In Brooklyn, any ranking of top real estate developers is dominated by a familiar list of marquee firms led by Forest City Ratner and Two Trees Development. But rankings can be deceiving. Outside the spotlight, the borough’s middle-market is seeing a cast of fast-rising newcomers and shadowy figures who are aggressively marking their turf.

From a tight-knit Hasidic clan in South Williamsburg to a small up-and-coming Midtown Manhattan firm, these developers and investors rebuilding Brooklyn are not always in plain sight.

This month, The Real Deal brings you a mini-guide of the developers and investors who are taking the borough by storm. The rundown was culled from the amount of residential product they have in the pipeline, as well as from insider sources. The 10 companies TRD looked at are largely non-institutional and under the radar and have been especially active over the past three years. Some are hungry for more institutional financing and bigger projects but for now are making waves in the middle of the pack.

Brookland Capital: The realist

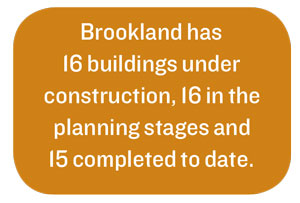

Brookland Capital, a Bedford-Stuyvesant-based firm founded in 2012 by Boaz Gilad and Assaf Fitoussi, is one of the borough’s most prolific developers based on number of projects, though it’s far from the top when measured by square footage.

The company has 16 buildings under construction, 16 in the planning stages and 15 completed to date, according to Brett Kaplan, the firm’s head of business development. The firm prefers to develop 40-to-90-unit properties and has never paid more than $10 million for a development site.

That level of caution is a choice: During the housing crisis, Gilad and Fitoussi both lost their shirts as independent developers, but they’ve been fully recovered for more than a year, Gilad said. Fitoussi, 39, now heads the acquisitions department at Brookland.

Every Brookland condo project has a “very, very strong rental backup plan,” Gilad, 44, said.

For example, a month before sales were set to launch at a 41-unit condo at 691 Marcy Avenue in Bed-Stuy, Brookland changed course. Now, the ground-up project will operate as a rental.

“We looked at it and felt the valuation as a rental was very high, so we’ll convert it to rentals, refinance it and sit on it,” Gilad said. “The big condos in Manhattan — if there’s a crisis, you can’t go rental in those.”

“We looked at it and felt the valuation as a rental was very high, so we’ll convert it to rentals, refinance it and sit on it,” Gilad said. “The big condos in Manhattan — if there’s a crisis, you can’t go rental in those.”

The 40-person firm is ramping up its rental development as a means to diversify. Its investors are short-term, hard-money lenders like small funds or family offices. Last year, Brookland raised $34.5 million through a bond offering on the Tel Aviv Stock Exchange — and is planning to raise an additional $30 million this month.

Gilad, who began investing in Brooklyn in the late 1990s, is wary of his contemporaries’ more ambitious plays because he knows how hard it is to bounce back.

“I see a lot of money now from people who never went through the crisis,” Gilad said. “They got on the plane or opened a fund in 2010, so they’re experiencing this amazing market and everything they buy is worth more. We’ll see where they are in a few years. I don’t think they have a sustainable business plan. We want to be very confident in what we’re doing.”

Brookland’s condo-buyer base is middle-income, first-time homeowners “who will not live in the building in five years,” Gilad said. Yet although this younger crowd is not buying for the long term, he said they are very much a Brooklyn mainstay.

“Wherever they go — Queens or the Bronx — I’m going to follow them,” Gilad said.

Slate Property Group: The go-getter

In less than two years, this firm has swept Brooklyn with dozens of mid-sized rental and condo projects. Slate has steadily increased the size of its deals by buying development sites across Brooklyn and large multifamily properties in Manhattan.

The firm has completed eight Brooklyn projects with about 650 apartments and has 350 condo units and 1,400 rental units in the pipeline.

As Martin Nussbaum and David Schwartz’s Midtown East-based company has gone from tackling $10 million deals to $70 million deals with $200 million capitalizations, their competition and the potential partnerships have changed. (In Manhattan, for example, Slate and GreenOak Real Estate are in contract to buy the RiverTower for $390 million, with plans to keep it as a rental.)

The power plays and high-profile partnerships put them closer to being viewed as an institutional firm, but the company doesn’t want to be pigeonholed.

“We’re the happy medium between the entrepreneurial, boots-on-the-ground firm and the corporate, institutional firm,” Schwartz said.

Of Slate’s two key partners — Adam America Real Estate and China Vanke — one is based in the same Midtown office building and the other is a world away. Slate and Adam America, which frequently partner on Brooklyn projects, recently spent a full week in China visiting Vanke, the country’s largest developer, to see their projects and meet the executives.

Although Vanke already had a U.S. operation, its first foray into Brooklyn was with Slate and Adam America this fall. The trio is now joining forces on a 150-unit condo tower in Downtown Brooklyn and a 44-unit condo building in Park Slope — with more to come.

Slate’s Martin Nussbaum, left, and David Schwartz have increased the size of their projects recently.

Nussbaum and Schwartz, both 38, began looking to buy properties in 2005 and in 2009 co-founded Silverstone Property Group with other partners. Silverstone, which specialized in buying distressed assets, had acquired at least 22 properties worth $345 million by November 2013, when Nussbaum and Schwartz left to begin Slate.

The firm is increasingly structuring deals using ground leases or joint ventures in an effort to combat high land prices. Slate’s preferred amount of leverage is 60 to 65 percent, Schwartz said.

“When the market moves in the next one to five years, we’ll be in a position to sustain,” Nussbaum said.

Schwartz added: “We still think Brooklyn has a long way to go. Ten years ago, people started talking about Brooklyn. Now everyone’s talking about it. Ten years from now, what we’re going to see in Brooklyn will be pretty amazing.”

Adam America Real Estate: Built for scale

Adam America emerged as a major force in Brooklyn upon its formation in 2010. The Midtown East-firm soon began filing plans for condos and rentals at an accelerated pace. Adam America has been involved in more than 20 projects, often in partnership with Slate and Israel-based Naveh Shuster Limited.

According to a TRD analysis in September, the company has more than 1 million square feet under development, comprised of 14 buildings with 1,135 residential units, mostly in Brooklyn. While they are clearly a development heavyweight, they remain newcomers compared to the likes of Two Trees and Forest City Ratner.

Though founders Dvir Cohen Hoshen and Omri Sachs are natives of Israel, their real estate experience is largely derived from developing in Europe, in countries such as Turkey, Romania and Ukraine.

“They have captured a great momentum in New York,” said Ofer Cohen, head of the Brooklyn-based brokerage TerraCRG. “They know how to scale the business and build a platform that supports 20 to 30 projects at a time.”

Unlike Slate, Adam America is concerned purely with Brooklyn development. The firm’s transactions and projects are increasing in size, but it strives to avoid complicated deal structures.

“Dvir often tells me, ‘If it’s not simple, it’s not going to happen,’” Ofer Cohen said.

Bruman Realty: The dynamic duo

Joseph Brunner and Abe Mandel run Williamsburg-based Bruman Realty, which says it owns roughly 100 residential buildings in the city and 10 office properties elsewhere in the U.S. Their holdings include 1,500 residential units in New York City.

Brunner, who grew up in Borough Park, and Mandel, who grew up in Williamsburg, are both in their late 30s, according to a representative for the company. Both are members of an insular community of Brooklyn’s Hasidic real estate players, along with Chaim Miller, Simon Dushinsky and Abraham Leser. They teamed up in 1997, focusing on investing in and developing rentals. They’ve tapped small banks, commercial banks and institutional funds to source their deals.

Insiders say Brunner is a tough, shrewd businessman who is adamant that things go his way.

“If you step on the wrong toe, it’s going to hurt you, not him,” a source said about Brunner.

Abe Mandel is typically the one who finds the deals by looking at potential development sites. Brunner then crunches the numbers and negotiates with lenders, said Pinnacle Realty’s David Junik.

The dynamic is sometimes that of a “good cop, bad cop” routine, sources said.

“These are two self-made men who are tough but very fair when it comes to business,” said their lawyer, William Fried of Herrick Feinstein.

Bruman is especially active in Williamsburg and Greenpoint. Last month, the company closed on the purchase of a Williamsburg development site on Wythe Avenue for a pricey $700 per buildable square foot, or $27 million.

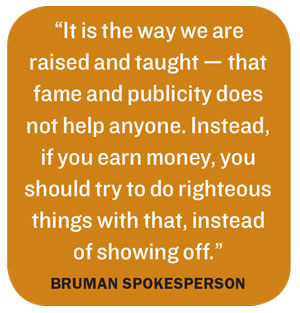

Despite the size of their deals, Brunner and Mandel have no interest in the public eye, which is not uncommon in the Orthodox Jewish real estate community.

“The choice of keeping a low profile has nothing to do with any business strategy,” a Bruman spokesperson said. “It is the way we are raised and taught — that fame and publicity does not help anyone. Instead, if you earn money, you should try to do righteous things with that, instead of showing off.”

“The choice of keeping a low profile has nothing to do with any business strategy,” a Bruman spokesperson said. “It is the way we are raised and taught — that fame and publicity does not help anyone. Instead, if you earn money, you should try to do righteous things with that, instead of showing off.”

Bushburg Properties: The pioneer

Since forming in 2000, this rental-centric development firm has expanded beyond the Bushwick and Williamsburg locales that inspired its name.

The eight-member Kensington-based firm owns more than 20 buildings and has more than 1,000 rental units in the pipeline.

“I build for a five to six cap and hope the market will go up and it will turn into a 10 to 11 cap,” said Joseph Hoffman, 41, who runs the firm with Israel Hirsch.

Hoffman said part of his strategy has been to be ahead of the curve in moving into hot neighborhoods such as Ridgewood and South Slope. He said he has taken calculated risks — but steered clear of condo development.

“Condos equal a lawsuit and I don’t like being in litigation,” Hoffman said. “A hard-knocks condo buyer will eat your heart out because the paint is peeling or some other reason.”

Bushburg, however, has not fully avoided conflict. In a complaint filed in July with the National Labor Relations Board, former maintenance workers at its Mitchell-Lama building on Fulton Street in Bed-Stuy accused the company of unjustly cutting their wages and benefits before firing them.

The firm and the employees reached a settlement in September, with four of the eight workers accepting offers to return to their jobs. Hoffman said the two sides “came to a meeting of the minds.”

Hello Living: New school

Eli Karp is a former special education teacher who jumped into the real estate game in 2005. A decade later, his 20-person Sunset Park-based firm, Hello Living, has 10 residential projects under its belt and another eight in the pipeline. The market-rate buildings are concentrated in workforce housing neighborhoods like Flatbush and Prospect-Lefferts Gardens.

“I thought, ‘Wouldn’t it to be nice to create a building and help change a whole area?’” Karp said.

Hello Living started out exclusively developing condos but is now largely focused on rentals. Karp considers a 23-story project at 1580 Nostrand Avenue in East Flatbush — the firm’s biggest one yet — to be the best of both worlds. Slated to open in 2017, it will have 93 rental units and 60 condos.

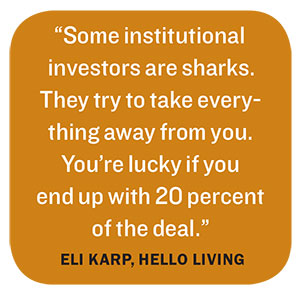

Hello Living’s deals continue to be sourced by Karp’s friends and family as well as local small-time investors. Karp said it’s easier to raise money for condos. “Institutional” financing is not exactly his bag, though he said he has had several meetings recently with Israeli banks.

“Some institutional investors are sharks,” said Karp, 40. “They try to take everything away from you. You’re lucky if you end up with 20 percent of the deal.”

Read Property Group: The savvy investor

Heads turned when veteran investor Robert Wolf received city approval in 2013 to develop 10 eight-story properties on the 6.4-acre former Rheingold Brewery site. He’d spent years amassing the land.

Eli Karp of Hello Living has 10 residential projects under his belt and another eight in the pipeline.

But Wolf, who founded Borough Park-based Read Property Group in the late 1990s, is known for putting together deals for income-producing properties and moving on. A source close to Wolf described him as a “mini-David Werner,” referring to the Brooklyn-based investor who last year was the biggest buyer of New York real estate. In other words, Wolf is a skilled dealmaker but not a developer.

In the two years since getting the green light for the Rheingold project, he and partner Joseph Tabak of Princeton Holdings sold the entire site to developers; the majority of the parcels went to Dushinsky’s Rabsky Group last year and the remaining piece to Yoel Goldman’s All Year Management in November. The deals totaled more than $120 million, records show. That is a sizeable haul for Bushwick.

“He made a lot of money,” said Slate’s David Schwartz. “I don’t know that Robert is known to do very large developments. He appears to be a good investor. He made a smart purchase. If Dushinsky and Goldman got a high enough offer, they would sell it.”

A source familiar with Wolf’s dealings described him as sophisticated as well as more pragmatic and measured than most investors.

Wolf, who declined to comment, started out in the early 1980s managing the real estate holdings of his father-in-law, Herman Klein, according to his company’s website. His firm owns 381 units of Brookdale’s University Hospital’s former rental holdings and in 2012 rescued a long-stalled 127-unit rental project at 1209 DeKalb Avenue in Bushwick out of foreclosure. According to sources, he finished construction but didn’t rent it out. He sold it for $58 million last year to another firm, Spruce Capital Partners, which then began leasing the apartments for rents starting at $1,800 per month.

Wolf has also been involved in deals involving institutional and high-profile players. He was a minority investor in a group led by the Chetrit Group of the Willis Tower in Chicago. The tower is now in contract to sell to Blackstone for $1.3 billion, making it the biggest U.S. office-building sale outside of New York.

Wolf has also teamed up with Chetrit on a number of other occasions. The two were among the investors in the development of the 48-story Cassa Hotel and Residences in Midtown, for which a $70 million loan was secured.

RedSky Capital: The ace assembler

Dumbo-based newcomers Benjamin Bernstein and Benjamin Stokes swooped into Williamsburg after the downturn and picked up dozens of apartment buildings. More and more, their investment firm is buying up retail in addition to rental units.

One of RedSky’s largest and most ambitious undertakings could reflect a new long-term assemblage strategy in Downtown Brooklyn. Over the last three years, RedSky has been buying up pieces of a giant semi-triangular strip — bounded by Fulton Street along with DeKalb and Flatbush avenues. The firm, which could not be reached for comment, now owns 11 of the 16 properties there, having shelled out roughly $87 million to date. RedSky has been mum about its plans for the site, which could hold a 500,000-square-foot-plus building if the firm were to develop it rather than upgrade the existing structures.

Most of the time, RedSky has its eye on calculated investment plays. In July, the firm and partner Megalith Capital Management sold two Park Slope rental buildings for $37 million after buying them for a combined $16.6 million in separate deals in 2011 and 2012.

“RedSky has always had a set business plan for retail and mixed-use that has taken them far,” a source said.

The firm declined to comment.

Bernstein and Stokes, both Cornell University graduates, made their first investment in 2007, when they paid $3.9 million for a Greenpoint rental building. Stokes previously served as a project manager at Warren Claytor Architects, and Bernstein was an analyst at investment management firm Pimco and venture capital firm Blue Martin Ventures.

Yoel Goldman: The deal junkie

Goldman’s Williamsburg-based All Year Management has had a hand in many Brooklyn deals and developments, whether it be for a small stake or a lead role.

Goldman, who is in his mid-30s, grew up in Borough Park and started out buying small multifamily properties in the mid-2000s, according to a source close to the developer. He then switched to buying development sites and larger multifamily buildings.

“He was also one of the first developers who built his buildings in Williamsburg with the intention of making them rentals,” the source said. “In 2006 and 2007, most developers were building condos to sell.”

“He was also one of the first developers who built his buildings in Williamsburg with the intention of making them rentals,” the source said. “In 2006 and 2007, most developers were building condos to sell.”

The firm raised $100 million in a bond offering on the Tel Aviv Stock Exchange last year. The move triggered a conflict between Goldman and his business partner Toby Moskovits of Heritage Equity Partners. Earlier this year, in four related lawsuits, Moskovits accused Goldman and investor Joel Gluck of using their joint LLC partnership to secure a Tel Aviv bond offering without her consent. In October, the parties reached a settlement in which Moskovits is transferring her membership interests to Goldman and Gluck on some projects while they are transferring interests to her on others.

All Year, which declined to comment, has about 2,000 residential units and at least four hotel projects in the pipeline, including a 112-key hotel in Bushwick and a 120-unit rental in Crown Heights.

Sources say Goldman, a member of the Hasidic real estate community, is a “deal junkie,” in that he likes executing smart transactions, but is “not working for the money.”

“He pretends to be a one-man band, but he actually has a sizable operation,” a source said.

Bo Jin Zhu: The Chinese transplant

Some Chinese developers are just now invading Brooklyn for the first time. At least one developer is already there.

Elmhurst, Queens-based developer Bo Jin Zhu is something of a mystery developer but has ties to Chaim Miller and Joseph Brunner.

A native of mainland China, Zhu controls Z&K Realty Developers LLC, among other entities. He develops hotel, office and retail space in industrial buildings. His project pipeline includes a 162,000-square-foot Midwood property that is slated to hold apartments, retail and a synagogue, and a 338,000-square-foot, mixed-use property in Flushing. He also quietly bought a stake last year in the 10-parcel development site of a former plastics factory in Greenpoint for $48.5 million.

Two of Zhu’s closest business partners are Yi Han, a design consultant for investors and developers, and designer Richard Guishard, who specializes in finishes. They declined

to comment.

In July, Zhu was hit with a suit from Brooklyn investor Moshe Oratz for allegedly continuing to market a 60-key Bushwick hotel despite entering into contract to sell it to Oratz for $13 million. The lawsuit is ongoing.