South Florida hotel operators will face greater competition as developers deliver thousands of new hotel rooms in Miami-Dade County and Broward during the next two years, according to a hospitality consultant.

“Existing hotel operations are going to have to emphasize yield management to get ready for this wave of new supply that’s coming online,” said John Lancet, a director and partner in the Miami office of hospitality consulting firm HVS. “It’s not a question of if it’s going to come, it’s a question of when.”

Lancet spoke Thursday on a panel of hospitality professionals at a luncheon organized by brokerage firm Marcus & Millichap. Another member of the panel said he foresees softer business conditions in the Florida hospitality industry.

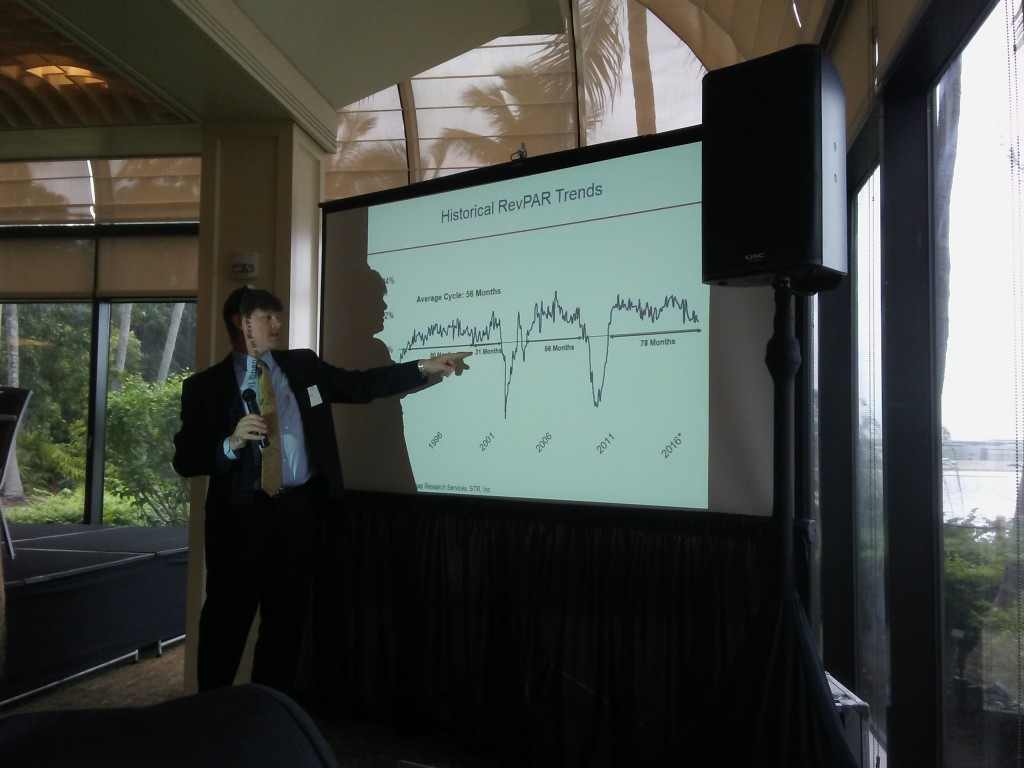

“This is a business that runs in cycles,” said Mike Bou-Sliman, founder and managing partner of Naples Hotels Group, a Naples-based hotel management. “I think we’re going to see some softening over the next six to 12 months, probably into 2018. I don’t think it’s a cliff we’re dropping off, but it’s slowing.”

Lancet cited an analysis by HVS showing that Miami-Dade County has about 50,000 hotel rooms in its existing supply. Rooms now under construction represent about 5.3 percent of the existing supply, he said. Rooms in the final planning stages and likely to get built represent another 7.8 percent of Miami-Dade’s existing supply.

“The pipeline for Broward County also shows significant growth in supply, but not as significant as in Miami-Dade,” Lancet said.

In Broward’s hotel pipeline, rooms now under construction represent 5.6 percent growth over the current supply, and hotel projects in final planning would add an additional 5.3 percent to Broward’s existing supply of rooms, HVS data show.

Lancet said the impact of new rooms on the South Florida hotel market will be greater in 2018 than in 2017. “We’re near the end of our development cycle. We’re going to have to absorb this new supply,” he said. “I believe we’re up against three years of absorbing this supply increase in Miami-Dade and Broward County.”

Pete Nichols

Pete Nichols, national director of the national hospitality group of Marcus & Millichap, said hotel construction nationwide is concentrated in the midscale and upper midscale segments of the market.

He said the leading hotel brands based on U.S. rooms under construction are Holiday Inn Express, Hampton and Home2 Suites. More than 30,000 rooms across the country are under construction under each of these three flags.

Nichols also cited data showing that, while Airbnb is a competitive force, the supply of Airbnb rooms is equal to just 5.4 percent of all U.S. hotel rooms.

Hotel developer Vinay Rama, CEO of Miami-based Mandala Holdings, said five characteristics of hotels drive their success irrespective of the development cycle: the location, brand, cost basis, product and the management. “If one or two are weak,” he said, “you’re susceptible to a downturn.”