Properties fitted out for tech and creative tenants led the way in investment sales in 2016, a banner year for the industry.

In Playa Vista, Invesco’s $34 million-per-acre acquisition of Runway Playa Vista not only shattered price-per-square-foot records but created a domino effect, lifting values across the submarket — even for residential properties.

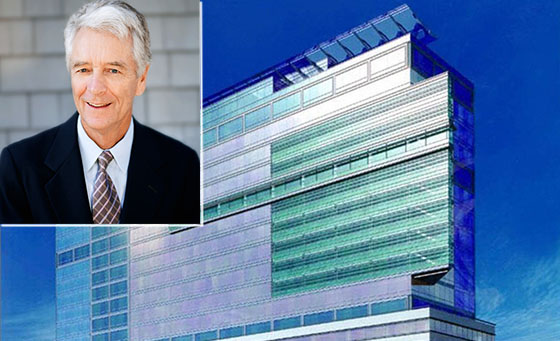

East Coast developers contributed to demand for L.A.’s tech hubs, too. Edward Minskoff’s purchase of the Bluffs at Playa Vista and Boston Properties’ acquisition of a 50 percent stake in the Colorado Center in SaMo were among the most talked about deals of the year.

Read on for The Real Deal‘s ranking of 2016’s top commercial sales, compiled using data from CoStar.

1. Westwood Office Portfolio, $1.3 billion

Santa Monica-based real estate investment trust Douglas Emmett partnered with the Qatar Investment Authority on the biggest deal of the year — the purchase of a four-building Westwood office portfolio for $1.3 billion. The sale price for the buildings, at 10960, 10940 and 10880 Wilshire Boulevard and 1100 Glendon Avenue, penciled out to about $777 a foot for 1.7 million square feet. Douglas Emmett will retain up to 30 percent of equity in the partnership, while QIA holds the rest. The seller was Blackstone Group. The sale, reported by TRD in March, upped Douglas Emmett’s control of the Westwood Wilshire office corridor to 74 percent. Eastdil Secured was the listing brokerage.

2. Colorado Center, $511 million

Boston Properties’ first-ever Los Angeles deal, the purchase of a 50 percent stake in the six-building Colorado Center, was the second priciest commercial deal of 2016. The $511 million price tag worked out to about $860 per square foot for the 1.1 million-square-foot complex. The Teachers Insurance and Annuity Association (TIAA) retains the other half. The campus on Broadway and Colorado Boulevard was 75 percent leased at the time of the sale in May by tech tenants such as Hulu and Edmunds. Chris Houge, Tyler Jammet and Peter Best of LA Realty Partners were the leasing brokers, along with Randy Starr of Avison Young.

3. Runway Playa Vista, $475 million

Dallas-based seller Lincoln Property and its two partners won big on its deal to unload Runway Playa Vista, netting $175 million in profits after shelling out $300 million to develop the 663,000-square-foot project. Buyer Invesco was able to increase its stake in Playa Vista with the 14-acre campus; the Atlanta firm also has interest in the Reserve and Hercules campuses. In addition to retail, residential, and office space, the Runway features a Whole Foods and Cinemark theater. HFF represented Lincoln and its partners in the sale.

4. AEW Multifamily Portfolio, $430.5 million

AEW’s nine-property sale was, hands down, the most contentious big ticket deal of the year. Almost immediately after the Boston firm sold the Westside apartments to a subsidiary of San Francisco’s SPI Holdings, an appellate judge swooped in and said, “not so fast.” The ruling halts an earlier court order that stripped Santa Monica developer Neil Shekhter of control over the buildings, for which he was a joint venture partner with AEW. But AEW’s attorney, James Fogelman of Gibson Dunn & Crutcher, isn’t concerned. The appellate ruling would have “no impact” on the sale, he said in a statement late December. The portfolio includes the Harlow residences in Culver City and LUXE in West Hollywood; the remaining seven properties are all in Santa Monica.

AEW’s beef with Shekhter began in 2014, when Shekhter alleged that AEW violated the terms of their joint venture agreement. AEW counter-sued, alleging that Shekhter had forensically altered legal documents to match his claims. In late November, a judge threw out Shekhter’s claims. In addition to ordering him cede control of the nine properties, the court ruled that he had forged documents, destroyed evidence and committed perjury.

5. The Bluffs at Playa Vista, $428.9 million

Investors just can’t get enough of Playa Vista. New York developer Edward Minskoff shelled out nearly $429 million, or a whopping $858 per square foot, for the Bluffs, at 12121 and 12181 Bluff Creek Drive, TRD reported in July. The seller was JPMorgan. Sitting on 15 acres of land, the complex was developed by Lincoln Property Company, which sold it to JPMorgan for $294 million, or $587 a square foot, in 2011. Its biggest tenant is Fox Interactive Media, which occupies 90 percent of the fully-leased space. Eastdil Secured represented JPMorgan.

6. Lantana Entertainment Media Campus, $403 million

Lantana Santa Monica (via Lantanasantamonica.com) and, from left: Mark Laderman and Collin Komae of Artisan

Artisan Partners, led by a duo of former Tishman Speyer execs, bought the 485,000-square-foot Lantana campus with Brightstone Capital Group, which was acting on behalf of an investor. Jamestown, the seller, purchased the campus in 2013 for $328.4 million, or $681 a square foot, from Houston-based Lionstone Investments. Tenants include Mark Burnett Productions, One Three Television, and Beachbody, the maker of P90X. Stephen Somer of Eastdil Secured brokered the deal.

7. 2600 & 2700 Colorado, $367.6 million

The property at 2700 Colorado Boulevard (2700Colorado.com) and Oracle chairman and founder Larry Ellison (Getty)

At $1,165-per-square-foot, the deal for 2600 and 2700 Colorado was the priciest per-square-foot deal in the history of Santa Monica, TRD reported in November. Larry Ellison’s Oracle, the buyer, will move into about 100,000 square feet at the properties. The five-story main building is anchored by Lions Gate Entertainment. Invesco, the seller, made a sizable profit — it bought the complex last year for $284 million, or $899 per square foot, according to CoStar. JLL’s Carl Muhlstein and Hayley Blockley were the listing agents. Oracle was represented by Cresa’s Matthew Miller.

8. Citigroup Center, $336 million

DTLA veterans Coretrust Capital Partners will renovate and restore the lobby of the 48-story Citigroup Center, which which bought for about $377 per square foot from Hines. The 891,100-square-foot property at 444 South Flower Street was 74 percent leased as of September, TRD reported. Tenants include Citigroup, Morgan Stanley, Freddie Mac and the U.S. Securities and Exchange Commission. Stephen Somer, Stephen Silk and Jay Borzi of Eastdil Secured represented Hines.

9. CBRE headquarters, $330 million

Brokerage CBRE sold its Downtown Los Angeles headquarters to a joint venture between Pittsburgh, Penn., firm PNC Financial Services Group and Munich, Germany-based real estate fund manager GLL Real Estate for about $470 a square foot. But the deal also included free rent credits, TRD reported, which would lower the per-square-foot price tag. And in an interesting twist characteristic of the ever-changing industry itself, the deal was brokered by Kevin Shannon and his team — Ken White, Michael Moll, Rob Hannan — of Newmark Grubb Knight Frank, who used to work for CBRE. CBRE’s Todd Doney, John Zanetos, and Michael Longo were also involved in the deal. The property is now 90 percent leased, with Capital Group as its largest tenant.

10. Apollo at Rosecrans, $326.3 million

Boston’s Intercontinental Real Estate Corporation ponied up about $328 million, or a $600 a square foot, for the 18-acre office campus in El Segundo — that’s nearly six times what the seller, Invesco and Second Street Ventures, paid in 2013. Totaling about 547,000 square feet, the four-building complex at 800 Apollo Street, 2120, 2121 and 2175 Park Place was 98 percent leased at the time of the sale. Kevin Shannon of Newmark Grubb Knight Frank and his team represented the sellers with CBRE’s Bob Healey and Grafton Tanquary. Invesco and Second Street paid $75 million to renovate the property.