded north of 2.5 million square feet of real estate with 1,448 units across 10 buildings during the period TRD reviewed.

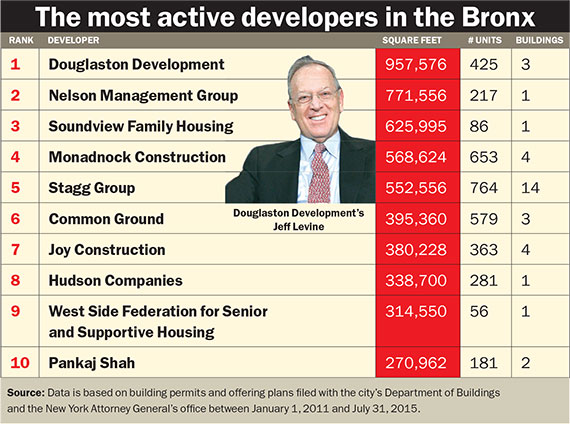

Queens-based Douglaston Development clocked in at No. 1 as the most active private developer by square footage in the borough. Jeffrey Levine’s firm, in conjunction with the city, is developing the 957,600-square-foot Crossroad Plaza, a three-building complex with 425 affordable units at the border of Mott Haven and Melrose.

Nelson Management Group, meanwhile, took the No. 2 spot with 771,556 square feet under construction, all of it at the Lafayette-Boynton complex in the Soundview area, where it paid $51.5 million for the four-building, rent-stabilized complex in 2011. It is now adding two more buildings with 434 units combined at the site.

Also cracking the top five were Monadnock Construction (with 568,624 square feet and 653 units under construction) and the Stagg Group (with 552,556 square feet and 764 units). Next was the nonprofit supportive housing developer Common Ground (with 395,360 square feet and 579 units).

By and large, the largest development projects in the Bronx are bringing affordable and mixed-income rental units to the South Bronx specifically. In fact, just five condominium plans were filed in the borough since 2011 and none since May 2014.

Still, developers say the Bronx — which as the city’s poorest borough has been the last holdout when it comes to market-rate development — is at a tipping point. Once populated by desolate warehouses, the South Bronx is attracting developers who see the upside of its waterfront locale. Increased competition and rising prices, in turn, could prompt the market to pivot toward market-rate development.

And as prices rise in the other four boroughs, demand for cheaper rental housing in the Bronx is increasing.

Already the Chetrit Group, one of the city’s biggest developers with projects like the massive conversion of the former Sony Building on Madison Avenue to über-luxury condos, is planning six market-rate residential towers in the borough. (The firm did not make the official ranking as plans for that project have not yet been filed.)

New development marketing guru Nancy Packes said developers are willing to overlook the grittiness of the area when they see the low price for land, and the availability of development sites.

“It is an industrial area,” she said. “When developers see industrial, their eyes light up.”

Zoning restrictions aren’t likely to dissuade them, either: “Developers are willing to take the risk of rezoning a piece of land when they see the inevitability that it’s going to happen,” said Packes, who has a client looking at sites near the Grand Concourse, the borough’s main thoroughfare, close to Riverdale.

Brooklyn developers, for example, who are weighing how deep to push into Brooklyn, are considering the Bronx as an alternative, she said. “If we look at city transfer records, I’m going to bet you that someone is quietly amassing huge parcels under the radar,” she said.

Sweetening the deal

Even as market-rate developers are poised to leave their mark on the Bronx, the city — through tax credits, subsidized financing and city-owned land — has a substantial footprint on residential development in the borough.

“A lot of it has to do with where there is available land,” said Libby Rohlfing, a spokeswoman for HPD, referring to city-owned plots.

While the amount of city-owned land has dwindled, the de Blasio administration has responded with a slew of aggressive offerings for developers building affordable housing — from new financing mechanisms to rezonings. “If it’s physically possible to build, we will offer it,” said Ted Weinstein, HPD’s director of Bronx planning.

Land prices, which are 500 to 600 percent lower in the South Bronx than in Queens and Brooklyn, are the key driver for many builders in the Bronx.

“When you’re building affordable housing, you start with land before you have anything,” said Eli Weiss, managing vice president of Joy Construction, which has 363 units under construction in the borough.

Joy, which has a diverse portfolio citywide — including a condominium at 11 Beach Street with Ziel Feldman’s HFZ Capital — ramped up its affordable housing development in the Bronx during the financial crisis when it began building St. Ann’s Terrace, an eight-building complex in the heart of the South Bronx that was completed in 2012. “The thing about affordable housing and multifamily housing in New York is the supply-and-demand paradigm plays in your favor,” Weiss said.

Joy recently received more than 53,000 applications for 64 units at 1016 Washington Avenue in the Morrisania neighborhood.

Now, the developer is building Webster Commons, a five-building, 470-unit complex in Norwood. So far, Joy has filed plans for two buildings.

Whereas Joy has historically concentrated on large-scale projects, longtime player the Stagg Group has focused on smaller, infill buildings with anywhere from 35 to 65 units. That niche has given the firm a leg up against the competition, CEO Mark Stagg said. “That doesn’t seem to appeal to the Manhattan-based developers,” he said. “They pass it by.”

Most of Stagg’s projects are 80/20 rentals (meaning 80 percent are market rate, while 20 percent are affordable).

Overall, Stagg built 350 units last year and the developer is on track to complete north of 750 in 2015. (Some of those projects were filed before 2011, and aren’t part of TRD’s tally.) To accommodate the growing pipeline, the firm, which is based in Purchase, N.Y., nearly doubled its employees to 400 in the past year. “We’re seeing opportunities everywhere, across the board,” Stagg said. “We think the prospects are only improving.”

Heat turns up

As a growing number of developers see the value in Bronx deals, increased competition has pushed Bronx land prices higher over the past 12 months. Prices have shot up from a borough-wide average of $35 per square foot to $50 per square foot. In areas like Riverdale, which some see more as an extension of Manhattan, land prices can top $80 per square foot. By comparison, land prices in Brooklyn average $350 per square foot and shoot as high as $400.

Some longtime players said that as a result of soaring development site prices, it’s getting harder to land deals.

Common Ground, which develops housing for the homeless, paid $9.25 million, or just under $30 per square foot, for a site in Mott Haven. “There’s virtually nothing on the market less than $50 per square foot,” said David Beer, the nonprofit’s vice president of development, who added that the organization has been edged out of some deals.

Many longtime Bronx developers bought land before the recent surge in prices. Stagg, for example, is developing 130 market-rate units at a former horse stable at 1680 Pelham Parkway, which he described as a “quality building.” He bought the site last year from another local investor who paid $451,000 at auction. Stagg also shelled out $3.3 million for an adjacent lot. The new building will house one-bedroom units asking around $1,600 a month, and two-bedrooms asking around $2,100 a month.

“There’s definitely more competition, but there’s opportunity. The housing stock is outdated,” Stagg said.

Relying on rezonings

Joy Construction’s 64-unit affordable housing development at 1016 Washington Avenue.

With large swaths of industrial space, rezoning efforts have boosted residential development in the Bronx in recent years.

Brooklyn-based Monadnock, perhaps best known for its 55-micro-unit project in Kips Bay, has seen rezonings touch a large chunk of its portfolio. The developer, an arm of Monadnock Construction, is currently completing the first phase of the 10-building Compass Residences, a complex being built in Crotona Park East in an area that was once comprised of defunct warehouses. Owners Signature Urban Properties and GTIS Partners began working on the project in 2007 and the area was rezoned in 2011 from industrial to mixed-use. Signature and GTIS tapped Monadnock to build the first five buildings, which will have 721 affordable units combined. So far, Monadnock has filed plans for two buildings.

The de Blasio administration is aggressively looking to rezone patches of the city as a way to help it achieve its affordable housing goals.

“You can’t create land,” HPD’s Weinstein said. “The Bronx is 43 square miles. We have to find new places to build because there isn’t enough land to do what has to be done.”

One of the strongest signs that market-rate developers are bullish on the Bronx is Keith Rubenstein and Joseph Chetrit’s planned development on a 1.5-acre site in the South Bronx.

Chetrit Group and Rubenstein’s Somerset Partners paid $58 million for two sites in a one-time piano-manufacturing district. The waterfront sites, at 2401 Third Avenue and 101 Lincoln Avenue in Mott Haven, can hold 1.2 million square feet and the developers plan to build six residential towers.

Joy Construction’s 64-unit affordable housing development at 1016 Washington Avenue.

“It’s a huge turning point for the Bronx,” said Weiss. “When people do straight market rate with no government subsidies … it’s become a sustainable market on its own.”

Overall, the South Bronx can accommodate 2.8 million square feet of affordable and market-rate apartments, according to an analysis conducted last year by the South Bronx Overall Economic Development Corp. In addition to Chetrit and Somerset’s development, smaller deals are also popping up in Mott Haven, such as real estate investment firm Savanna and Hornig Capital Partners’ eight-story loft project at 2415 Third Avenue.

Meanwhile, a number of affordable projects now include units targeting residents with slightly higher income levels.

Construction is currently underway at La Central, a five-building, mixed-income development in Melrose. The $345 million, 985-unit project is being jointly developed by BRP Development Corporation, Hudson Companies, Common Ground, the YMCA and several other developers. Meanwhile, Common Ground is building a 160-unit affordable housing building for residents earning up to 60 percent of area median income or AMI, but eligibility for other buildings will be up to 100 percent AMI.

“The Bronx is coming into line with other boroughs,” said Common Ground CEO Brenda Rosen. “As people get priced out of Manhattan, parts of Brooklyn and Queens, you’re looking for the next area that will be able to meet your needs.”