Memorial Day Weekend marked the official opening bell for the Hamptons season. And while most of those flooding into the East End were thinking about which beaches and restaurants to hit, residential brokers were more focused on capturing business.

That’s especially true because while prices and sales volume were up in the first quarter on the East End over last year, they were down compared to the fourth quarter.

“Everybody seems to be taking a little bit of a breather,” said Paul Brennan, the Hamptons manager for Douglas Elliman.

That goes for the brokerages, too. Unlike in 2014, when almost every major brokerage had beefed up its sales force, some of the top firms this year have slightly slimmer operations. That trend even held true at some big firms like the Corcoran Group and Brown Harris Stevens, according to this year’s ranking of top East End firms by The Real Deal.

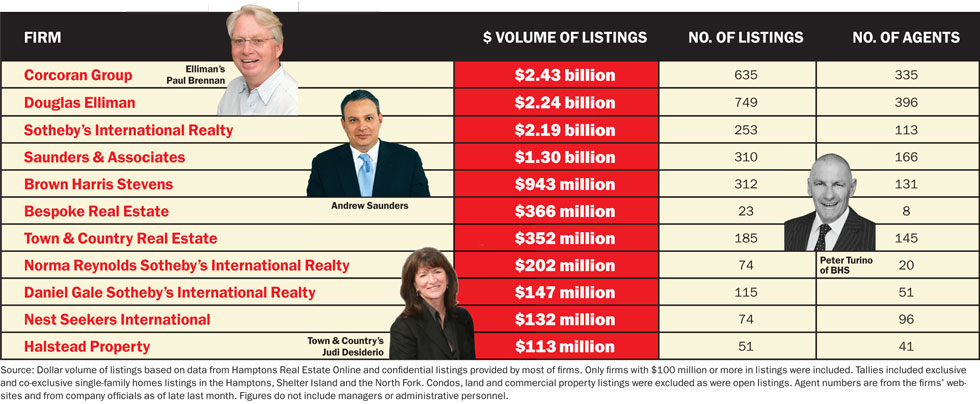

But this year, TRD’s annual survey has a new twist: For the first time, it also evaluated firms by dollar volume of listings, based on data from the Hamptons Real Estate Online database and with confidential listings provided by most of firms. The tally, which only included firms with $100 million or more in listings, covered only exclusive and co-exclusive single-family home listings in the Hamptons, Shelter Island and the North Fork.

The Corcoran Group took the top spot with $2.43 billion in active listings. Elliman was a close second with $2.24 billion.

Those two mega firms were followed by Sotheby’s International Realty with $2.19 billion; Saunders & Associates with $1.3 billion; and BHS with $943 million.

While comparable listings statistics don’t exist for 2014, these numbers offer the first glimpse at the level of business the biggest firms are doing in the notoriously secretive Hamptons market. The figures also show how much market share is concentrated in the hands of just a few big players.

“This market is opaque,” said Anthony DeVivio, the Hamptons manager for Halstead Property, adding that a lack of a Multiple Listing Service makes it hard to know precisely what each firm is marketing.

DeVivio noted that the East End is riddled with quiet listings that don’t turn up anywhere, as well as open listings which allow a broker to market a property but not as an exclusive.

Assessing the ranks

In the first quarter of the year, the Hamptons market appeared robust when compared with a year prior.

The average sale price on the South Fork, which stretches from Westhampton Beach to Montauk, was $1.76 million, up from $1.71 million in the year-ago quarter, according to the latest Elliman market report.

Similarly, the median sale price, $921,000, was higher than the $880,000 price of a year ago, the report said. But both of those first-quarter figures were down from the fourth quarter — a potentially troubling sign. And that dip was particularly worrisome, brokers say, as year-end bonuses are usually spent in the first quarter, though severe winter weather may have also played a part.

Brennan noted that when second-quarter sales figures are released next month, that slowdown would be even more apparent.

Judi Desiderio, the founder and president of Town & Country, No. 7 on the ranking with $352 million in listings, warned, however, that talk about a cooling market can be a self-fulfilling prophecy.

“Right now the chatter is about a correction, and once the correction chatter starts, there is a little bit of a pullback,”

she said.

With sluggishness in the market headed into the peak season, it’s not surprisingly that some firms slimmed down their ranks.

Corcoran, which has 10 offices, saw its count dip to 335 from 342 last year and BHS logged 131 agents, down from 138.

Aspasia Comnas, who manages BHS’ seven Hamptons offices, said, however, that she’s in the midst of hiring and hopes to have a head count of 140 before the season really kicks in.

But Brennan said headcount tallies are overrated because many agents don’t carry much weight and can also cost a firm up to $3,000 a year in licensing and other fees. In fact, 20 percent of agents at any firm do 80 percent of the work, he said.

Nonetheless, several firms — Elliman, Saunders, Sotheby’s, and Halstead —added agents.

Elliman, which has nine East End offices, saw its agent tally jump to 396 from 370.

Meanwhile, Saunders & Associates, which launched in 2008, saw an almost 25 percent increase in agent totals, jumping to 166, from 128, according to firm founder Andrew Saunders.

Saunders said he’s recruited more than two dozen agents in the last year, and noted that the company’s ban on managers brokering deals has appealed to a lot of agents.

He also adamantly denied rumors that he was planning on selling his firm. In April, insiders said Compass was in talks to acquire the firm and last month several sources said that Corcoran parent NRT was doing the same.

“We are having no conversations regarding selling this company,” he told TRD last month. “This is an engineered strategy by our competitors to create a level of uncertainty.”

One thing that is certain is that the company is expanding. Last month it opened its third office, in a 5,200-square-foot one-time gas station in East Hampton. Saunders, who said he buys rather than leases office spaces, noted that he does what it takes to ensure that his agents are comfortable and that nobody has to “sit on window ledges.”

Meanwhile, Halstead, which has just two offices in the Hamptons, saw its agent count jump to 41 agents from 36. However, Halstead’s DeVivio said he’s currently looking to expand by acquiring a smaller local firm.

“It would give is instantaneous presence in their market right away,” he said.

For its part, Sotheby’s — which has four offices and is under the umbrella of a corporate parent — also boosted its heft. It increased its ranks to 113 agents from 101. (It is not affiliated with the franchised Sotheby’s outlets on the East End.)

At $140 million, 90 Briar Patch Road in East Hampton is the priciest Hamptons listing. It’s on the market with BHS.

At $140 million, 90 Briar Patch Road in East Hampton is the priciest Hamptons listing. It’s on the market with BHS.

Sotheby’s growth can be explained in part by extra bodies filling its new Sag Harbor office at 35 Main Street, the former site of the Sag Harbor Express newspaper. (The newspaper moved upstairs.) The new 18-person office, which opened last month, replaces a small satellite office the firm had in the village.

It’s not surprising to see residential brokerages beefing up their presence in Sag Harbor. The town’s profile has been rising in recent years. It’s now home to several new and high-end condo projects, including the Watchcase Factory, a long-derelict industrial site that Cape Advisors has turned into 64 penthouses, lofts and townhouse homes. Available units at the property, which is being marketed by Corcoran Sunshine Marketing Group, currently range from $2.1 million to $10.2 million.

Nearby, there’s also Harbor’s Edge, at 21 West Water Street, a 15-unit project that claims to have the Hamptons’ only rooftop pool. That property, developed by Water Street Development, is being marketed by Halstead Property Development Marketing. Available units there ranging from $2.7 million to $6.3 million.

Brokers say Sag Harbor is a safe bet for those projects — especially because it draws visiting boaters who like low-maintenance pied-à-terres.

“People want new product, they want ease, they don’t want to do a lot of work,” said John Gicking, the manager of the Sotheby’s East Hampton office.

Listings leaders

Just how dominant the top five brokerage firms on the list are is pretty astonishing. Together, the top five firms have $9.1 billion in active listings, compared to the bottom six firms on TRD’s list, which have a combined $1.31 billion.

BHS scored the priciest listing: The $140 million 90 Briar Patch Road in East Hampton, an 11.2-acre estate on Georgica Pond that’s owned by Chris Whittle, who founded the Avenues private schools in Chelsea. The listing came on the market in November with Peter Turino, the president of BHS’s Hamptons operation.

For its part, Corcoran’s $2.43 billion in listings was spread over 635 properties and included some of the East End’s priciest estates such as 51 Halsey Lane, a 1919 estate in Water Mill, which is asking $85 million and being co-listed with Sotheby’s.

Interestingly, Elliman’s slightly lower $2.24 billion in dollar volume was spread over more properties, 749 to be exact, suggesting that its average listing price is lower. Elliman disputed its figures, saying it has $2.78 billion in listings at 1,059 properties. However, it didn’t provide a list to back that up by press time.

Among Elliman’s priciest listings: A 12-bedroom compound on six-plus acres at 26 Actors Colony Road in North Haven, owned by the actor Richard Gere. The property was listed for $47.5 million with Elliman’s Brennan.

But according to Brennan, it’s the lower-end properties (not the celebrity-worthy homes) that are driving the market now. Saunders agreed, adding that $2 million and under “is where the action is.”

He said 70 percent of all trades in 2014 were in the $1.5 million-and-under bracket. Last month, the firm was listing a 3,000-square-foot new-construction home at 7 Corwin Road in Sag Harbor, with a pool and guesthouse, for about $2 million. In late May, it went into contract after nine months of marketing, according to Saunders, who did not disclose the sale price.

Brokers say that they’ve seen weakness with trophy properties of $10 million and up, with homes sitting longer than they have in the recent past. According to HREO, there were 379 listings of $10 million or more for sale in mid-May.

For example, 344 Little Noyac Path in Water Mill, which goes by the name Longview, has been kicking around for several years. The north-of-the-highway home, which has a pool and tennis court, is on the market for $10 million with Sotheby’s after being listed at $14.5 million in July 2013, according to listings website StreetEasy.

“The inventory of these types of homes is the largest I have seen in a while,” said DeVivio of Halstead, which ranked No. 11 with $113 million in listings.

And these $10 million-plus homes don’t always sell after price chops. DeVivio said that older homes are particularly harder to sell. “The younger buyers, they want the kind of bathroom they had when they stayed at the Four Seasons in Bali,” he said. “There is no doubt that ‘new’ is king,” he added, noting that it commands up to a 20 percent premium.

51 Halsey Lane in Water Miller is listed for $85 million with Corcoran and Sotheby’s.

51 Halsey Lane in Water Miller is listed for $85 million with Corcoran and Sotheby’s.

While ultra-expensive properties seem to be finding buyers quickly in New York City, the Hamptons market functions differently, brokers said. For one, there’s not as much foreign capital flooding in. But more fundamentally, it’s a second-home market.

“We are tied at the hip to New York, because that’s where we’re getting 90 percent of our buyers from,” DeVivio said. “But it operates differently, because these are discretionary purchases, even for the people with the big bucks.”

On a more ominous note, he added that the Hamptons is usually a bellwether that tends to sputter a couple years before Manhattan does.

High-end holdouts

If trophy homes are struggling, Bespoke Real Estate, a boutique firm that launched last summer to focus exclusively on the $10 million-and-up sector, doesn’t seem to have gotten the memo.

The firm — which was founded last summer by ex-Corcoran agents and brothers Zach and Cody Vichinsky — has a shocking $366 million in listings at just 23 properties, putting it at No. 6 on the ranking. Even more impressive, perhaps, is that the firm only has eight agents.

Its properties include a three-home compound that developer Jay Bialsky is currently constructing on Parsonage Lane in Sagaponack, at about $60 million. The Vichniskys did not respond to requests for comment.

Not far behind was the 145-agent Town & Country, with 185 listings valued at $352 million. The eight-office firm is holding steady on the headcount front — down just a hair from 147 last year.

Meanwhile Nest Seekers International, which opened in the Hamptons in 2012, had 74 listings at $132 million.

The firm’s agent count dropped to 96 from 106 last year, but Geoff Gifkins, the manager of the firm’s five Hamptons offices, said the firm has made a lot of progress.

Last fall, Nest Seekers relocated its Westhampton Beach office from a second-floor berth on Main Street to a ground-floor storefront; it also grew to 20 agents from 8, Gifkins said. He’s now looking to expand Nest Seekers’ Bridgehampton office. Growth has also been helped by technology, he explained; a smart phone app that allows buyers to more easily search for properties unveiled last year has boosted business.

Laser focus

Focusing on a niche may avoid the ups and downs of hirings and firings, according to some specialized firms.

Norma Reynolds Sotheby’s International Realty, a Sotheby’s franchise that focuses solely on the area west of the Shinnecock Canal, including Westhampton and Quogue, had 74 listings at $202 million. And its roster of 20 agents, in a single office, is virtually unchanged from 2014, said Vicky Reynolds, its broker/owner. “Nobody really ever leaves,” Reynolds said.

Westchester families are buying in her corner, she said, noting they are attracted to the area because of the relatively short drive.

Also, “people are now looking at Westhampton Beach because they want to get to the beach quickly” and it’s usually no more than a 10-minute ride away, she said. And parts of the area can seem steeply discounted: a renovated four-bedroom 1950s ranch in Remsenburg that Norma Reynolds listed in May came on the market for $849,000.

Meanwhile, Daniel Gale Sotheby’s International Realty, another Sotheby’s franchise, ranked No. 9 with $147 million and 115 listings. It focuses on the North Fork and has no plans to expand geographically.

Like the South Fork, the North Fork is also seeing weakness in the market. The average North Fork sale price in the first quarter was $673,000, according to Elliman’s latest market report. That was down significantly from $812,000 in the year-ago quarter.

Carol Tintle, a senior vice president of the firm, said the winter weather had a lot to do with the slowdown.

“It snowed so often, we couldn’t even get to homes to show them until they were plowed out,” she said. “But we’re catching up.”

In the steady-growth market of the 1990s, Tintle would tell sellers that by waiting a year, they could fetch higher prices. Today, there’s less certainty about that kind of future, she said. Her firm had 51 agents in four offices, versus last year’s 48.

What’s surprising, said Elliman’s Brennan, is that on paper, the economy is sound — low unemployment, a booming stock market and strong corporate profits. That, he said, gives him more confidence.

“There are no dark clouds looming on the horizon,” Brennan said, “so it would seem that things would have to pick up.”