South Florida is once again a rising star among the world’s top destinations for commercial real estate investments, with new interest from international buyers pouring cash into the region.

For the first time since the global financial crisis, the region has made it into CBRE’s top 10 metropolitan areas for commercial investments. In 2014, Miami ranked 12th with a total of $13.1 billion in activity by the year’s end.

The first half of 2015 saw roughly $407 billion circle the globe through commercial real estate investments, of which South Florida saw $7.7 billion, according to a new CBRE report.

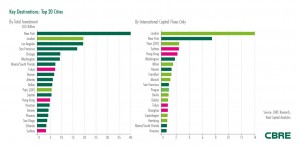

(Click to enlarge) Global rankings for both total investment and international investment (Source: CBRE)

That puts the region in seventh place among the world’s most active investment destinations, behind metros like New York, which ranked first, London, second and Los Angeles, third. South Florida edged past Tokyo and Boston.

Most of that money is from domestic investments, according to the report. International money accounted for $913 million during the first half of 2015, or roughly 11.8 percent.

Chris Ludeman, CBRE’s global president of capital markets

But that’s quickly changing: last year, Miami ranked 49th in the world for international investments. Now, the region ranks 19th.

The United States as a whole was one of the world’s largest markets for commercial real estate, along with the United Kingdom and Germany. The trio represented $301 billion, or 74 percent of the world’s commercial investment activity for the first half of 2015, according to CBRE’s report.

“There are numerous new sources of capital that have emerged only recently. With its commodity driven economy slowing, Canadian investors have sought opportunities abroad. The lower oil price has triggered and accelerated global deployment of capital from the Middle East’s non-institutional investors, particularly private high net worth,” Chris Ludeman, CBRE’s global president of capital markets, wrote in the report. “However, of all the new sources, Asia has been the most captivating due to the size, speed and potential long-term impact brought by the recent regulatory changes; this has allowed many of the local pensions funds and insurance companies to invest globally for the first time.”