Investment firm Colony Capital has merged with the New York-based NorthStar Asset Management Group and NorthStar Realty Finance Corporation, the companies announced last week.

Investment firm Colony Capital has merged with the New York-based NorthStar Asset Management Group and NorthStar Realty Finance Corporation, the companies announced last week.

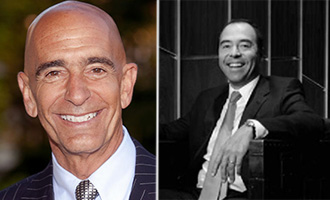

With a combined $58 billion in assets, the resulting entity will be called Colony NorthStar, the L.A. Business Journal reported. The executive chairman of NorthStar, Thomas Barrack Jr., will become the chief executive of the new company.

Barrack, a native Angeleno, has invested more than $60 billion in hotels, offices, vineyards and other properties in the past 25 years. Colony Capital was created in 2014 when he combined his private equity firm with his publicly traded REIT. Earlier this year, Barrack formed Colony Starwood Homes by merging his Colony Starwood Homes REIT with the Starwood Waypoint Residential Trust.

In 2014, NorthStar Realty Finance bought the Griffin-American Healthcare REIT for $4 billion in a cash-and-stock deal. Last year, CEO David Hamamoto was ranked as the highest-paid chief executive in the real estate industry, The Real Deal reported. He made nearly $74 million from his two real estate investment trusts.

The Colony/NorthStar merger will save the respective companies $115 million a year. [LABJ] — Cathaleen Chen