Analysts are prescribing a healthy dose of optimism for commercial real estate in Miami-Dade County, with factors like explosive job and population growth to thank for the ongoing strength of the markets across the board.

The county is on track to blow past its peak of $6.8 billion in foreign investment recorded last year, with investors continuing to purchase trophy properties in the office and hotel sectors for hundreds of millions.

Miami’s role as a trade hub for Latin America is a steady driver of demand for local industrial space. And a bustling retail market showed its muscle with the $370 million sale of an entire block along Lincoln Road to a Spanish billionaire in September.

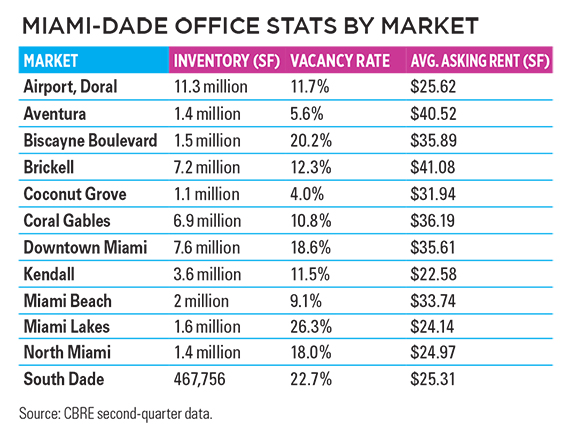

Office market

So far this year, the Miami-Dade office market has been defined by limited inventory that has driven lease rates up as vacancy rates head downward, according to Scott Strickland of JLL.

Vacancy rates for the county fell to 13.3 percent in the second quarter, down from 15.5 percent for the same period last year. The average asking price per square foot has climbed more than 5 percent to $32.44 over the same period.

Developers have responded to market demand by beginning construction on a bevy of new office projects, with almost 1 million square feet expected to be delivered by 2017.

But that still won’t be enough to satiate the demands of an ever–growing office market, Strickland said. That shortage of supply has shifted the market in favor of landlords, causing not only an increase in rental rates but a decrease in concessions such as landlords offering suite improvements as part of lease agreements.

In September, Swire Properties, the developer behind the mixed-use Brickell City Centre project, announced that one of its towers would become an office building instead of a wellness center, as was originally planned. That tower, Three Brickell City Centre, will now match its sister building Two Brickell City Centre. Law firm Akerman LLP has already preleased 80 percent of Three’s 134,600 square feet of office space.

This year alone, 263,078 square feet of office space has been under construction, with roughly half of that located inside the county’s central business district, which includes downtown Miami and Brickell, according to data from commercial brokerage firm CBRE.

“This time next year, I think you’re going to see a lot more office announcements,” said Diana Parker, a CBRE senior vice president.

Despite an uptick in the amount of development, rising construction and labor costs are proving prohibitive for new projects, said Christian Lee, CBRE senior vice president. “It’s hard to support construction with these rents,” he claimed. “There’s really very little under construction here compared to the job growth we’ve had.”

Some of the year’s biggest transactions so far include RREEF Property Trust’s $112 million purchase of 800 Brickell and Gaedeke Group’s $142 million acquisition of Espirito Santo Plaza in Brickell.

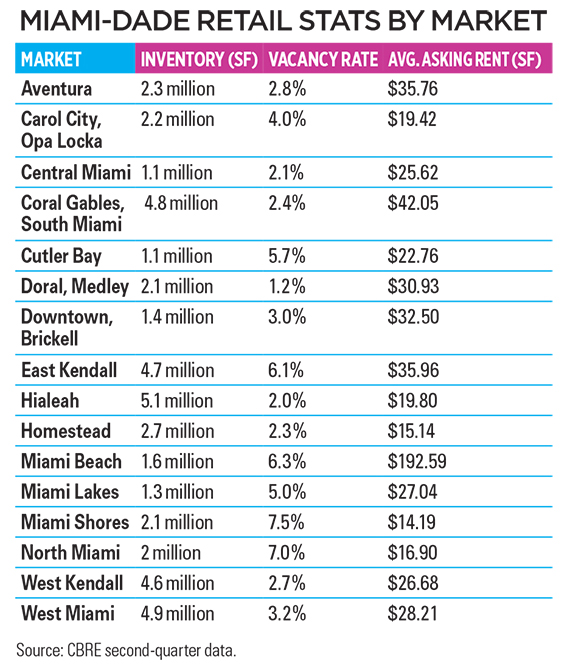

Retail market

Miami’s retail market has continued to shine; it was one of the country’s most attractive destinations for global retailers behind only New York, according to 2014 data from the U.S. Chamber of Commerce.

Retail vacancy rates are down and rents are up. The average asking rent was $42.98 a square foot for the second quarter, an increase of 6.5 percent from the same quarter last year. Vacancy rates declined to 3.6 percent, having shrunk 1 percent over the same time period, according to CBRE data.

Rents continue to be highest in Miami Beach, where the average asking price is $192.59 a square foot.

Some 1.9 million square feet of retail space is under construction throughout the county, and 1.2 million of that is expected to be completed by the end of this year.

The most notable transaction so far this year was the $370 million sale of an entire block on Lincoln Road to an entity affiliated with Amancio Ortega, a Spanish billionaire and the world’s fourth-richest person, according to Forbes.

Investors have been assembling huge portfolios of land in hot markets like Wynwood and the Design District. Thor Equities, a New York real estate company, picked up almost an entire block of Wynwood retail properties for $29 million in April. And in July, David Edelstein’s TriStar Capital paid $65 million for a three-property retail center known as Atlas Plaza in the Design District.

“You really get the sense that Miami is getting a lot of attention on a national scale,” said CBRE’s Zach Winkler. “Overall, you’re seeing a more sophisticated retail mix coming down here.”

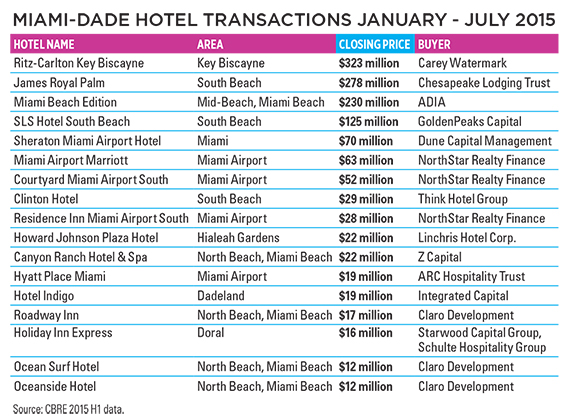

Hotel market

Analysts are predicting a slowdown in Miami’s hotel market due to two major factors: an influx of new property openings this year and a strengthening U.S. dollar that could discourage international travel.

Inside the county, 1 Hotel & Homes, Aloft South Beach, Hyatt Centric South Beach Miami and the AC Hotel by Marriott have all launched this year, bringing hundreds of new rooms to the market.

Occupancy rates have tapered off slightly in Miami-Dade County after several years of steady growth, declining from 81 percent in the first half of 2014 to 80.8 percent in the first half of 2015, according to CBRE data.

Yet the county’s average daily room rate in the first half of this year has soared to $217.62 from roughly $202 in the same period last year. And the average revenue per available room has surged from about $164 in the first half of 2014 to $175.80 for the first half of this year.

CBRE Vice President Paul Weimer said the market could see a slowdown in the growth of revenue per available room for the next 12 to 18 months. But he said the market is in no danger of a bust. And with the airport adding new destinations like Middle East travel hub Istanbul in October, the roster of nationalities for Miami vacationers continues to expand, said Christian Charre, CBRE vice chairman.

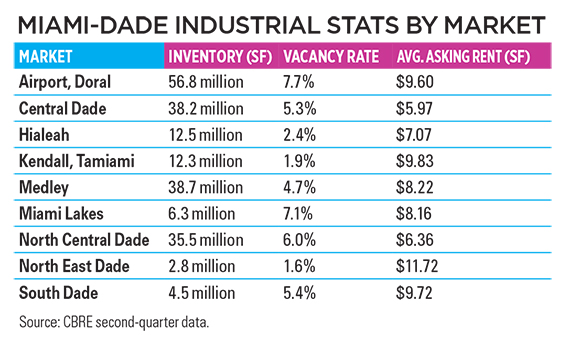

Industrial market

A strong economy has encouraged demand for industrial properties in Miami-Dade County, said CBRE’s Chris Lee.

Miami International Airport and the port of Miami continue to move millions of tons in international freight each year, and such trade needs industrial space to support itself, Lee said.

That need was reflected in the second quarter of 2015, which saw a net absorption of 836,000 square feet of industrial space, according to CBRE data. The county’s vacancy rates declined to 3.8 percent during this year’s second quarter from 4.6 percent for the same period last year. Developers have struggled to keep pace with demand.

During the second quarter, construction was completed for 462,000 square feet of industrial space, and another 1.2 million square feet are being built for delivery by the end of this year. In addition, 3.4 million square feet of industrial space are in the pipeline.

GBX Capital, a new Brazilian developer, is gearing up to break ground on a 1.6- million–square-foot speculative business park in Homestead in a bid to capitalize on Miami’s ripe industrial market.

Despite this ravenous demand, the average asking price for leases has hovered around $8 a square foot over the past two years. Dave Albert, a CBRE analyst, attributed this to developers and landlords trying to fill their spaces as soon as they can.

“Landlords are very keen on delivering the product today and not pushing rental rates as hard,” Albert said.