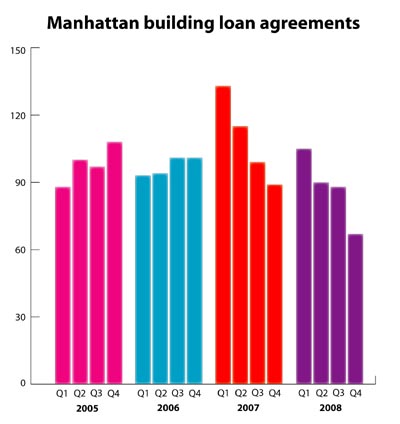

A little-known bureaucratic filing provides further evidence that lending and construction have slowed in Manhattan.

The

number of building loan agreements filed in Manhattan fell by 20

percent in 2008 to the lowest level in a number of years, as lenders

pulled back the reins on construction spending.

The quantity rose to 436 in 2007 from 393 in 2005, before declining

sharply to 350 in 2008, the lowest level in at least four years,

according to data The Real Deal obtained from the County Clerk of New

York County.

In the fourth quarter of 2008, the number of loans filed fell by 24

percent to 67, when compared to 89 filed in the fourth quarter of 2007,

the data showed.

“Right now a lot of people will only make

construction loans for a project that really makes sense with a strong

sponsor,” said Richard Nardi, a partner specializing in commercial real

estate at law firm Loeb & Loeb.

However, the slide was not as pronounced as many expected, as loan

agreements continued to be filed for buildings in the borough even

during the fourth quarter.

“I suspect looking at 2009, that is when you will see an amazing drop-off,” he said.

Building loan agreements are generally filed as the construction

loan is closed, regardless of the size of the loan, to record what

money is available for so-called “hard” construction costs like

contractors and suppliers. It does not include “soft” costs like

architects and marketing, real estate attorneys said. The Real Deal

reported in October that only three new building permits were filed in

September 2008.

Real estate experts suggest a number of possible explanations for the

relative strength in loan filings when compared to the New York

economy, including the lag time between when a deal was negotiated and

when the loan was closed.

Sheri Chromow, senior partner in the real estate group at Katten

Muchin Rosenman, suggested the 421a tax incentive induced developers to

secure funding when they might otherwise have waited.

“So maybe

it was a little higher than it might have been,” she said. “But I did

not have the sense there was this much activity, so I guess I would

call it a pleasant surprise that it is still happening.” She added that

funding remained relatively easier to obtain for deals under $50

million.