From the New York website: Who really owns the city’s biggest development projects? It’s a question that has stumped industry observers for years, as investors typically operate from behind LLCs and ownership stakes are closely-guarded secrets.

On Friday, AmBase Corp, a Florida-based investor in 111 West 57th Street in New York, filed a $105 million lawsuit against JDS Development Group and Property Markets Group, alleging the developers engaged in a scheme that diluted AmBase’s equity stake in the supertall condominium project.

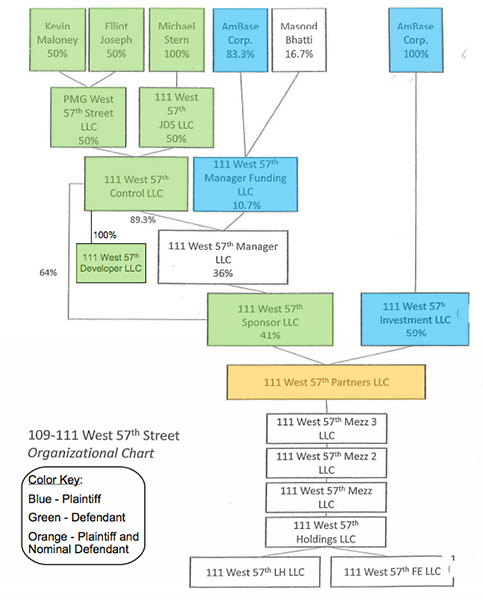

Contained in the lawsuit was an exhibit that detailed the ownership of the Billionaires’ Row tower. Though the document detailed ownership at the time the partnership was first struck in 2013, and there have been changes since then, it still provides a rare look into the labyrinthine structures used on large-scale projects.

A rendering of 111 West 57th Street

The tower is slated to rise to a height of 1,438 feet, and has a projected total sellout of $1.45 billion for its 60 units, according to an offering plan filed with the New York Attorney General. JDS and PMG have delayed sales at the tower, acknowledging the market isn’t as receptive to high-end project as it was a year ago.

According to the exhibit, behind a web of shell corporations there were five principal investors in 111 West 57th Street at the project’s outset in 2013: PMG principals Kevin Maloney and Elliott Joseph, JDS principal Michael Stern, an entity tied to AmBase and Masood Bhatti, a managing director at Silverpeak Real Estate Partners who was previously an investment banker at Lehman Brothers.

As of June 2013, the structure looked like this (see chart): Maloney, Joseph and Stern controlled an entity named 111 West 57th Control LLC, while AmBase and Bhatti controlled an entity called 111 West 57th Manager Funding LLC. Together, the LLCs owned an entity named 111 West 57th Manager LLC, which owned 36 percent of the sponsor. The rest, 64 percent, was controlled by JDS and PMG, which means that together, the two developers owned about 96 percent of the sponsor entity.

Friday’s lawsuit included this detailed “organizational chart” of 111 West 57th Street’s ownership

The sponsor entity, in turn, owned 41 percent of the project, while AmBase, through an entity named 111 West 57th Investment LLC, owned the remaining 59 percent. AmBase pumped $56 million into the project in June 2013 for that 59 percent stake, according to its June 2013 filing with the Securities and Exchange Commission.

The structure is fairly typical of a condo project, said Carl Schwartz, co-chair of the real estate practice at Hunton & Williams. The managing entity, in this case the sponsor LLC, typically handles day-to-day operations while the investment entity only weighs in on major decisions, he said.

In this case, however, the investment entity also has a stake in the sponsor entity.

“It’s not as common as just the straight sponsor and investor structure, for someone to be on both sides, but there can be various reasons for it,” Schwartz said. An investor may want to come into the sponsor entity to take advantage of a promote, or, as Schwartz put it, “money that goes to the sponsor that’s not a return on capital, [but] a reward for having promoted the deal and for having succeeded.” Under the above agreement, AmBase would get a slice of that promote.

But according to AmBase’s lawsuit, an entity called Atlantic 57 LLC, which does not appear in the original ownership structure, now holds a 26.3 percent interest in the project. AmBase claims that JDS and PMG diluted its ownership stake by “artificially driving up” expenses and “issuing unnecessary capital calls to cover the purported costs.”

Representatives for JDS declined to comment. Representatives for 111 West 57th Street declined to comment. An attorney for AmBase, Michael Tremonte, could not be reached for comment.

According to the original partnership agreement, the sponsor entity has the right to transfer up to a 26.3 percent stake in the project to Atlantic 57 LLC. But that document also allows AmBase to withhold its consent if such a transfer would “adversely affect the rights, obligations, or economic return” of AmBase. Time and litigation will tell who gets what.

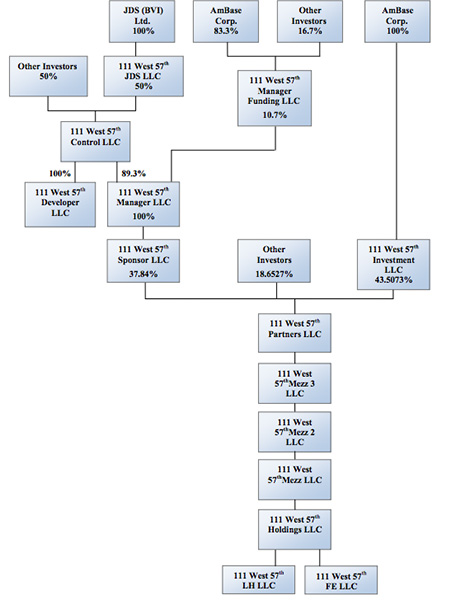

Some shake-up in ownership had already occurred by the beginning of 2015, according to documents JDS filed with the Tel Aviv Stock Exchange (TASE). In those documents, JDS told potential investors that AmBase’s investment entity stake stood at just 43.5 percent, down from 59 percent at the outset of the project (although AmBase’s suit suggests that this stake downsize did not officially occur until after February of 2015).

According to a chart included in the TASE documents, a group called “Other Investors” owned 18.65 percent of the project. It is unclear if this group is Atlantic 57 LLC.

JDS included this diagram of the project’s development in a December 2014 filing with the Tel Aviv Stock Exchange