All appears to be well in Miami-Dade’s commercial real estate world. Transactions involving trophy office buildings in downtown Miami and Brickell have been spurred by dropping vacancy rates and rising rents, thanks to a lack of inventory. The hotel sector continues to sizzle with eye-popping deals including the sale of the Miami Beach EDITION for $230 million. Global and national retailers are fueling demand for new and existing storefronts, leading to record-breaking sales in submarkets like Miami Beach’s Lincoln Road. Meanwhile, the industrial market remains a safe bet for investors seeking a stable place to park their money.

Office market

In the office sector, developers added 120,724 square feet of office space last year and close to 200,000 square feet are scheduled for completion this year, according to a 2014 fourth quarter market report by CBRE. That’s a significant improvement over the less than 60,000 square feet delivered in 2013.

Don Cartwright, senior vice president for Jones Lang LaSalle, said they’ve seen “a fair number of trades occurring in the marketplace.” He added that he believes “it is an opportune time for owners to sell.”

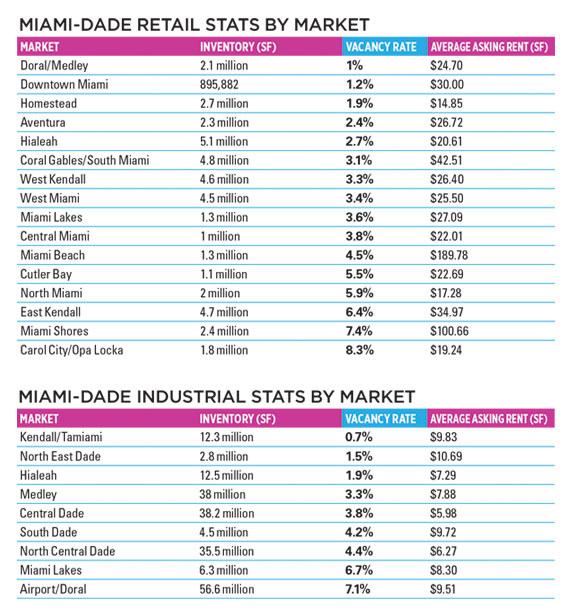

Vacancy rates declined to 14.3 percent in fourth quarter 2014 from 17.4 percent during the same period in 2013, while average rent per square foot increased by 60 cents to $31.03 over the same period.

Miami’s commercial business district, which includes downtown and Brickell, has seen considerable tenant growth.

Brickell Bay Office Tower at 1001 Brickell Bay Drive announced in January that the building was 93 percent occupied after completing 15 leases totaling nearly 53,000 square feet in 2014.

In February, a partnership between Newgard Development and Midgard Management announced it had sold half of the available 143,000 square feet of live-work space at One Flagler, a former office tower designed by Morris Lapidus that is being converted into an office-condo building.

Other significant transactions include the $140 million sale of the SunTrust Bank tower at 777 Brickell Avenue to a Brazilian investment group, and AEW Capital Management’s $50.2 million buy of a Coral Gables office building at 550 Biltmore Way.

Source: CBRE Miami Office MarketView (Q4, 2014), Source: CBRE Miami Hotel MarketView (Q3 & Q4, 2014)

Hotel market

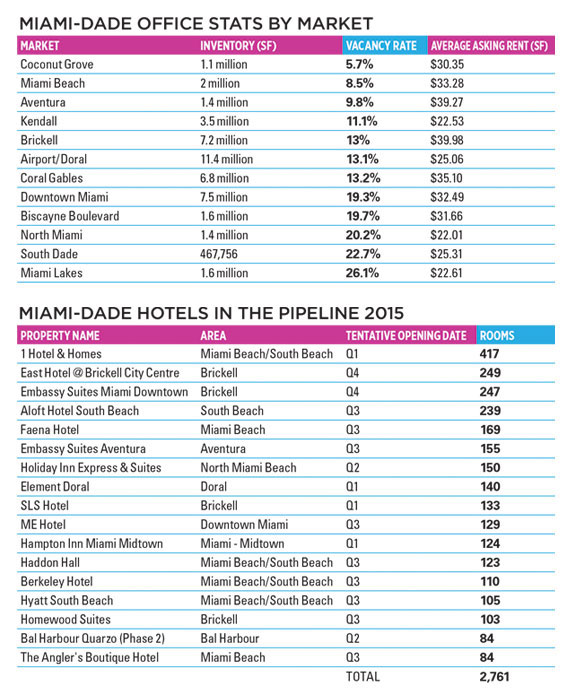

Miami’s hotel market can expect several more years of robust growth, said Paul Weimer, a CBRE vice president who analyzes hospitality.

“We do not foresee a ‘bust’ in the short to medium term,” Weimer said. “This growth is partly the result of the overall national economic recovery and partly the result of Miami’s growing importance as a true 24-hour, gateway city.”

According to CBRE’s Miami Hotel Outlook annual report, 2,269 new rooms are currently under construction and another 992 are in the final planning stages. At the end of 2013, 1,975 rooms were under construction. Weimer said the new supply is enough to accommodate the 3.4 percent growth in demand CBRE projects in 2015.

Investors also seem convinced Miami’s hotel market is still on the rise. In late December, the Nakash family, founders of the Jordache Jeans empire and owners of the old Versace mansion, bought The Setai Hotel in South Beach from Lehman Brothers Holdings for nearly $90 million.

In February, Marriott International sold the Miami Beach EDITION at 2901 Collins Avenue for $230 million in cash to companies owned by the Abu Dhabi Investment Authority.

Retail

In comparison to other major cities in the Southeast, Miami is one of the very few areas where demand for traditional shopping malls and brick-and-mortar stores is growing, according to Paco Diaz, senior vice president of CBRE’s retail brokerage.

“We are definitely in the boom part of the cycle,” he said. “Retail vacancy is extremely low, and mixed-use projects with a sizeable retail component are underway in just about every part of the city, from downtown Miami all the way out to Doral, to meet the tremendous demand.”

According to CBRE’s 2014 fourth quarter retail report, the vacancy rate in Miami-Dade is 3.9 percent, down from 4.1 percent for the same period in 2013. Total net absorption was 659,819 square feet in 2014 compared to 622,811 square feet the previous year.

While the average rent rate dropped by 24 cents compared to the third quarter, Diaz noted that rents were still up by $6.64 in 2014 over the previous year.

Retail investment activity also decreased slightly in the fourth quarter compared to the third quarter. The largest transaction was the sale of a partial interest in the Design District to General Growth Properties and Ashkenazy Acquisition Corporation. They paid $280 million to developers Dacra Realty and L Real Estate for a 20-percent stake in the 58-property portfolio consisting of retail, office and parking garages.

CBRE also noted the $88 million sale of the ArtCenter of South Florida building at 800 Lincoln Road. That corridor has maintained its status as the preferred home of national and global retailers — those that can afford the steep rents, that is. Nike will take over neighboring storefronts vacated by William Sonoma and Pottery Barn in the 1000 block of Lincoln Road. The sneaker maker has permission from the City of Miami Beach to demolish the structure and replace it with a new Touzet Studio-designed store.

“There is tremendous buzz surrounding Miami,” Diaz said. “Every retailer wants to be here.”

Industrial

Investor and tenant demand remain strong in the industrial segment, in part due to Miami’s geographical proximity to Latin America and an increase in cargo trading at Miami International Airport and PortMiami. Warehouses are providing investors with safe havens for their funds.

But land is becoming scarce, as most industrial properties have been scooped up by pension and investment funds, according to the 2015 Industrial Market Report by the Commercial Industrial Association of South Florida.

Jose Fernandez, president of The Easton Group (one of the largest industrial developers in west Miami-Dade), said institutional investors believe industrial warehouses are a safer bet than multifamily residential. “You have institutional players who appreciate the lack of volatility that exists in the industrial space,” Fernandez said.

Swiss billionaire Saul Gilinski, a pharmaceuticals executive, is one institutional investor making major deals in South Florida. On Nov. 25, his company, MSG Dania Beach, bought a 535,200-square-foot industrial park in Dania Beach for $26.6 million. Publicly-traded Terreno Realty has also been busy. In February, the company made its fourth industrial buy in Miami’s Airport West submarket, buying a 107,000-square-foot-warehouse at 10100 Northwest 25th Street.

According to 2014 fourth quarter market data by CBRE, the vacancy rate in Miami’s industrial sector declined slightly to 4.5 percent compared to 4.9 percent in 2013, which has led to a slight increase in rental rates from $8.02 a square foot to $8.15