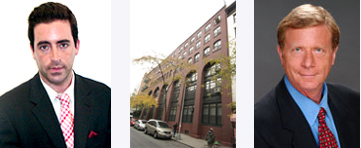

Left to right: Manhattan Residential’s Shai Shustik, 140 Thompson Street, Elliman’s Stanley Ginsberg

Left to right: Manhattan Residential’s Shai Shustik, 140 Thompson Street, Elliman’s Stanley GinsbergManhattan Residential President Shai Shustik is calling foul play on a recently resolved arbitration case with Prudential Douglas Elliman.

In a 2007 complaint filed with the Real Estate Board of New York, Shustik and his client, Laurence Beame, accused Elliman Senior Vice President Stanely Ginsberg of preventing Beame from purchasing an apartment to avoid splitting the commission. Shustik filed an ethics complaint with REBNY and a lawsuit with the state Supreme Court,But The Court rejected the case and it went into arbitration at REBNY. The Real Deal broke the story about the case in 2007.

In REBNY’s decision, which was made this week, all charges were dismissed and each party — Elliman, Ginsberg, Manhattan Residential and Laurence Beame, Shustik’s long-time friend and client — had to pay their own legal fees of $850.

While REBNY has settled the case, Shustik says he’s incredibly surprised with the outcome and will continue to fight it.

“I thought we definitely won, it was just a matter of what we were going to get,” Shustik told The Real Deal, adding that he might sue REBNY for his membership dues because he feels shorted. REBNY said it does not comment on arbitration cases, and Elliman said all REBNY matters are confidential and therefore cannot comment.

In January 2007, Shustik brought Beame, who is the great-nephew of former New York City Mayor Abraham Beame, to see apartment 3F at 140 Thompson Street, a co-op unit Ginsberg listed for $1.495 million, according to a document submitted by Shustik for the REBNY arbitration case. After seeing the apartment a second time, Shustik says he submitted an all-cash bid of $1.435 million on behalf of Beame. In a January 2 e-mail to Shustik, Ginsberg said he would “inform the owner immediately. Please be informed that an offer substantially over this has also been submitted.”

Shustik then submitted an offer of $1.565 million in cash in a February 12 e-mail on behalf of Beame, and Ginsberg responded that the sellers were looking to sell for more money, and that the apartment had received multiple offers. Shustik submitted a final offer of $1.6 million for his client. However, none of Beame’s offers were ever presented to the seller, which Shustik told The Real Deal was because the broker did not want to split the commission, and he therefore violated several rules outlined in REBNY’s code of ethics.

“I’m absolutely shocked,” Beame said. “Basically, the broker never gave our offers to the seller, and REBNY didn’t care. It gives brokers freedom to do whatever they want.”

In a letter to REBNY, Ginsberg said he did not present Beame’s offers to the seller because the prospective buyer did not submit financial and employment documents.

“Based upon the seller’s having already accepted an offer … who had provided employment and financial information and proved to be a very strong candidate in terms of obtaining approval from the cooperative board,” Ginsberg wrote, “and based upon [Shustik and Beame’s] repeated refusal to provide employment or financial information supporting its offers … Mr. Beame’s offers were not presented to the seller.”

The seller accepted a buyer — who was not represented by another broker — in late February 2007, and he was going to buy the apartment for its asking price and went into contract, but the seller pulled the home off the market, according to Shustik. Soon after, Elliman and the seller terminated their agreement, and waived all fees.

When The Real Deal contacted Ginsberg about the case, his lawyer, Mark Moody, responded to say they weren’t aware that it had been settled. Moody, a partner at M W Moody, said they are delighted with the outcome of the case.

“[Shustik] did not follow Stanley’s instructions which were very specific. He repeatedly asked him for financial information,” Moody said.

Moody said that Shustik violated REBNY’s rules of ethics by taking the case to the state Supreme Court at the same time he filed the REBNY complaint.

In REBNY’s dismissal of the case, Shustik said he feels betrayed by the organization because it is supposed to uphold brokers’ ethics. Beame and Shustik said they are frustrated by the situation because REBNY dismissed the case and did not provide an explanation for their decision.

“If the tables were turned, I would put anything I have that I would be penalized,” Shustik said. “It’s not REBNY, it’s PEBNY — Prudential Elliman Board of New York.”

For violating REBNY’s ethics code, penalties can range from having to take an ethics course to having membership revoked.

“[A broker’s] first responsibility is to the client, and [Ginsberg] shorted [him] out of $105,000. [Ginsberg] jeopardized the deal I brought to the table,” Shustik said. “This is far from done. I will spend everything I have to make sure this keeps going.”