Los Angeles developer Elite Investment Management Group has filed for Chapter 11 bankruptcy about a month after it was sued for fraud involving an unfinished Bel Air mansion.

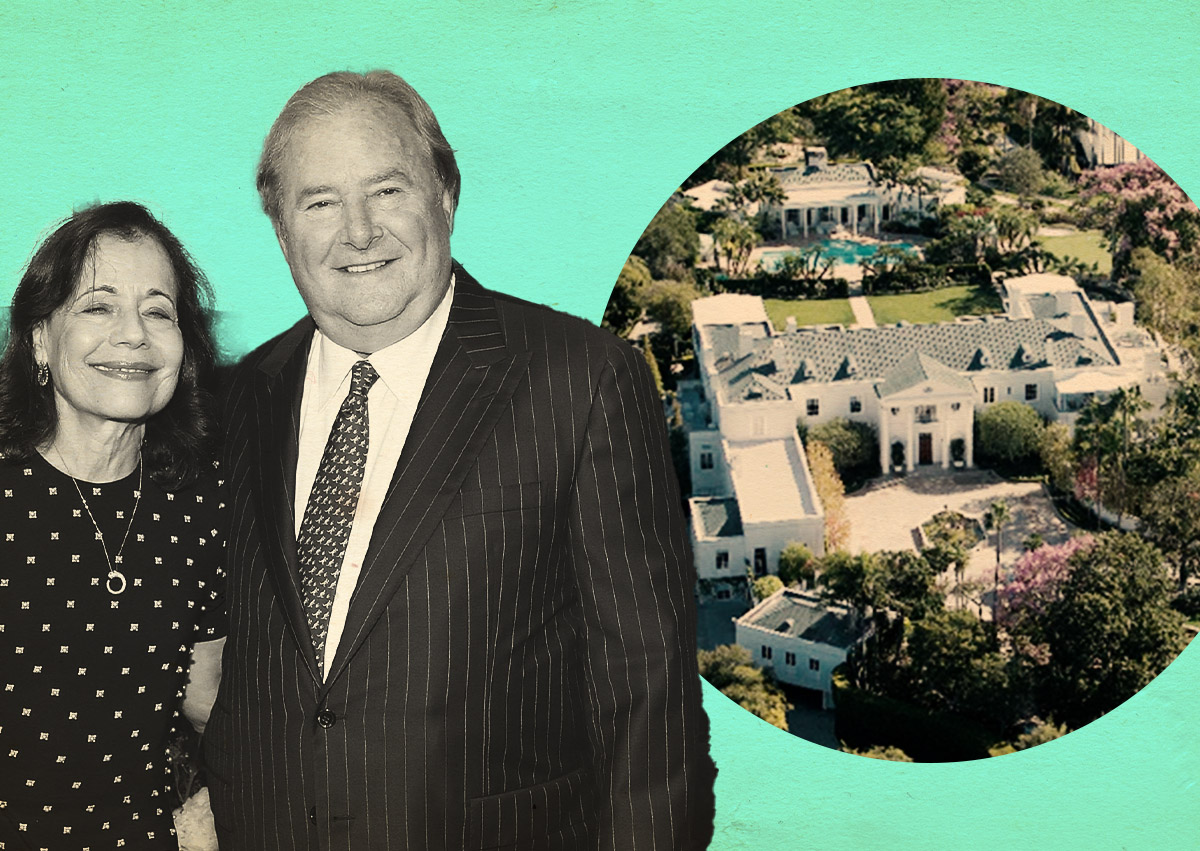

The filing gave the location for the company’s principal asset as 10710 Chalon Road. In 2018, the Bel Air megamansion project was touted for its stratospheric price of $88 million. The unfinished mansion is the focus of the lawsuit against Elite Investment in Los Angeles Superior Court.

The voluntary bankruptcy, filed Sept. 5, is intended to protect the company from creditors. It gave an estimated value of assets from $10 million to $50 million, with estimated liabilities in the same range.

A telephonic meeting for creditors is scheduled for Oct. 4.

They include a trade debt for $18,059 from finance company First Insurance Funding. There’s also a debt for about $260 from cable carrier Spectrum and a debt for $216 from a fitness equipment company The Dumbell Man. It wasn’t clear from the filing if more creditors were going to be added.

An email and a phone call to Elite Investment Management Group’s attorney requesting comment was not returned.

The bankruptcy comes on the heels of a lawsuit against Elite Investment Management Group that continues to wind its way through the courts. On Nov. 29, a case management conference for 932 Irolo LLC v Elite Investment Management Group has been scheduled.

The lawsuit centers on the same abandoned construction site at 10710 Chalon Road. In its complaint, 932 Irolo alleges that Elite Investment used loans on the project to pay for separate real estate transactions, “all the while holding Irolo’s invested funds hostage, and binding plaintiffs to deeper and deeper debt.”

The plaintiff seeks return of its $4.5 million loan, plus $20 million in damages.

Read more