When real estate players talk shop about South Florida, if you look closely enough, you’ll catch a glint in their eyes, like a prospector talking about an untapped gold mine.

There’s no question that South Florida’s commercial markets have been hot tickets over the past two years: A retail assemblage on Lincoln Road fetched $370 million, institutional-level assets such as the $119 million Alhambra office complex in Coral Gables traded like flat-screen TVs on Black Friday and vacancies declined across the board.

And while global factors — from ailing stock markets to volatile foreign economies — have put a damper on growth in certain sectors, industry insiders say there are still plenty of noteworthy deals expected to close this year.

Developers are planning to open a plethora of new hotels this year with thousands of rooms collectively, while tight office supply has brought major business districts like Brickell to equilibrium. Meanwhile, price conservatism could pull more commercial sellers into the market as they adopt “as good as it’s going to get” mentalities.

So while a sense of restraint is mounting in the commercial real estate industry, especially when it comes to underwriting finance deals, bullish brokers like Chris Lee of CBRE’s capital markets team say South Florida won’t hit its peak in 2016.

“Typically before the market peaks out, you see a lot of abuse — people getting irresponsible with how they price their deals,” Lee said. “We haven’t seen any of that.”

Office

Office development has long competed with condos in South Florida’s hotly contested land markets, primarily because it’s easier to fund construction with 50 percent deposits rather than leasing up most of a building before breaking ground.

Even Greater Downtown Miami, the region’s preeminent office market, is only now getting some of its first major new office deliveries in years. About 770,000 square feet of new office space is set to open in Miami between 2016 and 2017, according to a fourth-quarter 2015 report from CBRE.

Among the largest projects under construction: Brickell City Centre’s two roughly 130,000-square-foot office buildings, one of which has already opened, and another pair of office buildings with a combined 280,000 square feet in All Aboard Florida’s upcoming MiamiCentral station, which is set for completion in 2017.

But despite large-scale office development finally returning to Miami, those deliveries represent only half of what was built during the last cycle that ended in 2011, which means the market will continue to tighten, according to JLL’s Alan Kleber.

Vacancies for Miami fell to 12.7 percent in the fourth quarter, down 1.9 percentage points from the previous year, all while Class A rents in the central business district grew 5.1 percent to $46.98 per square foot.

Broward and Palm Beach counties are experiencing similar trends, according to fourth-quarter CBRE reports: Broward’s vacancy rates fell by 0.4 percentage points to 15.5 percent, while rents in the central business district rose 4.2 percent to $22.85 per square foot. Meanwhile, Palm Beach County hit a seven-year low for vacancies, standing at 18.9 percent, with rents rising slightly to $18.14 per square foot.

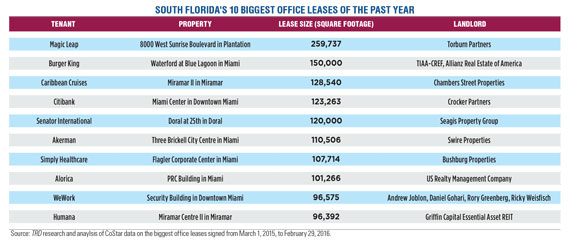

Miami’s downtown and airport submarkets saw some of South Florida’s largest leases last year: Burger King’s new 150,000-square-foot corporate headquarters in the Waterford at Blue Lagoon commercial park ranked as the second-biggest lease in terms of size, Citibank’s renewal of its 123,263-square-foot lease at Miami Center came in fourth and Miami law firm Akerman’s move to its new 110,506-square-foot space at Three Brickell City Centre ranked sixth.

Three Brickell City Centre

Last year’s biggest lease, however, belonged to the former Motorola Mobility campus in Broward’s Plantation. Virtual reality startup Magic Leap agreed to a nearly 260,000-square-foot lease in the campus for its new headquarters, which Kleber said is a testament to South Florida’s growing attractiveness to tech companies.

As far as investment activity goes, Lee of CBRE said he expects sales to accelerate across the board compared to last year. As prices flatten out, more sellers will be pulled into the market as they hope to cash out while the market is at a high point, Lee said.

Already a handful of high-profile deals have closed in the first months of 2016: The real estate arm of New York Life Insurance Company paid $115 million for a Class A office park in Weston, Triarch Capital Group put down $74 million for the three-building Doral Costa office complex and New York-based Brickman purchased the Courthouse Tower in downtown Miami for $28 million.

“People don’t want to miss this investment cycle,” Lee said. “That’s going to cause a lot of people to say, ‘It’s time to go.’”

Hotels

South Florida’s hotel market is a mixed bag. Up until several months ago, the lodging industry had enjoyed steady gains in occupancy and revenue per available room (revPAR) — two key metrics measuring the health of the market.

But February data from hospitality research firm STR show both took a hit in Miami compared to the beginning of 2015. Occupancy stood at 84.4 percent — 4.7 percent lower than the year before — and revPAR fell 8.7 percent to just under $213.

Much of that decline can be explained by a perfect storm of factors, said Max Comess, a managing director at the commercial brokerage HFF. Thousands of rooms were opened last year, which created a glut of supply for travelers to choose from, he said.

And while a steady stream of northeasterners escaped to South Florida early last year from the so-called “Snowmageddon,” which buried much of the U.S. under several feet of snow for months, a relatively warm winter this year has all but evaporated that surplus business.

But Comess said wavering occupancy and revPAR figures aren’t heralding a downturn for one of South Florida’s most important industries. Instead, the market is “bouncing off the top” as it matures, he said.

Traffic through Miami International Airport continues to grow — more than 52 million people passed through the area’s biggest airport last year, according to its website — and developers are planting new seeds north of Miami Beach’s costly land markets.

The largest of those developments is the Related Companies’ newly finished Hilton West Palm Beach, which opened its 400 rooms in January, followed by The Related Group’s Hyde Resort & Residences in Hollywood Beach, which isw expected to open its 367 condo-hotel rooms in late 2016.

“We’re seeing interest in South Florida’s secondary and tertiary markets, which is typically what happens in this stage of the cycle,” Comess said.

But some hotel developments are having a harder time finding their place in the market. The MDM Development Group recently announced a major redesign for its Marriott Marquis Miami Worldcenter Hotel & Expo project, reducing the project’s size by $225 million and 100 rooms and splitting it into two phases so construction financing would be easier to come by.

And the controversial 800-room Miami Beach Convention Center Hotel failed to garner enough referendum votes in March to approve the ground lease it needed to move forward.

While hotels are stabilizing performance-wise this year, investment activity remains volatile in the face of troubled financial markets, according to Comess.

Early last year, sovereign wealth funds and real estate investment trusts closed several big hotel deals with prices tags in the hundreds of millions. Among those were the Abu Dhabi Investment Authority’s $230 million purchase of the Miami Beach Edition and the Chesapeake Lodging Trust’s $278 million acquisition of the James Royal Palm in South Beach. Both deals closed before the end of February.

Hilton West Palm Beach

But so far in 2016, those types of mega-deals have been absent in South Florida, save for Hyatt Hotels’ announcement in March stating it would buy the Thompson Miami Beach for an undisclosed price.

“REITs are just now wading back into the market now that their stocks are recovering,” Comess said, noting that some sovereign wealth fund are still licking their wounds from low oil prices and uncertain political situations at home.

Top Commercial Owners

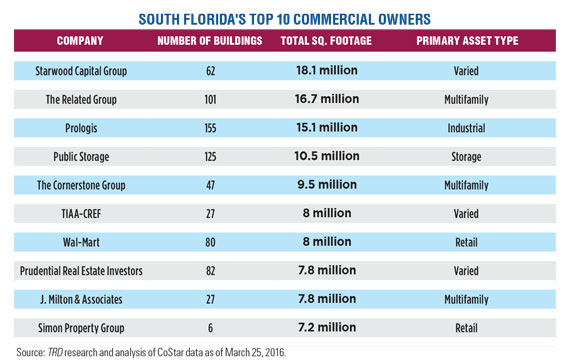

Despite the uncertainty in the hotel market, it’s been a busy six months for Starwood Capital Group, now South Florida’s largest commercial property owner.

With a single multibillion-dollar move in October, the private investment group, headquartered in posh Greenwich, Conn., became the biggest commercial player in the tri-county region in terms of portfolio size.

The firm paid $5.34 billion to Equity Residential for its massive assembly of 72 apartment properties, 33 of which are located in Florida. On top of that, the company ranked as Broward County’s second-largest commercial buyer during 2015, spending just under $282 million for a consortium of office properties.

Starwood’s holdings in the region now stand at 62 properties totaling 18.1 million square feet. Even Barry Sternlicht, the company’s chairman and CEO, has a soft spot for the Sunshine State. In mid-2015, Sternlicht picked up a waterfront residential lot on North Bay Road in Miami Beach, where he’s building a sprawling contemporary mansion.

Close behind Starwood is The Related Group, which boasts a portfolio of 101 properties totaling 16.7 million square feet. Related, largely known for its luxury condo developments in Miami, also has an extensive rental and affordable housing portfolio. The company owns more than 60 apartment communities housing about 20,000 units, according to its website.

The firm’s affordable housing arm, Related Urban Development Group, is also the lead bidder for Miami-Dade County’s plans to redevelop an aging rental complex in Liberty City called Liberty Square. That project alone would add more than 1,500 units to the company’s portfolio, though the plans have yet to go before county commissioners.

Prologis, a commercial real estate giant of a different kind, is South Florida’s third-largest property owner thanks to its vast industrial holdings.

The San Francisco-based firm owns 15.1 million square feet of industrial space in the tri-county region. That equates to 155 distribution centers and warehouses, according to data from the CoStar Group.

Prologis was the most active commercial buyer in Broward County last year in terms of dollars, spending $407 million on 23 industrial sites. The company also ranked ninth in Palm Beach County with its $81 million purchase of seven properties.

A sizable chunk of Prologis’ immense industrial holdings in South Florida came from its acquisition of KTR Capital Partners, along with the firm’s 70-million-square-foot portfolio in April 2015. Prologis and its joint-venture partner Norges Bank Investment Management, which manages Norway’s wealth fund, paid $5.9 billion for the assembly of 322 properties in one of the year’s largest real estate deals.

“Broward County’s industrial market is an attractive destination for investors, as lack of available product forces tenants to compete for existing space,” according to a fourth-quarter CBRE report.

While many of South Florida’s biggest commercial owners muscled their way to the top through massive portfolio purchases last year, some of the companies on the list are perennial players that have become prominent through sheer staying power.

The retail giant Wal-Mart, for instance, made its way onto the list as South Florida’s seventh-largest commercial property owner with 80 stores and just under 8 million square feet of space.

The company has made a point to expand its Florida presence in recent years: Fort Lauderdale got its first-ever Super Walmart in January, and the company is opening a new store in Midtown Miami, which borders the city’s booming neighborhoods of Wynwood and the Design District.

Simon Property Group, one of the nation’s largest owners of shopping malls, also made it onto the list with its portfolio of 7.2 million square feet of retail in South Florida. The company has stakes in some of the region’s largest shopping centers, including Sawgrass Mills in Sunrise, Aventura Mall in Aventura, Dadeland Mall in Kendall and the Miami International Mall in Doral.

Aventura Mall, primarily owned by the Soffer family, is in the preliminary stages of adding a new 241,000-square-foot wing. And Sawgrass Mills is in the midst of redeveloping its outlet center for the third time since it was built in 2006.

Of course, doubt has seeded itself into the lifeblood of many financial markets — stocks, oil and currencies. But apparently not South Florida commercial real estate.

“Despite the fact that we’re going through a little turbulence this year,” said Comess, “it’s still one of the top five investment markets for real estate in the world.”