There’s no doubt that a quieter condo market and tighter financing have been having an overall impact on real estate development in South Florida.

Veteran real estate analyst Jack McCabe foresees a pullback in investment capital flowing into the area’s commercial real estate market, especially from foreign investors. “Many of these new projects that have been announced are backed by foreign capital,” he said. “We’ll see how many of those actually get built.”

McCabe also expects refinancing pressure to hit developers who borrowed money in the commercial mortgage-backed securities markets, especially, of course, those with loans that are maturing by 2017. “We’re probably going to see an uptick in commercial foreclosures over the next 18 months,” he predicted.

On the rental apartment front, many developing projects are either in construction or have been proposed in Miami-Dade, Broward and Palm Beach counties. But several have yet to break ground, including the 132,000-square-foot Valencia at Coral Gables and the 1.25 million-square-foot Live Galleria, which claimed the number one spot in The Real Deal’s ranking of biggest development projects in Fort Lauderdale.

Billionaire real estate investor Jeff Greene

Robert Suris, a principal at Estates Investment Group, which is an active developer of rental apartments in the city of West Miami, said there’s still plenty of opportunity in the multi-family space. But he said that banks were becoming more selective about which of these projects they would finance in South Florida. “They are realizing there is a lot of multi-family out there,” he said.

The Palm Beach County market appears to be holding up better than other parts of the region, perhaps in part because of its attractiveness to domestic money managers (see page 16). Palm Beach billionaire Jeff Greene said commercial real estate development is happening at a steady pace in West Palm Beach, where he is a major real estate investor.

“We have sort of stabilized since the last crash, and now it’s a building here and a building there,” Greene said. “It’s not a big boom going on. You don’t have 20 cranes in the air like you do in some cities.”

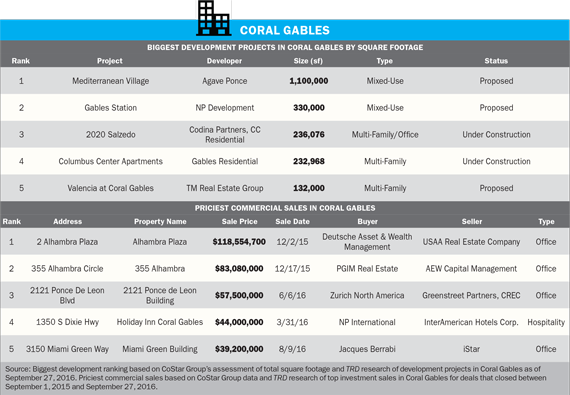

Here’s a tally of some of South Florida’s largest development projects and deals in the key markets of Coral Gables, Fort Lauderdale and West Palm Beach.

Coral Gables

In Coral Gables, four of the five largest projects based on total square footage include multi-family housing.

The top-ranked development is a proposed mixed-use project called Mediterranean Village, planned for 2801, 2901 and 3001 Ponce De Leon Boulevard. The massive $500 million plan includes 229 residential units, 300,000 square feet of office space, plus retail and restaurant space. Agave Ponce, the developer behind Mediterranean Village, has ties to the Jose Cuervo tequila brand. The project has yet to break ground.

The second-largest project in the TRD ranking for Coral Gables is also still in the planning process. Gables Station is a proposed 330,000-square-foot, mixed- use development at 251 South Dixie Highway. In July, the Coral Gables City Commission approved a revised plan for the project. The company that won city approval for the development, NP Development, has a contract to buy the 4.3-acre site from Miami-based Berkowitz Development Group.

NP won approval for a multi-use cluster of residential buildings, hotel space, retail stores, parking and open-air space. “Though it has some retail in it, it’s not a predominantly retail product,” said Jeff Berkowitz, the president and founder of Miami-based Berkowitz Development, which nixed earlier plans to build Gables Station as a retail-only property. Pure retail is “no longer the highest and best use of the property,” said the developer, who cited “the escalating rents that multi-family buildings have been able to obtain, combined with the fact that you could get two floors for every one floor of commercial,” under existing zoning.

The third- and fourth-ranked projects on the list are already under construction. Codina Partners and CC Residential are building a 16-story office and apartment building at 2020 Salzedo Street. It is slated to have 213 luxury apartments, a parking garage with 566 spaces, and 49,379 square feet of office space. And Gables Residential has broken ground on the Columbus Center Apartments, a 233,000-square-foot multi-family development at 100 Alhambra Circle.

On the commercial sales front, office properties accounted for four of the five priciest deals during the 12-month period that ended in mid-September. The priciest was the $118.5 million sale of Alhambra Plaza, a two-building office property at 2 Alhambra Plaza in Coral Gables spanning 326,415 square feet. Deutsche Asset & Wealth Management bought the two-building office complex from USAA Real Estate Company.

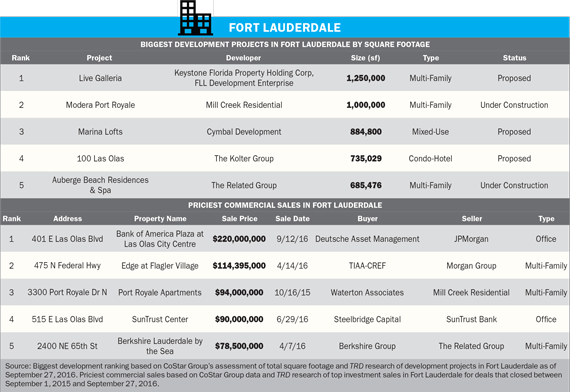

Fort Lauderdale

Fort Lauderdale’s largest project is a proposed residential development at the Galleria Mall — which is located near the city’s affluent Coral Ridge neighborhood — called Live Galleria. The developers, Keystone Florida Property Holding Corp. and FLL Development Enterprise, are planning a 1.25 million-square-foot multi-family building at 2414 East Sunrise Boulevard, which is also the mall’s address.

In northeast Fort Lauderdale, a 1 million-square-foot multi-family building has already broken ground at 3333 South Port Royale Drive. Mill Creek Residential, a Dallas-based developer, is building the project, called Modera Port Royale.

The plans for another project, Marina Lofts, call for a 885,000-square-feet mixed-use development, making it the third-largest on TRD’s ranking in Fort Lauderdale. Marina Lofts is planned for a six-acre site downtown at 413 Southwest 3rd Avenue, but Cymbal Development has faced numerous delays since the developers won approval for it in late 2013, and it still has yet to break ground.

With a design by starchitect Bjarke Ingels, Cymbal Development initially planned the project as solely rentals, then later as a blend of condos for sale and apartments for rent. In 2015, the developer got a two-year extension of an initial deadline — giving it until August 2017 — to obtain building permits.

The investment sales market also had some notable deals in Fort Lauderdale. In September, Deutsche Asset Management paid $220 million to buy the Bank of America Plaza at Las Olas City Centre from JP Morgan. That was nearly double the second-priciest deal on TRD’s Fort Lauderdale commercial sales ranking — the $114.4 million purchase of a 332-unit apartment building called the Edge at Flagler Village, which works out to $344,277 per rental unit. Houston-based Morgan Group sold the multi-family property to pension giant TIAA-CREF in April.

A rendering of One West Palm, an 830,000-square-foot, mixed-use development project

Steve Patterson, president and CEO of the multi-family and mixed-use development division of Related Group, said that Fort Lauderdale’s rental apartment market is tight these days. He pointed to the fact that Broward County, where Fort Lauderdale is the largest city, added 36,000 payroll jobs during the 12 months that ended in August 2016. Yet permits for apartment construction covered just 3,800 units. “Permitting in Broward County is well below what we think is comfortable,” he said.

However, some residents have objected to new residential development. Critics of the Live Galleria project, for example, pushed back in public meetings, complaining about the prospect of increased street congestion and other concerns. The mall’s owner, Keystone Property Holdings, subsequently reduced the scale of its proposal, eliminating plans for a hotel and office space. Keystone also reduced the planned number of condo units to 1,250, down from an initial plan for 1,600 units, and lowered the height of the project’s tallest building to 27 stories, down from 45. “It is progressing,” said Ashley Walker, a spokeswoman for the project.

Despite the seemingly solid demand for rentals from baby boomers and millennials alike, banks are overly cautious in deciding whether to finance rental construction, Patterson said.

“Nobody wants to overbuild,” he said. “We just got beat up so bad in the last cycle that everybody is extremely paranoid, starting with the Fed and the banks.”

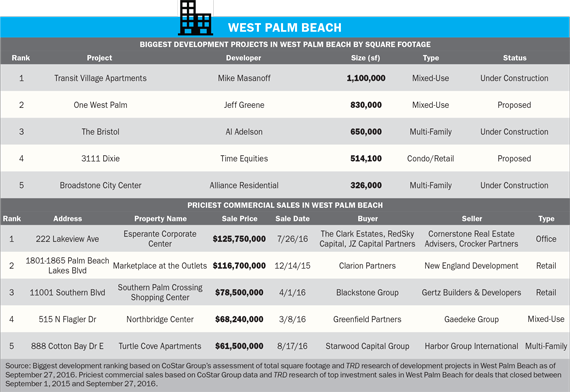

West Palm Beach

In Palm Beach County, Greene, who has spent $300 million on West Palm Beach properties, has plunged into developing them. He’s behind the One West Palm project, an 830,000-square-foot, mixed-use development at 550 North Quadrille Boulevard. “We’re still in the permit process,” Greene said. “Hopefully, we can break ground in the next three or four months.”

The 30-story, twin-tower project designed by Arquitectonica would take up an entire block and feature office space, luxury residences, and 200 all-suite hotel rooms. The ground floors would have shops and restaurants, plus a daycare center and a fitness center. “I’m more convinced than ever that this is going to be a huge success,” Greene said. “It’ll be the best office address in Palm Beach County.”

The recent eight-figure sale of a multi-family property in West Palm Beach is further evidence of investor interest in the region’s rental housing market. The property, called Turtle Cove Apartments, sold in August for $61.5 million, making it the fifth-priciest commercial property purchase in West Palm Beach during the 12 months that ended in mid-September.

The highest-priced commercial property transfer in West Palm Beach during that period was the July sale of a 256,100-square-foot office building in the city’s downtown area. The 20-story Esperante Corporate Center changed hands for $125.7 million. The sellers were Cornerstone Real Estate Advisers and Crocker Partners, and the new owners are the Clarke Estates, RedSky Capital and JZ Capital Partners.

Market pros say that office space is becoming scarce in West Palm Beach, as numerous money managers are relocating offices from Northeast business markets such as New York and Greenwich, Connecticut. The occupancy rate for West Palm Beach’s four trophy Class A office buildings totaled 93.5 percent at the beginning of 2016, up from 91.1 percent a year earlier, according to JLL.