One of the country’s largest mortgage lenders settled a lawsuit with a college professor in Maryland, agreeing to policy changes the professor says are a fitting legacy to his late wife.

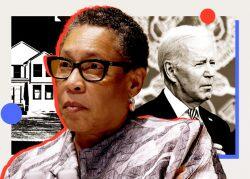

Johns Hopkins University history professor Nathan Connolly and the estate of his late wife, Shani Mott, settled two years after suing loanDepot for alleged appraisal bias, the New York Times reported. Claims against the appraiser and the appraisal company remain active.

Connolly’s family will receive an undisclosed payment in the settlement. LoanDepot is also revamping its policies: The lender will be offering second appraisals quicker if there is suggested bias, and has pledged to communicate the right to request an appraisal review and escalate appraisal bias allegations to the company’s fair lending group. The company committed to sever ties with appraisers who demonstrate bias.

Mortgage applicants who request a review of their appraisal will be locked into the rate they were promised upon the initial appraisal.

The Baltimore couple filed their lawsuit in 2022, a year after facing alleged discrimination when trying to refinance their home in Baltimore. They paid $450,000 for the home in 2017 and spent $42,000 on upgrades.

Shane Lanham appraised the home for an underwhelming $472,000, leading loanDepot to deny an application to refinance. But when the couple applied for a loan later with another company, they received an appraisal for $750,000.

The difference? The second time around, Connolly’s family removed their personal photos and put up photos of a white colleague’s family, instead.

While loanDepot settled, it continues to deny wrongdoing in this case. A spokesperson for the company said in a statement that the firm “strongly opposes bias in the home finance process.”

Mott died this month after battling Stage 4 adrenal cancer; she was 47. She entered hospice care in January, but gave an eight-hour deposition two weeks before her death.

“I’m obviously saddened to a profound degree that Shani was not alive and well to see this happen, and this will instead need to be part of her legacy,” Connolly told the Times. “But what a mighty legacy it is.”

— Holden Walter-Warner

Read more