|

Weak leasing in Manhattan’s submarkets continues to trigger comparisons with velocity rates not seen since the start of the decade.

In the Penn Station Midtown district in January, just 10,000 square feet was leased, a level last seen in September 2000, and only 15,000 square feet was leased in The Plaza District, according to the February leasing report from CB Richard Ellis released today.

Overall, vacancy rates last month in Manhattan rose to 7.9 percent from 7.6 percent in December 2008, while average asking rents fell to $63.65 per square foot from $67.20 per square foot a month earlier, the report said.

And despite the 163,226-square-foot renewal lease by Polo Ralph Lauren at 650 Madison Avenue in Midtown, net absorption for the borough was a negative 4.19 million square feet, the CBRE report said. In December 2008, negative absorption was 1.02 square feet, while for all of 2008 it was 12.57 million square feet.

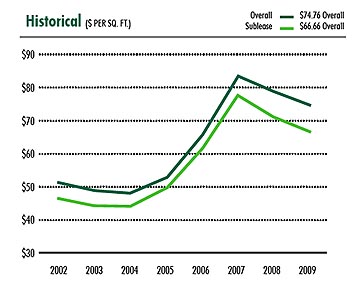

January vacancy rates in Midtown rose .2 points from a month earlier to 7.8 percent, while rents fell during the same period by $4.13 to $74.76 per square foot.

Midtown rents are not likely to go up in the near future.

“Over the coming months, as landlords continue to reprice availabilities, and as new blocks of space come online with prices that reflect current market conditions, Midtown’s average asking rent is likely to fall below $70 per square foot,” the report said.

Vacancy rates in Midtown South rose to 8.7 percent from 8 percent in December, and average asking rents fell $0.63 to $51.80 per square foot, CBRE said.

Downtown, vacancy rates climbed to 7.7 percent from 7.4 percent in December, and the average asking rent declined $2.90 to $44.78, the data showed.