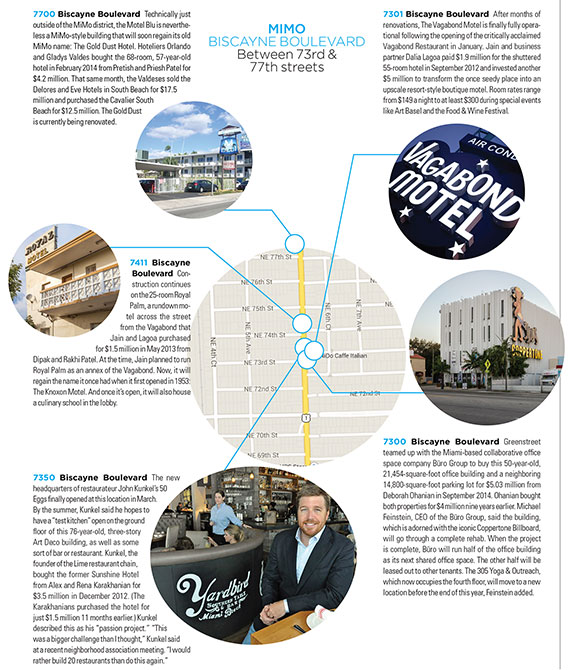

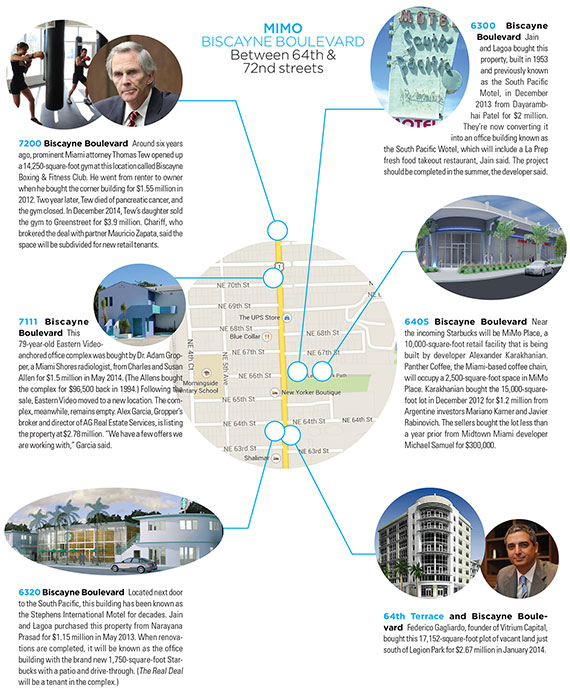

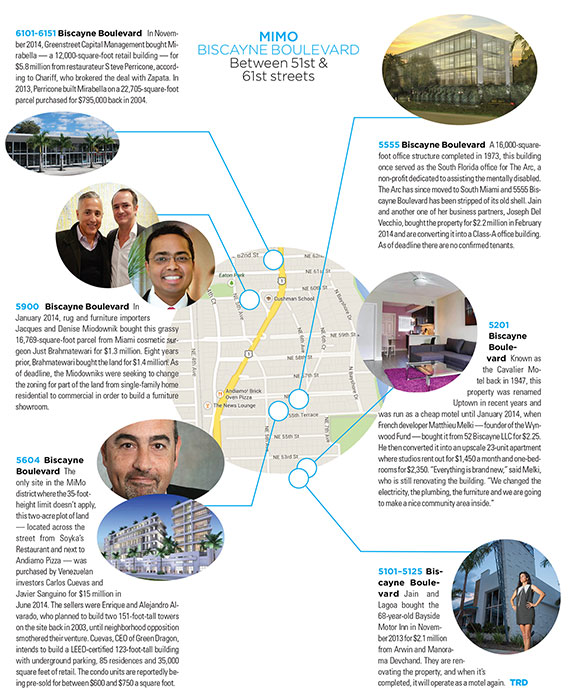

Just 20 years ago, the motels along Biscayne Boulevard were seen as havens for drug dealers and prostitutes to ply their trade. Now many of these structures make up the backbone of the Miami Modern Biscayne Boulevard Historic District, located between 50th and 77th streets along the boulevard. Here, this once blighted area is seeing a steady influx of trendy shops, good restaurants and new office space.

Tony Ulloa, a broker for Keyes Commercial, said the MiMo district has benefited from a steady stream of Miami Beach transplants eager to trade their expensive condo life for a home and a yard in Miami’s Upper Eastside neighborhoods.

“It’s become more of a place that I would take my friends from New York and other places to have dinner,” Ulloa said. “Before, you had a very limited choice.”

But it isn’t just small-business owners who are moving to the MiMo district, an area named after a style of architecture that dominated the Miami scene from the late 1940s until the early 1970s. Developers and real estate investors are flocking here as well.

One of the major MiMo players is Avra Jain, a former bond trader who renovated old buildings in New York’s Tribeca and Soho neighborhoods prior to investing in Miami real estate.

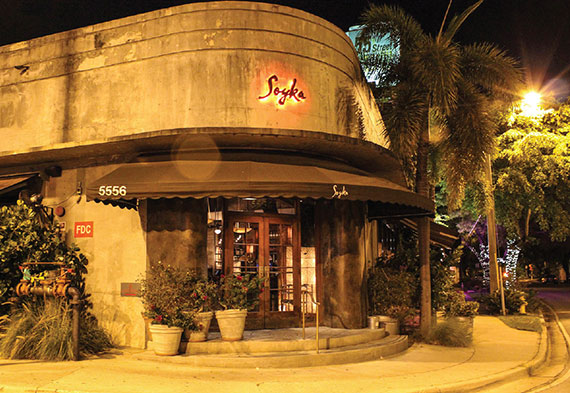

Jain said her interest in the MiMo district began when her friends tried to get a room at The New Yorker, a recently restored 1950s-era hotel on Biscayne Boulevard, only to find that it was booked solid. It was then that she realized that while Miami Beach had plenty of rehabilitated — and expensive — boutique hotels from that same period, there were few in the City of Miami. So she bought the 62-year-old Vagabond Hotel in 2012.

“We knew we would make a difference in the perception of Biscayne Boulevard,” Jain said.

Since that deal, Jain has purchased several more properties in the district. The $12 million-plus she spent buying MiMo real estate does not account for fixing up those neglected properties.

“Renovation costs run more than acquisitions,” Jain said. And how much has she invested in renovations? “I try not to think about it,” she answered.

Greenstreet Real Estate Partners, a $1.5 billion real estate investment fund, is also putting money in MiMo. Last fall, Greenstreet spent more than $14 million buying retail and office properties there.

Tony Cho, president of Metro 1 Properties, said investors are attracted to the area because the cost to buy or rent property in the MiMo district is a comparative bargain. “It’s a cost-effective alternative,” he said.

However, as MiMo’s popularity increases, so to do the district’s retail rents. Cho said rents have increased 50 percent in the MiMo district in the last three years, though he noted that the trend is “fairly market wide.” Retail rents in the area range anywhere from $35 to $50 a square foot.

But Chariff Realty president Lyle Chariff worried that some new owners may expect far more rent from their properties than what MiMo’s current market warrants.

“That can create a big problem,” Chariff said. “If people pay too much, they’ll charge too much … Rents will go up, and businesses can’t survive.”

Ulloa disagreed. “I think the people going into MiMo are banking the properties, which suggests a real business plan,” he said. “It’s not just speculation and people plopping down money.”

District in depth