Home prices continue rising

Miami’s home prices saw another month of growth during May, but the market’s quick ascent over the past few years has begun to level off.

The metropolitan area saw an 8 percent increase in home prices year-over-year, but only 0.8 percent growth from April to May.

Since March, the growth of home prices has fallen 0.1 percent each month, according to data from this month’s S&P Case-Shiller’s Home Prices Indices, released Tuesday.

David Blitzer of S&P Case Schiller

The market saw a rapid appreciation in prices over the past three years as it recovered from the downturn, and now analysts are saying that slowing growth shows the market is stabilizing.

“As home prices continue rising, they are sending more upbeat signals than other housing market indicators,” David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices, wrote in the report. “Over the next two years or so, the rate of home price increases is more likely to slow than to accelerate. Prices are increasing about twice as fast as inflation or wages.”

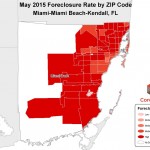

Foreclosures fall in Miami-Dade

Foreclosure rates in Miami-Dade County fell yet again during May, according to a report from CoreLogic.

Out of all the county’s mortgage loans, foreclosures represented 3.68 percent. That’s a 2.93 percent decrease compared to the same month last year.

This trend was mirrored statewide: Florida had 2.34 percent fewer foreclosures year-over year. And nationally, the United States saw a 0.44 percent drop in foreclosures.

The report also looked at the amount of delinquent mortgages in the county. Delinquent mortgages are triggered when a borrower fails to make payments. Miami-Dade had 4.11 percent fewer delinquent mortgages year-over-year, standing at 8.64 percent in May.