As demand for housing in L.A. continues to outpace a stagnating supply, condo prices continue to skyrocket as sales wane in number.

For low-rise buildings, the average price per square foot was $670 from April 2015 to April 2016, reflecting a 7 percent increase compared to that same period a year earlier, according to a new report from condo brokerage and research firm Polaris Pacific. The report pulled data from condos in five submarkets: Downtown Los Angeles, the Westside, Koreatown, Hollywood and the Tri-Cities.

High-rise condos saw a heftier increase: The average price per square foot for condo complexes 13 stories or higher was $895 — a 25 percent increase.

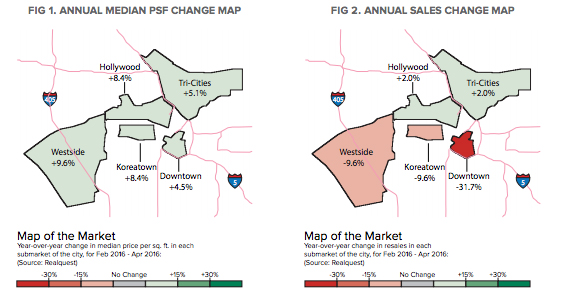

The Westside, thanks in part to its ever-appealing proximity to the Pacific coast, saw the biggest price growth. The median price per square foot in this part of L.A. from February 2016 to April 2016 increased 9.3 percent when compared with the same period last year, according to the Polaris report.

In that period, the median sale price of a Westside condo was $825,000 — nearly twice as much as pricing in the Tri-Cities area. Hollywood came in second, with a median sale price of $639,000.

All the while, sales volume is down. In Downtown L.A., for instance, condo resales have decreased by more than 31 percent over the past year.

The single most impactful factor behind this decrease is a stalling inventory, Rhonda Slavik, Polaris Pacific’s business development director, told The Real Deal.

“On the development side, there’s not much available land. And what is available has become prohibitively expensive so that puts a damper on would-be developers’ enthusiasm,” she said. “[Buyers for] existing homes became more competitive and that has resulted in the faster-than-typical increase in pricing.”

The months of remaining inventory, or a figure that indicates how many months it would take to absorb current supply, is currently 3.8 months — a substantially lower number than the six month figure that’s typically considered a balanced market.

And even though there are currently 733 unsold new condominiums on the market — more than double the number from the same time last year — Slavik said that inventory and sales will more likely than not remain at current levels.

Still, there are options for buyers, albeit expensive ones. Nine condo developments are currently selling, including the Metropolis buildings, TEN50 and The Waverly. Meanwhile, more than 10,000 residential units under construction in Downtown L.A. alone, according to the Downtown Center Business Improvement District.