Florida’s foreclosure inventory on the decline but still leading with the most completed foreclosures in 2014, CoreLogic

Florida ranked second in declines of year-over-year foreclosure inventory, with a drop of 48.6 percent. Despite the decline, Florida had the highest number of completed foreclosures for 2014 with 118,000. Michigan, Texas, California and Ohio followed.

“There remain many pockets of the country with very high foreclosure inventories, underscoring the unevenness of the nation’s housing recovery,” Anand Nallathambi, president and CEO of CoreLogic, said in a statement.

Not surprisingly, South Florida leads state in percentage of cash sales, CoreLogic

Cash sales made up a whopping 58.2 percent of home sales in Miami, Miami Beach and Kendall in November. West Palm Beach, Boca Raton and Delray Beach closely followed at 57.3 percent, well above the national average of 36.1 percent.

The national peak was in January 2011 with cash sales making up 46.4 percent of total home sales. In terms of states, Michigan has the highest percentage at 54.4 percent, followed by West Virginia at 53.3 percent and Florida at 51.4 percent.

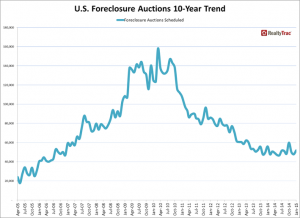

RealtyTrac U.S. foreclosure auctions 10 year trend

Florida posts 17 percent increase in bank repos in January, RealtyTrac

Eight Florida cities, including Miami and Orlando were in the top 10 for foreclosure rates nationwide. Florida was also among the 27 states that posted annual increases in bank repossessions in January — a 17 percent increase.

“Due to our ponderous judicial system, most of the options have been exhausted, and the judges are now expediting the process,” Mike Pappas, CEO and president of the Keyes Company, said in a statement. “The banks recognize the opportunity in this improving market and are aggressively trying to remove these properties from their balance sheets. It is encouraging, after seven years, to see the end near on this dramatic cycle.”

Average price of a single-family home in Miami-Dade jumped 4.7 percent, Miami Association of Realtors

The average price increased to $246,140 in the fourth quarter of 2014. For condos, the average price increased 8.6 percent to $190,000. The county has now seen three consecutive years of growth for single-family homes and condos.

So, will that continue?

“We expect Miami home prices to continue to increase in 2015 but at a more moderate rate,” Christopher Zoller, a real estate agent and residential president of the Miami Association of Realtors, said in a statement. “Limited supply and strong demand for single-family homes is still reflective of a seller’s market.”