|

The owners of the Apthorp, an iconic but troubled apartment building on the Upper West Side, have slashed prices by roughly one-third in the wake of their recent brush with foreclosure.

Renovated condominium units at the block-through limestone building will now sell for an average of about $1,950 per square foot, according to Karen Mansour, director of sales and marketing for Prudential Douglas Elliman’s Development Marketing Group, who is overseeing sales at the condo conversion. That represents a dramatic drop in prices from the building’s initial offering plan, released in June, which called for prices of nearly $3,000 per square foot.

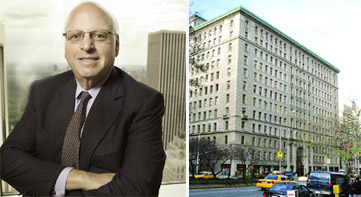

Early buyers at the building, which spans an entire block between Broadway and West End Avenue on 79th Street, have the option to buy either renovated or “as-is” apartments, said Howard Lorber, chairman of Elliman. Unrenovated units will sell for roughly $1,650 per square foot.

The price chop is the largest across-the-board reduction for a new condo or conversion project since the Wall Street meltdown this fall, said Jonathan Miller, president of appraisal firm Miller Samuel. The closest contender was a recent price cut at Northside Piers in Williamsburg that averaged 20 percent.

“I’m not aware of a listing price adjustment that large for a new construction project,” Miller said.

Lorber said the intent of the price reduction is to quickly sell the first 30 units in order to get the condo plan declared effective.

“The fact is we want to make sure it gets declared effective, and then after that, [prices] will go up,” he said.

The Apthorp, known for its three-story vaulted gateway and circular drive-in courtyard, was built by the Astor family and modeled after the Pitti Palace in Florence. Over the years, it has been home to celebrities like Nora Ephron, Conan O’Brien and Al Pacino, and more than half of the units remain rent-regulated.

Developer Maurice Mann and billionaire Lev Leviev acquired the 163-unit landmark building in 2007 — at the height of the real estate bubble — for a record $426 million.

But sales of the high-priced units were slow. By October of 2008, four months after the attorney general approved the offering plan, not a single apartment was in contract. A subsequent amendment offered some units for sale “as-is,” allowing them to be sold for lower prices. Still, before long, the parties were enmeshed in a legal struggle that ended with Mann stepping down as managing agent, though he retains his stake in the building.

In the wake of the dispute, the Apthorp’s lenders, including Anglo Irish Bank and Apollo Real Estate Advisors, asked the newly restructured Apthorp team to come up with a revised business plan to avoid foreclosure. Lorber said the revising price structure has been now established, and the owners are ready to proceed with a new marketing push.

“All the documents are done and signed and it’s ready,” he said. “They have all agreed on everything.”

While Mann recently filed a lawsuit to block the new loan agreement from being executed, a source close to the negotiations said the parties are working on finalizing a settlement.

One- to four-bedroom units in the building will now range in price from $2 million to $7 million, Elliman’s Mansour said. Prior to the reduction, the lowest priced unit was a 1,750-square-foot two-bedroom listed for $3.45 million, and the most expensive was a 12-room spread for $15.5 million.

“We came up with pricing that was very fair to the market,” Mansour said, adding that the price cuts are accompanied by a renewed marketing effort. A model unit at the building will be ready within 10 days, she said.

Mansour said that two condos at the Apthorp have been sold to date, although Streeteasy.com shows no units in contract.

The Apthorp’s prices are still high compared to other condos in the area, said Amelia Gewirtz, an executive vice president at Halstead Property, who has listings in the neighborhood. Still, “the Apthorp is a very special building,” she said. “It’s definitely a building that people will pay extra to live in.”

While there are other issues at the building, price cuts could help.

Leonard Steinberg, an executive vice president at Elliman, said he has shown units in the Apthorp to potential buyers, but they were put off by the building’s legal troubles, the fact that so few apartments had been sold, and the presence of so many rental tenants.

He added that the initial pricing was overly ambitious. “If you aren’t on Central Park, those prices are high,” he said.

The current pricing, however, is more likely to motivate buyers to sign on the dotted line. “At this price, you could sell out the building,” Steinberg said.

As for the drama surrounding the project, its impact on buyers depends on whether the squabbling is over.

“Once [the legal troubles] are resolved and the parties make it clear that it’s over, I don’t think [they will have] any impact on sales,” Miller said.

Elliman’s Lorber said the legal squabbles have certainly been an impediment to sales in recent months.

“I think it impacted it up until now,” he said, adding that some buyers were dissuaded from purchasing in the building by their lawyers on account of the uncertain fate of the project.

But he believes the building is now priced attractively enough that buyers will overlook past troubles.

“Buyers are going to be looking for value,” Lorber said. “It’s [a] one of a kind [building], and they’ll be ready to buy.”

Mann and Richard Marin, chairman of Africa Israel USA, Leviev’s company, declined to comment.