Chinese interest in New York and U.S. real estate has grown at an unprecedented rate in recent years. But there is still a massive untapped market of Chinese investors looking for properties to park their money in, as well as for real estate players who can help make those deals happen.

While New York City real estate projects are written about daily in the U.S., many Chinese investors don’t have access to key information about those projects or how to get involved because of restrictions on Internet use there.

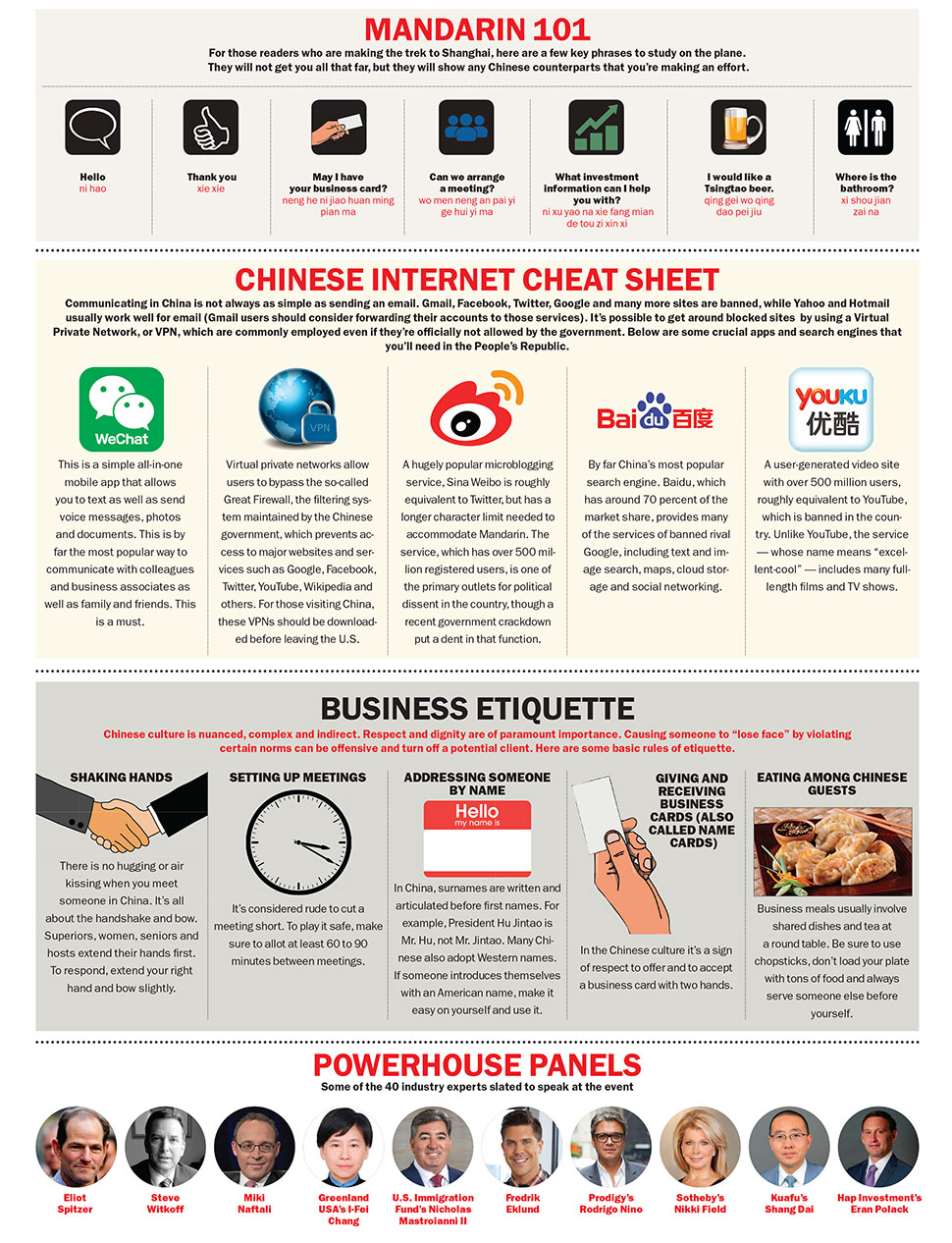

This month, The Real Deal will host the largest-ever U.S. real estate forum in China, designed to help bridge that information gap by connecting Chinese investors and American real estate professionals.

“There is a growing population of wealthy Chinese investors that do not have access to information about what’s happening in the New York and U.S. real estate markets,” said TRD’s publisher, Amir Korangy. “We are trying to help rectify that by bringing together two groups of people that have overlapping interests in the market.”

Eliot Spitzer

TRD’s U.S. Real Estate Showcase and Forum — to be held at the five-star Jing An Shangri-La Hotel in Shanghai — will begin with a reception the evening of Sept. 10 and continue Sept. 11 and 12 with two full days of panels and workshops. It will also include an invitation-only VIP dinner for the biggest U.S. real estate players and the most active individual and institutional Chinese investors.

The 5,000-plus attendees will include not only the broad Chinese real estate community, but also private wealth managers, high-net-worth individuals, executives and clients from major financial institutions like the Bank of China, Morgan Stanley, PricewaterhouseCoopers and Ernst & Young. For real estate professionals here in New York, these connections are increasingly important, as more Chinese nationals turn to New York and other U.S. cities with cash in hand.

The panelists will discuss a range of issues of interest to Chinese investors such as the EB-5 immigration program and how to invest in U.S. markets including New York, South Florida and Los Angeles. They will also be discussing how to help Chinese investors navigate the government restrictions and red tape involved in outbound investment.

The slate of more than 40 panelists includes former New York Gov. and current NYC developer Eliot Spitzer, developers Miki Naftali, Steven Witkoff and Greenland USA CEO I-Fei Chang. Also scheduled to appear are the Carlton Group’s Howard Michaels, investor Andrew Farkas and top brokers Fredrik Eklund, Nikki Field, Stephen Kliegerman, and Bruce Mosler among a slew of others.

Mega bets

The event is coming at a crucial junction in the Chinese economy. The devaluation of the Chinese renminbi and the plunge in the country’s stock market made international headlines last month.

But that sudden drop-off has deep roots. China’s economy has slowed markedly in recent years after decades of staggering growth, averaging 10 percent annually since the late 1970s. That growth was fueled in large part by massive government investment in housing and industry.

“Chinese investors have limited options for investing. With a fully formed housing bubble and what looks to be a stock market bubble, there’s been a strong interest in diversification around the globe,” said market analyst Jonathan Miller.

Jonathan Miller

Since the 2008 financial crisis, China’s central bank, the People’s Bank of China, like its U.S. counterpart, repeatedly cut interest rates to boost lending. But that also put pressure on Chinese financial assets such as government and corporate bonds, and sent Chinese investors abroad seeking security and higher returns.

And spend they did. Chinese buyers plunked down a gargantuan $28.6 billion on U.S. real estate investments in the 12 months that ended on March 31, a 30 percent increase from the previous year, according to the National Association of Realtors. That investment was concentrated in gateway cities, primarily New York, San Francisco and Los Angeles.

Chinese spending on commercial property in New York alone totaled $3.9 billion from March 2014 to March 2015, according to brokerage Newmark Grubb Knight Frank.

Half that total was dropped in just one transaction, the purchase of the Waldorf Astoria Hotel by Chinese insurance giant Anbang for $1.95 billion, which closed in February.

But that was far from the only high-profile deal in recent months. The state-owned Bank of China paid $600 million for 7 Bryant Park in Midtown in December. A few months later, Sunshine Insurance Group dropped $230 million to buy the Baccarat Hotel. Then Anbang jumped back in the game in May, spending $415 million for the office portion of 717 Fifth Avenue.

Chinese developers including Greenland USA, Xinyuan Real Estate and China Vanke are also getting in on the act (see related story on page 47) .

And EB-5, which grants green cards to foreign nationals who put up as little as $500,000 and create at least 10 jobs in the U.S., has played a big part in some of these investments. Chinese EB-5 investors account for 80 percent of all immigration visas issued.

The program itself, however, is in flux. Recent high-profile accusations of fraud have prompted the U.S. Senate to consider a bill that would both extend EB-5 and introduce a number of new transparency and oversight measures.

All of this comes as the Chinese government is “trying to allay investors’ fears,” after it devalued the country’s currency, said Miller. That, he said, could prompt even more investment abroad.

“On the one hand it makes U.S. real estate more expensive for investors,” Miller said. “But on the other hand it illustrates the economic uncertainty within the country, prompting even more investment out.”